Introduction

The Dow theory is the oldest and the most respected theories written in the field of financial technical analysis. The principles of the theory were proposed in the late 19th century by Charles Dow, the founder of the Dow Jones Industrial Average (DJIA) and Dow Jones Transportation Average (DJTA), in his editorials. After Dow’s death, William Hamilton refined and published Dow’s tenets in his book ‘The Stock Market Barometer’ in 1922. And following Hamilton’s death, Robert Rhea further refined and published the book ‘The Dow theory’ in 1932. Despite being proposed more than a century ago, the Dow theory has stood the test of time in spite of strong advances made in the field of financial technical analysis over the last 100 years.

The theory was originally written keeping in mind the DJIA and DJTA indices. However, the principles of the Dow theory are applicable to all other indices as well. Back then, trends in these two indices were used to gauge the overall well-being of the U.S. economy. For example, confirmation of a primary uptrend from both the indices was used as a signal that the broader market was also trending in the same direction.

Tenets of Dow theory

The Dow theory is based on a few important tenets as stated below:

The averages discount everything

We have already talked something similar in our previous lesson. The Dow theory assumes that the averages discount every possible piece of information that could potentially impact the demand and supply of securities. The only exception to this is natural calamities, as these cannot be anticipated beforehand. Nonetheless, as these events occur, their impact is quickly analysed, priced in, and reflected in the averages (look no further than the 2011 Japanese earthquake and how quickly its potential impact was factored into asset prices).

Markets have three trends

Charles Dow considered the averages to move in trends. The theory proposed that a trend has three parts: primary trend, secondary trend, and minor trend. Each of this is discussed below:

Primary trend

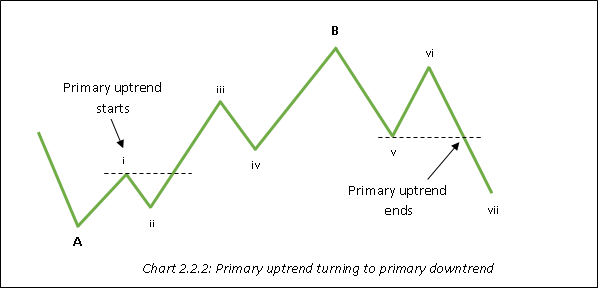

The primary trend represents the overall trend of the market and usually lasts anywhere between a year to several years. In a primary up trend, each high crosses the previous high and each low fails to cross the previous low. As long as this pattern continues, the primary uptrend is in effect. We will name a primary uptrend as a bull market. Similarly, in a primary down trend, each low crosses the previous low and each high fails to cross the previous high. As long as this pattern continues, the primary downtrend is in effect. We will name a primary downtrend as a bear market.

Secondary trend

The secondary trend represents a correction to primary trend. So, in case of a primary uptrend, a secondary trend is an important decline that retraces part of the preceding up wave. We will name this decline as a bull market correction. Similarly, in case of a primary downtrend, a secondary trend is an important advance that recoups part of the preceding down wave. We will name this advance as a bear market rally. Secondary trend lasts anywhere between three weeks to three months and usually retraces anywhere between one-third to two-third of the preceding up swing (in case of bull market) or down swing (in case of bear market).

Minor trend

The minor trend represents day to day fluctuations that has an impact on the secondary trend but not on the primary trend. The Dow theory does not pay much attention to these trends and it believes that, of the three trends, only minor trend can be manipulated while secondary and primary trends cannot be manipulated. Minor trends last anywhere between a few days to three weeks. For an investor, this is the least important of all three trends.

The above chart shows a primary uptrend in action, which eventually turns into a primary downtrend. The break above point (i) confirms the beginning of a new bull market that began at point A. Points (i), (iii), and (B) move in the direction of the primary uptrendwhile points (ii) and (iv) run counter to the it. These counter movements are nothing but secondary corrections in a bull market. Failure of point (vi) to cross the high of point (B) and an eventual break of point (v) suggests that the bull market has ended and that a bear market is underway starting from point (B). Now, points (v) and (vii) move in the direction of the primary downtrend while points (ii) and (iv) run counter to the primary downtrend. These counter movements are nothing but secondary advances in a bear market.

The three phases of market

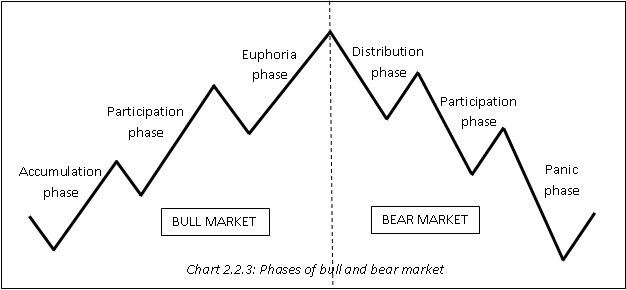

Dow theory posits that a bull market is comprised of three phases. The first phase is called the accumulation phase. This is the phase when the overall sentiment is very bearish, but informed investors, sensing that the averages have priced in most of the bad news, start accumulating stocks. The second phase is the public participation phase. This is the phase wherein the averages are already heading higher, and investor sentiment and business conditions start to improve. The third phase is the euphoria phase which eventually turns into distribution phase. This is the phase wherein speculation is rampant, and businesses and the economy are boiling with activity. This is also the phase where informed investors, sensing that most bullish factors have already been priced into the averages, start to liquidate their stocks. This is how a bull market is composed from the start till the end.

The exact opposite is true of a bear market, but of course in the reverse direction. In a bear market, the first phase is the distribution phase, which is also the last phase of a bull market.The second phase is the public participation phase, wherein business conditions start to deteriorate and investor sentiment turns bearish, causing buying activity to dry down and selling activity to intensify. The third phase is the panic phase, wherein there is a vertical sell-off with climatic volume as corporate outlook and economic conditions plummet, bankruptcies increase, and there is a general feeling that everything will fall apart. It is at this stage where informed investors, sensing that all the negatives have been priced in, start accumulating stocks, which eventually begins the first stage of a bull market.

The chart below shows the three phases of bull market and bear market

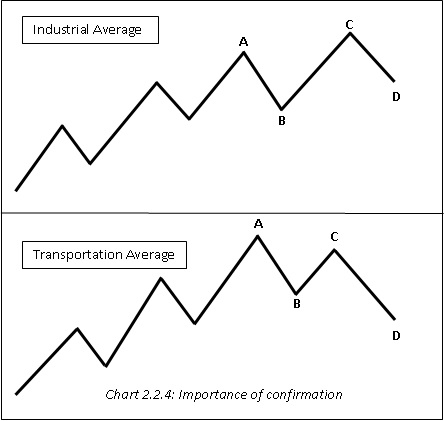

The averages must confirm

This is one of the most important tenets of the Dow theory. According to this tenet, the movement in one average must always be confirmed by movement in the other average. A new high in one average that is not confirmed by a new high in the other average tends to be misleading. And this makes sense from a practical standpoint also. An up movein industrial stocks, for example,that is not accompanied by an up move in transportation stocks is not a bullish sign as this could suggest that more goods are being manufactured but not all of them are not being transported and sold. Similarly, a new low in one average that is not confirmed by a new low in the other average should be treated with caution. Both the averages must be moving in the same direction to suggest that the ongoing trend (up or down) is intact. When the averages start to diverge, it could be a sign of warning that the trend is about to change.

The chart above highlights the importance of confirmation. It may be observed that a bull market has been in place in case of both the averages. At point C, while the transportation average failed to go above point A, the industrial average crossed point A to a new high. The ensuing decline in transportation average from point C saw it dropping below point B, highlighting that the transportation average has entered a bear market. However, note that during this same period, the industrial average has not gone below point B, suggesting that it is still in a bull market. As the industrial average has failed to confirm the bear marketin transportation average, the overall bull market is still in place. Having said that, the divergence between the averages must be treated as a warning that the bull market in the industrial average is now on a weak footing. If the industrial average goes to make a lower high (i.e. fails to cross above point C) and then breaks below the prior low (point D), it will be a confirmation that the overall bull market has ended, and we are now in a new bear market.

Volume is important

While not as important as price action in the averages, volume nonetheless provides clues as to the health of the trend. There is a common saying that volume must go with the trend. What this means is, in a bull market, volume must pick up during rallies and fade during secondary corrections, while in a bear market, volume must pick up during declines and fade during secondary recoveries. Volume will be covered in later chapters in greater detail.

Summary

-

The Dow theory is the oldest and the most respected theories in the field of financial technical analysis.

-

The Dow theory was proposed by Charles Dow and refined by William Hamilton and Robert Rhea.

-

The Dow theory assumes that the averages discount every possible piece of information that could potentially impact the demand and supply of securities.

-

The Dow theory proposed that a trend has three parts: primary trend, secondary trend, and minor trend.

-

The Dow theory posits that a market is comprised of three phases: accumulation phase, public participation phase, and distribution phase (which is called the euphoria phase in bull market and panic phase in bear market).

-

Movement in one average must always be confirmed by movement in the other average.

-

Volume must go with the trend i.e. in a bull market, volume must pick up during rallies and fade during secondary corrections, while in a bear market, volume must pick up during declines and fade during secondary recoveries.

Next Chapter

Comments & Discussions in

FYERS Community

Manjesh commented on March 13th, 2019 at 3:24 PM

Thanks for sharing

Kichu commented on March 13th, 2019 at 3:25 PM

Thanks

tejas commented on April 5th, 2019 at 6:46 PM

You're welcome. Hope you're enjoying the content.

Shashwat commented on April 5th, 2019 at 4:38 AM

Anything on Elliott wave analysis and gann

tejas commented on April 5th, 2019 at 6:45 PM

Yes, Elliott Waves have been covered in the Advanced Technical Analysis chapter.

Puneet Sachdeva commented on April 9th, 2019 at 3:31 AM

The index says Dow Theory has 11 lessons. I only see one starting with 2.1 - Introduction

and ending with 2.3 - Summary. Where are the rest of the 10 lessons ? Am i misunderstanding something?

tejas commented on April 9th, 2019 at 2:51 PM

Hi Puneet, Yeah it does have 11 lessons. Each of the sub-headings is counted as a lesson on School Of Stocks. Please don't get confused because of the numbering system in the chapters.

Rakesh Hansalia commented on May 16th, 2019 at 7:38 PM

Tejas, It is really a confusing thing, till the time I read your answer on Puneet's query I was thinking that there must be some pending from your side which you will add in future.

You will get this query multiple times in future from different people, so we would suggest use the caption as "Topics" instead of "Lessons" ( in index )

tejas commented on June 13th, 2019 at 6:13 PM

Yeah, there will be additions based on feedback. Your feedback is noted.

Trader1411 commented on April 12th, 2019 at 12:44 AM

Is there a module on options coming anytime soon?

Also is the fyers options lab not available at the moment..

These few chapters are excellent and in a very readable format.. when can we expect a module on options

Thanks a lot

tejas commented on June 13th, 2019 at 6:15 PM

Hi Trader1411, Yes, but not in the immediate future. I have written about that in the commodities module. But no dedicated module for options yet. It's a thing for the future.

ajith raj h,m commented on September 6th, 2019 at 2:32 PM

very good

Shriram commented on January 26th, 2020 at 5:19 PM

Thank you Ajith!

SHIVAKUMARA L E commented on February 21st, 2020 at 1:55 PM

Thank you so much your support sit

Shriram commented on February 21st, 2020 at 8:23 PM

Thank you Shivakumara!

Sandeep Sethi commented on March 10th, 2020 at 9:13 AM

Sir, i completed ur technical course , as in this chapter u said volume will be covered in seperate chapter , i did not find , can u share the chapter link? if there is no chapter kindly make a seperate detailed chapter on volume ..u have covered price action with technical indicator very greatfully.

Shriram commented on March 10th, 2020 at 7:53 PM

Hi Sandeep, thank you for the feedback! We have talked about volume sparsely in this module as well as in a few other modules. That said, we will surely come up with a dedicated chapter on Volume within the Technical Analysis module in the coming days...

Pranav Rawat commented on May 22nd, 2020 at 5:21 PM

As of now, I find this module really informative. I need to know if this module on tech. analysis is enough to enter in stock market as a trader or would I need to gain more knowledge?

Shriram commented on May 26th, 2020 at 2:28 PM

Hi Pranav, thank you for your valuable feedback. We have covered Technical Analysis in quite a great detail. Be assured that we will be adding more quality content in the Technical Analysis module in future.

Answering your question, we have covered several key areas of Technical Analysis in our module. Now, if you are new to the world of trading, we would suggest you to practice/apply the concepts that you have studied in this module into the real-world charts. The more you get comfortable with the charts using the TA techniques that you have studied, the better would it be towards gaining more hands-on charting experience. We highly suggest you to go through our other TA chapters as well.

Varun Gupta commented on May 24th, 2020 at 2:53 PM

Is it accurate to say that all three phases can be seen at all time frames such as 1 min, 15 mins, 1 hour, 4 hours, Daily, Weekly, Monthly and Yearly? or DOW is more accurate if we look at a particular a time frame? and is there a minimum timeline that we should select to identify a trend? like 1 month, 6 months, 1 year, 2 years and how many minimum sessions to scope for analysis such as last 10 or 20 or 100?

Shriram commented on May 26th, 2020 at 2:43 PM

Hi Varun, Dow Theory has undergone quite a bit of changes since the time it was first introduced by Charles Dow well more than 100 years ago. However, the principles on which the theory was formed back then still holds very well today.

Answering your question, you can start your analysis on the longer-time frame such as the monthly chart in order to identify what the primary trend of the market is. Then, you can drill down to smaller time frame charts such as weekly, daily, intraday etc. to identify the intermediate and the minor trends.

Yes, it is accurate to say all the 3 phases can be seen in all time frames. That said, primary trend looks more clear on, say, monthly chart because it removes the noise element from the price. On the other hand, an intermediate trend would be more clear on, say, weekly and daily chart, because it would contain more information than the monthly chart, thereby helping to further dissect intermediate waves. Using the same logic, a minor trend would be more clear on intraday chart. Hence, do get into the habit of looking into multiple time frame charts.

Answering your second question, this again depends on which trend you are interested in identifying. For example, if you are interested in analyzing the primary trend, then you preferably would need several years of data to get a better picture of the overall trend. However, if you analyzing an intermediate trend, then even 1-2 years worth of data would suffice. For minor trends, even fewer data would be needed. That said, I would suggest you to adopt to a top-down type approach. That is, start with identifying what the primary trend is, then drill down to intermediate trend, and finally to the minor trend.