SYNTHETIC CALL

| Strategy Details | |

| Strategy Type | Bullish |

| # of legs | 2 (Long Underlying + LongPut) |

| Maximum Reward | Unlimited |

| Maximum Risk | Limited to the extent of purchase price of the underlying - strike price of the Put + Put premium paid |

| Breakeven Price | Purchase price of the underlying +Put premiumpaid |

| Payoff Calculation | Underlying price at expiry - Purchase price of the underlying -Put premium paid + Maximum of (Strike Price - Underlying price at expiry, 0) |

Explanation of the Strategy

A Synthetic Call is astrategy wherein the trader would buy the underlying instrument and a Put option on the same instrument. It is a bullish strategy, with the long Put acting as an insurance for the underlying position. By paying this premium, the trader limits his/her losses on the underlying position while keeping the door open for upside price moves. The upside for this strategy is unlimited, while the downside is limited. Once the price of the underlying moves above the breakeven point of the strategy, profits start kicking in. On the flip side, if the underlying price falls, any losses in the underlying position would be offset by gains that would be made in the long Put position.

Previously, we studied long Call and Covered Call. We saw that long Call is an outright bullish strategy, while Covered Call is an income-based strategy. Synthetic Call, on the other hand, is a conservatively bullish strategy. I call it conservative because the trader wants to reap all the benefits of an up move in the underlying price but also wants to protect against any unexpected decline in the price of the underlying. Mostly, a Synthetic Call is deployed on ATM strikes as these offer a 100% protection. However, depending on the individual trading preference, one can also select an OTM strike.

Benefits of the Strategy

-

Potential for unlimited gains

-

Limited downside

-

In case one already has long exposure to the underlying, he/she can enter into this strategy by buying a Put option to safeguard against near-term price uncertainties

-

As the trader owns the underlying, he/she will be eligible to receive stock-related benefits such as dividends, bonus etc.

Drawbacks of the Strategy

-

Expensive to initiate as the trader will have to buy both the underlying and the Put

-

The strategy will become profitable only when the underlying price rises by the amount of the Put premium that is paid

-

This strategy is not as profitable as just buying the underlying, because a part of the profit would always be eaten up by the premium that has been paid

Strategy Suggestions

-

Ensure that the price trajectory of the underlying instrument is bullish and is trading above a key support, which looks difficult to crack

-

Because this strategy involves buying a Put option, ensure that there is sufficient time remaining in the life of the option contract

-

Theta will decay rapidly towards the end of the option’s life, which could cause the option to lose its value if the pace of the fall in the underlying price fails to match the pace of Theta decay

-

The Put option only acts as a protection to the underlying position. A general rule to remember is that the higher the premium, the higher the protection, and vice versa

-

When entering into this strategy, prefer buying an ATM Put. However, this is completely up to the trader who can select any type of strike depending upon his/her risk profile and the type of protection that is needed

-

That said, preferably avoid buying options that are deep OTM. Instead, buy options that are closer to being ATM

-

Ensure that there is enough liquidity in the option in which you want to create a position

Option Greeks for Synthetic Call position

| Greek | Value is | Notes |

| Delta | Positive |

Delta is positive for SyntheticCall. Remember, the underlying has a Delta of 1 whereas Put has negative Delta of up to -1. As a result, the combined Delta is still positive. Because of this, the position benefits when the underlying moves higher, and vice versa. Pay careful attention to Put Delta because the extent to which the option price is influenced by the underlying price depends on this metric. Also remember that Delta tends to be at its steepest angle for ATM Puts, meaning this is the region when the Put price is most sensitive to changes in underlying price. |

| Gamma | Positive |

Gamma is positiveand causes the Delta of the Put to increase as the underlying price decreases, and vice versa. Also, ATM Puts have the highest Gamma, which starts to taper off as the option moves away from being ATM. So, when the Put moves from ATM to ITM, the impact of Gamma on Delta tends to be higher (because absolute Delta moves above 0.5) than when the Put moves from ATM to OTM (because absolute Delta moves below 0.5). |

| Vega | Positive |

Vega is positive,meaning that rising IVs benefit the long Put position, and vice versa. |

| Theta | Negative |

Because the strategy involves buying a Put option, Theta is the trader’s biggest enemy. It is negative, meaning that the passage of time causes the Put premium to reduce, all else equal. The decay is highest for options that are ATM as the expiration approaches. |

| Rho | Negative |

Rho is negative for Synthetic Put. As a result, a rise in interest rates hurts the position, and vice versa. |

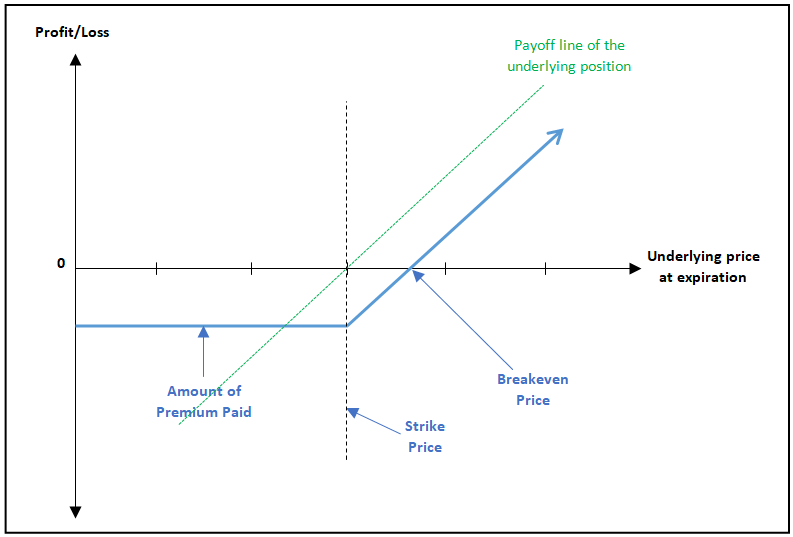

Payoff of Synthetic Call

The above chart shows the payoff structure for a Synthetic Call. Remember that this option strategy is a combination of two strategies: Long the underlying and Long the Put (usually ATM). The green dotted line above shows the payoff of the underlying position, whereas the blue line shows the overall payoff ofthe Synthetic Call position. Notice that Synthetic Call payoff resembles the payoff of a Long Call position. As can be seen in the graph, maximum loss for this strategy is limited, whereas maximum reward is potentially unlimited. Once the underlying price crosses the breakeven price, the position becomes profitable. If the option that has been purchased is ATM, then the maximum risk in the strategy is limited to the extent of premium that has been paid to buy the Put option. Going forward, if the price of the underlying rallies, the trader would gain in the underlying position, though the total profit would be reduced the amount of the premium (as the Put would expire worthless). On the other hand, if the underlying price falls below the strike price of the Put, the buyer would lose money in his/her underlying position, which nevertheless would be offset by gains made in the options position (as the Put would now become ITM).

A Synthetic Call strategy can also be created when one already has exposure to the underlying position. For instance, if an investor is holding a stock but is worried of near-term price uncertainties due to events such as earnings season, he/she could hedge such short-term uncertainties by buying an equivalent number of Put option contract(s) on the same stock. Doing so would protect the investor from any depreciation in the price of the stock, while leaving the door open for stock price gains. Once the near-term uncertainties are behind, the investor could consider closing out the option position

Example of Synthetic Call :

Let us say that Mr. ABC is bullish on the medium-term price trajectory of ITC Ltd and is contemplating buying the shares of the same. However, because ITC will be releasing its quarterly earnings report in the next few days, ABC wants to safeguard against any potential short-term volatility in the price of the stock. Hence, he also decides to buy a short-term protection against his underlying position. As such, Mr. ABC executes a Synthetic Call strategy wherein he buys 2,400 shares of ITC at the prevailing market price of ₹160per share and simultaneously buys 1 lot of ATM Put option by paying a premium of ₹6. Given the lot size of 2,400 shares, the total premium outlay amounts to ₹14,400 (2,400 * ₹6). Let us highlight the details below:

-

Strike price = 160 PE

-

Put premium = ₹6

-

Purchase price of the underlying = ₹160

-

Put premium paid = ₹14,400

-

Breakeven price of the strategy = ₹166 (160 + 6)

-

Total upfront investment = ₹398,400 ((2,400*160) + 14,400)

Now, let us assume a few scenarios in terms of where ITC Ltd would be on the expiration date and the impact this would have on the profitability of the trade.

| Underlying price at Expiration | Net Profit/Loss | Notes |

| 140 | Loss of ₹14,400 | Payoff = 140 - 160-6+ maximum of (160 - 140, 0). As the underlying price at expiration is below the breakeven price, the writer will incur a loss |

| 145 | Loss of ₹14,400 | Payoff = 145 - 160-6+ maximum of (160 - 145, 0). As the underlying price at expiration is below the breakeven price, the writer will incur a loss |

| 150 | Loss of ₹14,400 | Payoff = 150 - 160-6+ maximum of (160 - 150, 0). As the underlying price at expiration is below the breakeven price, the writer will incur a loss |

| 155 | Loss of ₹14,400 | Payoff = 155 - 160-6+ maximum of (160 - 155, 0). As the underlying price at expiration is below the breakeven price, the writer will incur a loss |

| 160 | Loss of ₹14,400 | Payoff = 160 - 160-6+ maximum of (160 - 160, 0). As the underlying price at expiration is below the breakeven price, the writer will incur a loss |

| 165 | Loss of ₹2,400 | Payoff = 165 - 160-6+ maximum of (160 - 165, 0). As the underlying price at expiration is below the breakeven price, the writer will incur a loss |

| 166 | No profit, No loss | Payoff = 166 - 160-6+ maximum of (160 - 166, 0). As the underlying price at expiration is equal to the breakeven price, the writer will neither make a profit nor incur a loss |

| 170 | Profit of ₹9,600 | Payoff = 170 - 160-6+ maximum of (160 - 170, 0). As the underlying price at expiration is above the breakeven price, the writer will make a gain |

| 180 | Profit of ₹33,600 | Payoff = 180 - 160-6+ maximum of (160 - 180, 0). As the underlying price at expiration is above the breakeven price, the writer will make a gain |

| 190 | Profit of ₹57,600 | Payoff = 190 - 160-6+ maximum of (160 - 190, 0). As the underlying price at expiration is above the breakeven price, the writer will make a gain |

| 200 | Profit of ₹81,600 | Payoff = 200 - 160-6+ maximum of (160 - 200, 0). As the underlying price at expiration is above the breakeven price, the writer will make a gain |

As can be seen in the above table, maximum loss in the strategy is limited no matter how lower the underlying price goes below the breakeven price. This is because losses made in the underlying position would be offset by gains made in the options position. However, once the underlying price crosses above the breakeven price, the trader starts making profits. The higher the underlying price goes above the breakeven price, the higher would be the trader’s profit.

SYNTHETIC PUT

| Strategy Details | |

| Strategy Type | Bearish |

| # of legs | 2 (Short Underlying + Long Call) |

| Maximum Reward | Unlimited |

| Maximum Risk | Limited to the extent of strike price - price at which the underlying is sold + Call premium paid |

| Breakeven Price | Price at which the underlying is sold -Call premium paid |

| Payoff Calculation | Price at which the underlyingis sold - Underlying price at expiry - Call premium paid + Maximum of (Underlying price at expiry - Strike Price, 0) |

Explanation of the Strategy

Synthetic Put is a strategy wherein the trader would short the underlying instrument (either in the cash segment or through the futures segment) and buya Call option on the same instrument. This is a bearish strategy, with the long Call acting as an insurance against any unexpected rise in the price of the underlying. By buying the Call option on the underlying, the trader limits his/her losses in case of a rise in the underlying price, while leaving the door open for earning unlimited gains (well, until the asset price falls to zero!). Usually, the Call option that is bought is an ATM Call, but traders also sometime prefer buying a slightly OTM Call option. If the view of the trader goes right and the underlying price drops as expected, the Call option expires worthless and the total profits earned on the short position gets reduced by the amount of the premium. On the other hand, if the view of the trader goes wrong and the underlying price rises, the losses in the short underlying position would be offset by the gains that would be made in the long Call position, thereby limited the trader’s losses. Profits start kicking in once the price of the underlying falls below the breakeven point of the strategy.

Benefits of the Strategy

-

Potential for unlimited gains

-

Limited downside potential no matter how higher the underlying price rallies

-

In case one already has short exposure to the underlying, he/she can enter into this strategy by buying a Call option to safeguard against near-term price uncertainties

Drawbacks of the Strategy

-

Expensive to initiate as the trader will have to buy equal number of underlying and Calls

-

The strategy will become profitable only when the underlying price falls by the amount of the Call premium that is paid

-

This strategy is not as profitable as just shorting the underlying, because a part of the profit would always be eaten up by the premium that has been paid upfront

Strategy Suggestions

-

Ensure that the price trajectory of the underlying instrument is bearish and is trading below a key resistance, which looks difficult to crack

-

Because this strategy involves buying a Call option, ensure that there is sufficient time remaining in the life of the option contract

-

Theta will decay rapidly towards the end of the option’s life, which could cause the option to lose its value if the pace of the rise in the underlying price fails to match the pace of Theta decay

-

The Call option only acts as a protection to the short position. A general rule to remember is that the higher the premium, the higher the protection, and vice versa

-

When entering into this strategy, prefer buying an ATM Call or a slightly OTM Call

-

Ensure that there is enough liquidity in the option in which you want to create a position

Option Greeks for Synthetic Put position

| Greek | Value is | Notes |

| Delta | Negative |

Delta is negative for a SyntheticPut. Remember, the short underlying position has a Delta of -1 whereas Call has a positiveDelta of up to 1. As a result, the combined Delta is still negative. Because of this, the position benefits when the underlying moves lower, and vice versa. |

| Gamma | Positive |

Gamma is positiveand causes the Delta of the Callto increase as the underlying price increases, and vice versa. Also, ATM Calls have the highest Gamma, which starts to taper off as the option moves away from being ATM. So, when the Call moves from ATM to ITM, the impact of Gamma on Delta tends to be higher (because Delta moves above 0.5) than when the Call moves from ATM to OTM (because Delta moves below 0.5). |

| Vega | Positive |

Vega is positive,meaning that rising IVs benefit the long Callposition, and vice versa. |

| Theta | Negative |

Because the strategy involves buying a Call option, Theta is the trader’s biggest enemy. It is negative, meaning that the passage of time causes the Call premium to reduce, all else equal. |

| Rho | Positive |

Rho is positive, meaning thata rise in interest rates benefits the option position, and vice versa. |

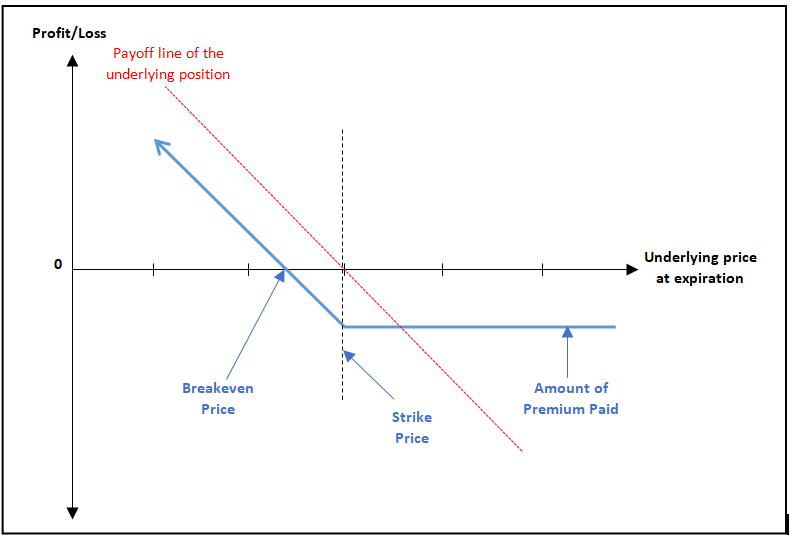

Payoff of Synthetic Put

The chart below shows the payoff structure of a Synthetic Put position. It can be seen that the payoff chart resembles that of a long Put position. Notice that this strategy entails limited risk. In case the option chosen is ATM, the maximum risk is limited to the extent of premium that is paid.It can be observed from the chart that the trader will start to earn profit once the underlying price falls below the breakeven price, which is nothing but the price at which the underlying is sold less the Call premium that is paid. As we already know by now, the more the underlying price falls below the breakeven price, the higher is the trader’s profit potential. Meanwhile, the Call that is purchased acts as an insurance against any unexpected rise in the underlying price. In case the trader’s view goes wrong and the underlying rises, losses in the short position would be offset by gains made in the long Call position, thereby protecting the trader from taking a bigger hit to his/her capital.

Example of Synthetic Put

Let us assume that Mr. ABC is bearish on Maruti Ltd and is contemplating shorting 1 lot ofthe same in the futures segment. However, ABC is also worried about any unexpected rise in the price of the stock. Hence, to safeguard against an up move in price, ABC also decides to buy an ATM Call option on Maruti. As such, Mr. ABC enters a Synthetic Put strategy wherein he shorts1lot of Maruti at the prevailing market price of ₹5,100 and simultaneously buys 1 lot of Maruti ATM Call option by paying a premium of ₹150. Given the lot size of 100 shares, the total premium outlay amounts to ₹15,000 (100 * ₹150). Let us highlight the details below:

-

Strike price = 5100CE

-

Call premium = ₹150

-

Futures price at initiation = ₹5100

-

Call premium paid = ₹15,000

-

Breakeven price of the strategy = ₹4,950 (5100-150)

Now, let us assume a few scenarios in terms of where Maruti would be on the expiration date and the impact this would have on the profitability of the trade.

| Underlying price at Expiration | Net Profit/Loss | Notes |

| 6500 | Loss of ₹15,000 | Payoff = 5100 - 6500-150+ maximum of (6500 - 5100, 0). As the underlying price at expiration is above the breakeven price, the trader will incur a loss |

| 6000 | Loss of ₹15,000 | Payoff = 5100 - 6000-150+ maximum of (6000 - 5100, 0). As the underlying price at expiration is above the breakeven price, the trader will incur a loss |

| 5500 | Loss of ₹15,000 | Payoff = 5100 - 5500-150+ maximum of (5500 - 5100, 0). As the underlying price at expiration is above the breakeven price, the trader will incur a loss |

| 5000 | Loss of ₹5,000 | Payoff = 5100 - 5000-150+ maximum of (5000 - 5100, 0). As the underlying price at expiration is above the breakeven price, the trader will incur a loss |

| 4950 | No profit, No loss | Payoff = 5100 - 4950-150+ maximum of (4950 - 5100, 0). As the underlying price at expiration is equal to the breakeven price, the trader will neither profit nor incur a loss |

| 4500 | Profit of ₹45,000 | Payoff = 5100 - 4500-150+ maximum of (4500 - 5100, 0). As the underlying price at expiration is below the breakeven price, the trader will make a profit |

| 4000 | Profit of ₹95,000 | Payoff = 5100 - 4000-150+ maximum of (4000 - 5100, 0). As the underlying price at expiration is below the breakeven price, the trader will make a profit |

| 3500 | Profit of ₹145,000 | Payoff = 5100 - 3500-150+ maximum of (3500 - 5100, 0). As the underlying price at expiration is below the breakeven price, the trader will make a profit |

Notice above that no matter how higher the underlying rises, maximum loss is limited because the losses that would be incurred in the short futures position would be offset by gains that would be made in the long Call position. On the other hand, it can be seen that the larger the decline in the price of the underlying, the greater would be the profits that the trader would earn. Theoretically speaking, maximum profit that a trader could earn on this option strategy is unlimited. In reality however, maximum profit is limited because the underlying price cannot go below zero. Maximum profit is attained when the underlying price falls to zero and the premium amount is subtracted from it to attain the net profit.

Next Chapter

Comments & Discussions in

FYERS Community

NITIN SURESH THAKARE commented on April 1st, 2020 at 7:50 PM

Perfect strategy & Perfect Psychology behind the strategy. Thanks for new way.

Shriram commented on April 2nd, 2020 at 7:20 PM

Thanks Nitin for the feedback. Hope you are finding the content quite useful

Hmdeep commented on April 12th, 2020 at 10:57 AM

The content is great and very educational, thanks for this.

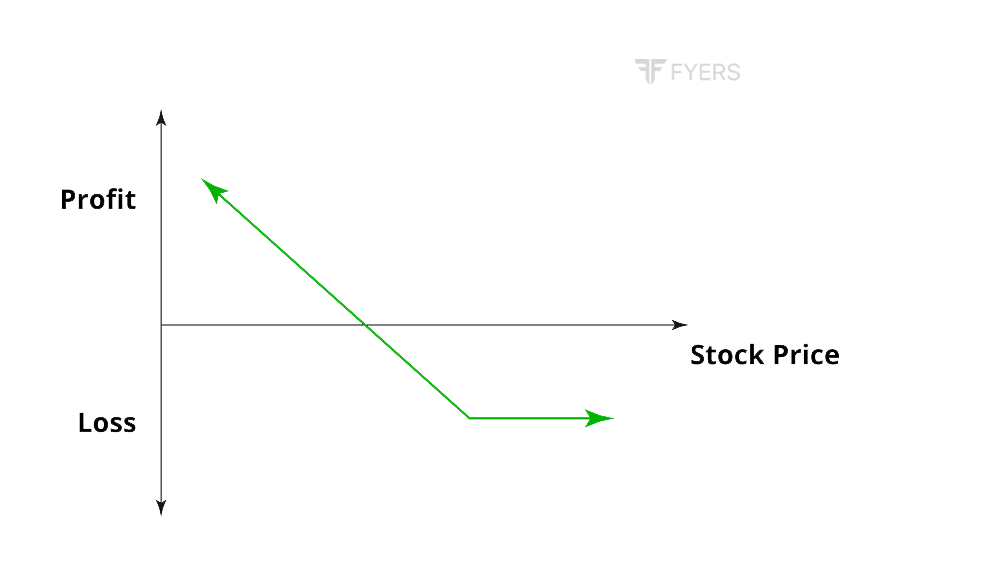

But I think the chart on top of the article is wrong. It is not Synthetic Call but Synthetic Put. You would like to change it.

Thanks.

Shriram commented on April 15th, 2020 at 3:28 PM

Hi Hmdeep, thank you for the feedback. The chart on the top of this page is just a sample chart. It is not the chart of the strategy being discussed in this chapter. The charts of the two strategies that are discussed in this chapter are shown in the respective payoff sections.

Krish commented on June 10th, 2020 at 8:48 PM

Equity shares are traded in physical delivery..so if I use the above strategies...wll the same profile loss hold true r wll the trades get auto squared of based on premiums on expiry day..because for every one point raise or drop...the option premium doesn't change to the same amount ...

Abhishek Chinchalkar commented on June 12th, 2020 at 8:13 AM

Hi Krish, a Synthetic Call strategy is used when a trader has long exposure in the underlying and continues to be bullish on it over the medium/long-term. However, because of events or any other factor, he expects near-term uncertainties in the price of the underlying. To hedge against such uncertainties, he buys a protection in the form of a Put option. Once he feels the uncertainties are behind, the long Put position is usually exited on or before expiration and the long underlying position continues to run as is.

The Payoff (profit/loss) chart shown in the chapter reflects the scenario that would prevail on expiration. Usually, this strategy (wherein a Put is purchased as a protection) is deployed only if one holds a position in the underlying asset and not the other way around. The primary objective of this strategy is protection. If the underlying price goes up after the Put is bought, the trader stands to benefits in the underlying position, while the Put becomes worthless as it is OTM. On the other hand, if the underlying price down after the Put is bought, the losses incurred in the underlying position would be more or less offset by the gains made in the long Put position as it moves ITM. As the Put moves more and more ITM, its Delta moves towards -1, meaning the Put position closely starts mimicing the underlying position.

krish commented on June 15th, 2020 at 7:31 PM

i have bought one lot of ashok leyland futures june contract for rs 52.... and also to protect myself from downside bought a rs 49 put option at 1.90. now my doubt is on the day of expiry of june contracts if the futures price is around 47.... and i havent squared off both the positions.....how wll the delivery of shares be affected? wll my future contract square off with the put option contract and the loss debited from my ledger balance....?

Abhishek Chinchalkar commented on June 16th, 2020 at 8:59 AM

Hi Krish, this is a very detailed subject and depends on a lot of things. We kindly suggest you to carefully read our policies on physical settlement to understand how it works at FYERS. The link to this is mentioned below:

fyers.in/fyers-policies-on-physical-settlement/