COVERED CALL

| Strategy Details | |

| Strategy Type | Cautiously Bullish |

| # of legs | 2 (Long the Underlying + Short the OTM Call) |

| Maximum Reward | Limited to the extent of strike price of the Call - purchase price of the underlying + Call premium received |

| Maximum Risk | Potentially unlimited, though the Call premium received will slightly reduce the losses suffered on the underlying position |

| Breakeven Price | Purchase price of the underlying-Call premiumreceived |

| Payoff Calculation | Underlying price at expiry - Purchase price of the underlying + Call premium received - Maximum of (Underlying price at expiry - Strike price, 0) |

Explanation of the Strategy

A Covered Call is an option strategy wherein a trader would purchase (or would be already owning) the underlying asset and simultaneously write an equivalent number of OTM Call option(s) on that underlying. This strategy allows the trader to earn an income on the underlying position that he/she is holding, by way of receiving a premium on the Call that has been written. Unlike a naked long Call, which is a bullish strategy, a Covered Call is a cautiously bullish strategy wherein the trader wouldn’t want the underlying price to rise sharply during the life of the option contract. Remember, no matter how higher the underlying price goes above the strike price, the writer’s profit potential is limited. On the other hand, the deeper the underlying price goes below the breakeven price, the larger would be the writer’s losses. Hence, a writer would want the underlying price to be as close as possible towards the strike price, to maximise his/her profit potential.

This strategy is commonly used to earn income on the underlying position that the writer is holdingonto. As such, some traders prefer writing a Covered Call each month to keep earning income on a regular basis. If, on expiration, the underlying price is above strike price and the writer has not yet closed out his/her existing short Call position, the Call will get exercised, in which case the writer will have to sell the underlying asset to the Call buyer at the stated strike price. Ideally, the quantity of the underlying asset mustmatch the size of the option position. For instance, the lot size of a Call option on Reliance Industries Ltd. is 500 shares. If a trader wants to write 1 Covered Call on Reliance, he/she would buy 500 shares of Reliance and simultaneously write 1 Call option of Reliance.

Benefits of the Strategy

-

If traded properly, this strategy can act as a good income generation strategy

-

If the underlying price rises only up to the strike price, the writer would not only profit from the underlying position but would also get to keep a large portion of the Call premium without getting the option exercised against him/her.

-

Because the option leg involves selling a Call option, Theta works in writer’s favour

-

Because the writer has a long exposure in the underlying, writing a Call would help him to reduce Delta exposure

Drawbacks of the Strategy

-

This strategy has a limited profit potential

-

This strategy has a potential for unlimited losses

-

A rise in volatility could hurt the trader who executes a Covered Call

-

Requires huge cash outlay, as the writer will have to buy an equivalent number of the underlying

Strategy Suggestions

-

Ensure that the price trajectory of the underlying is neutral to moderately bullish and that the price is trading above an important support level, which looks difficult to break

-

Because this strategy involves writing a Call option, ensure that the time of expiration is limited, preferably a month or less, so that there is not much time for the price to move against the writer

-

Keep in mind that Theta will decay rapidly during the last few days of the life of the Call option

-

If the objective of the strategy is purely from a trading perspective, reconsider the strategy in case the underlying falls and sustains below the breakeven price as the losses could amplify

-

Unless the writer is being more than moderately bullish on the underlying, write a Call option that is slightly OTM and not deep OTM

-

Although writing an ITM Call can enable the trader to profit even when the underlying is sideways or is slightly declining, keep in mind that the odds of such options getting exercised are higher

-

That said, if the writer intends to deliver the underlying to the Call buyer, he/she can consider writing an ITM Call as the odds of such options getting exercised are higher

-

A general rule to remember about which strike to select for a Covered Call strategy is this:

-

If you expect the underlying to rise, write an OTM Call. The more you expect the underlying to rise, the deeper the OTM strike you can choose

-

If you expect the underlying to remain sideways, consider writing an ATM Call

-

If you expect the underlying to remain sideways or decline till the strike price, consider writing an ITM Callas it offers greater protection

-

- Ensure that there is sufficient liquidity in the option in which you want to create a position

Option Greeks for Covered Call position

| Greek | Value is | Notes |

| Delta | Positive |

Delta is positive for a Covered Call position. Remember, the underlying has a Delta of 1 whereas selling an OTM Call has Delta ranging between 0 and -0.5. As a result, the combined Delta is still positive. Because the underlying has a positive Delta and the short Call has a negative Delta whose absolute value is less than that of the underlying Delta, the Covered Call position is less responsive to changes in the underlying price. For instance, if the underlying price rises (or falls) by 1pt, the value of the Covered Call position will rise (or fall) by less than 1pt. Also, because the Delta is positive, a Covered Call position benefits when the underlying moves higher and up to the strike price, beyond which Delta becomes zero. On the other hand, a decline in the underlying hurts the writer. |

| Gamma | Negative |

Gamma is negative for a Covered Call position, meaning it can hurt the writer especially during times when its value is high and the underlying moves adversely. Remember, as a Covered Call writer, you are only moderately bullish on the underlying and would neither prefer a sharp rise nor a sharp fall in the underlying. Hence, you would prefer a relatively stable Gamma without much impact on Delta. |

| Vega | Negative |

Vega is negative for a Covered Call position. As a result, rising IVs hurt the position, and vice versa. This is because rising IVs cause not only the Call premiums to rise, but also increases the volatility in the price of the underlying. Both these scenarios are ones which a writer wouldn’t prefer. Instead, the writer would want the IVs to reduce, as this would lower the Call premium and also cause the underlying price to remain steady rather than volatile. |

| Theta | Positive |

Because Covered Call is a moderately bullish strategy and works best when the underlying price does not swing much, Theta is the writer’s best friend. It is positive, meaning that the passage of time causes the Call premium to reduce, all else equal. |

| Rho | Negative |

Rho is negative for Covered Call position. As a result, a rise in interest rates hurts the writer, and vice versa. However, this is the least significant of the five Greeks, because it has the least impact on the price of the strategy, especially ones that are shorter-dated. |

Payoff of Covered Call

-

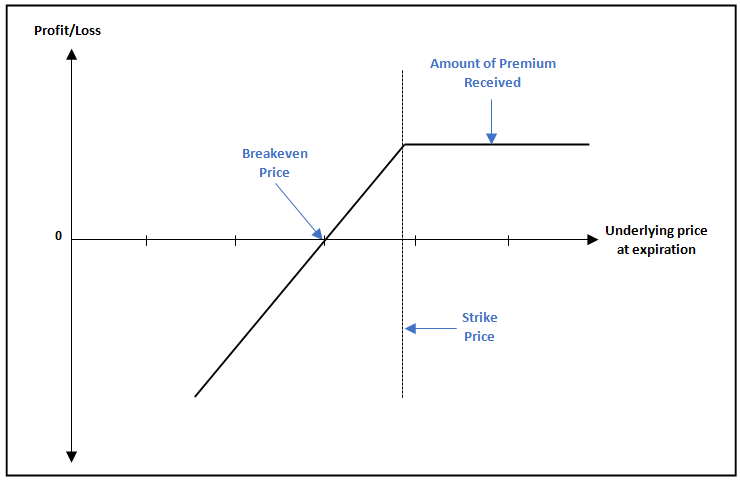

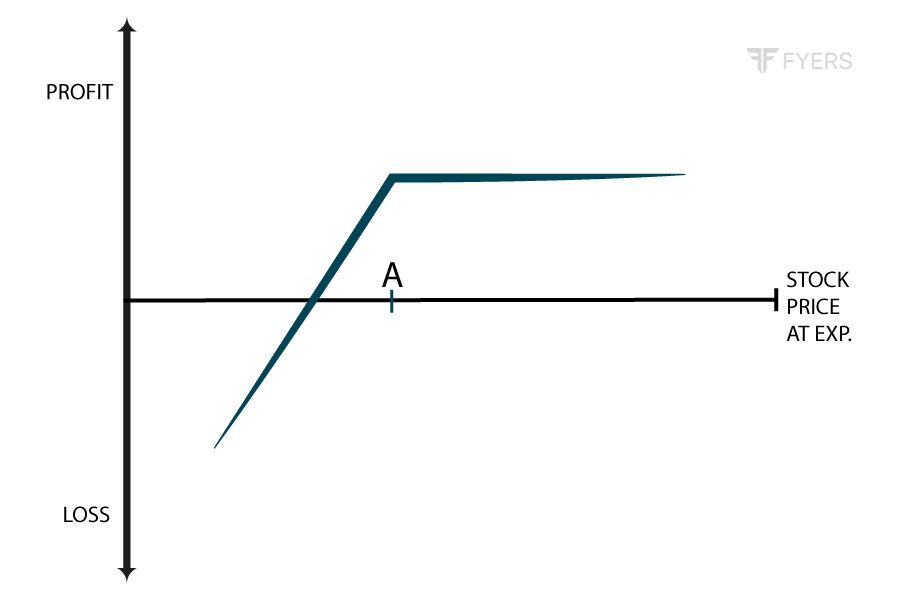

Payoff of the traditional Covered Call strategy:An OTM Covered Call

The above chart shows the payoff of a Covered Call position wherein the Call that has been written is OTM. Because the underlying price at initiation is below the strike price, for the writer to make maximum profit, the underlying price will have to rise to the strike price until expiration. The higher the strike price is above the underlying price at the time of initiation, the higher will the underlying price have to rise until expiration. Hence, a Covered Call strategy wherein the Call selected is OTM is a moderately bullish strategy. Writing an OTM Covered Call has a higher reward potential, but also has a high risk potential. Remember, for the position to make money, the underlying price will have to rise going forward in time. If it declines, the writer could even incur losses.

-

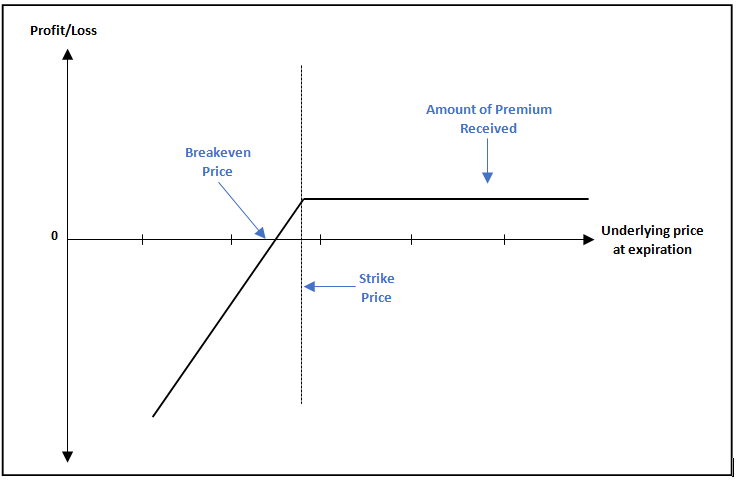

Payoff of the alternate Covered Call strategy:An ITM Covered Call

While the traditional Covered Call involves writing an OTM Call option, writers sometimes also choose to write an ITM Call option. The above chart shows the payoff position for an ITM Covered Call. By comparing this chart with that of an OTM Covered Call, a couple of things can be noted. First is that an ITM Covered Call offers a greater protection to the writer because it enables the writer to withstand a decline in the underlying price up to the strike price. Keep in mind that as long as the underlying price is above the strike price, the position earns maximum profit which is equivalent to the time value of the option. Second is that the maximum reward potential for an ITM Covered Call is lower than that ofan OTM Covered Call because of the greater protection the former offers over the latter.

Example of an OTM Covered Call

Let us assume that Reliance Industries is currently trading at ₹1,120 and Mr.X is holding 500 shares of the same. Based on chart patterns, Mr.X feels thatthe stock will trade within a range of ₹1,100 and ₹1,160 until the option expiry. He also feels that the stock will maintain a positive tone during this period and rally towards ₹1,160, though he doesn’t expect the stock to move past this. Based on this, he decides to execute an OTM Covered Call strategy having a strike price of 1160. Given that the option lot size of Reliance is 500 shares, Mr.X decides to write just the Call option rather than buying the underlying as he already owns 500 shares of Reliance. Let us assume that the premium of 1160 Call option is ₹45. Hence, for writing the Call option, Mr.X will receive a premium of ₹22,500 (₹45 *500). Let us recap the details below:

-

Strike price = 1160 CE

-

Call premium = ₹45

-

Underlying price at initiation = ₹1,120

-

Call premium received = ₹22,500

-

Breakeven price of the strategy = ₹1,075 (1,120 - 45)

Now, let us assume a few scenarios in terms of where Reliance would be on the expiration date and the impact this would have on the profitability of the trade.

|

Underlying price at Expiration |

Net Profit/Loss | Notes |

| 900 | Loss of ₹87,500 | Payoff = 900 - 1120 + 45 - maximum of (900 - 1160, 0). As the underlying price at expiration is below the breakeven price, the writer will incur a loss |

| 1,000 | Loss of ₹37,500 | Payoff = 1000 - 1120 + 45 - maximum of (1000 - 1160, 0). As the underlying price at expiration is below the breakeven price, the writer will incur a loss |

| 1,050 | Loss of ₹12,500 | Payoff = 1050 - 1120 + 45 - maximum of (1050 - 1160, 0). As the underlying price at expiration is below the breakeven price, the writer will incur a loss |

| 1,075 | No Profit/No Loss | Payoff = 1075 - 1120 + 45 - maximum of (1075 - 1160, 0). As the underlying price at expiration is at the breakeven price, the writer will neither make a profit nor incur a loss |

| 1,100 | Profit of ₹12,500 | Payoff = 1100 - 1120 + 45 - maximum of (1100 - 1160, 0). As the underlying price at expiration is above the breakeven price, the writer will make a profit |

| 1,150 | Profit of ₹37,500 | Payoff = 1150 - 1120 + 45 - maximum of (1150 - 1160, 0). As the underlying price at expiration is above the breakeven price, the writer will make a profit |

| 1,160 | Profit of ₹42,500 | Payoff = 1160 - 1120 + 45 - maximum of (1160 - 1160, 0). As the underlying price at expiration is above the breakeven price, the writer will make a profit |

| 1,200 | Profit of ₹42,500 | Payoff = 1200 - 1120 + 45 - maximum of (1200 - 1160, 0). As the underlying price at expiration is above the breakeven price, the writer will make a profit |

| 1,300 | Profit of ₹42,500 | Payoff = 1300 - 1120 + 45 - maximum of (1300 - 1160, 0). As the underlying price at expiration is above the breakeven price, the writer will make a profit |

Notice in the above table that the lower the underlying falls below the breakeven price (₹1,075 in the above case), the higher will be the losses that the writer would incur. Meanwhile, observe that the profit potential will be capped once the underlying price rises to the strike price (₹1,160 in the above case). Observe that because the Call written is OTM, the underlying will have to rise to the strike price for the writer to earn maximum profit on his/her position. It is because of this factor that this strategy is a moderately bullish strategy.

Example of an ITM Covered Call

Let us take the same example as above. However, let us now assume that Mr.X is neutral on the trajectory of the underlying price. He feels that the underlying will trade in a range between ₹1,080 and ₹1,140 until expiration. Because he is not so sure about the direction, he seeks for a greater protection and hence decides to execute an ITM Covered Call strategy. Remember, he is already holding 500 shares of the underlying, and hence will only write an ITM Call. Let us assume that he chooses to write 1080 Call option that has a premium of ₹90. Hence, for writing the Call option, Mr.X will receive a premium of ₹45,000 (₹90 *500). Let us recap the details below:

-

Strike price = 1080 CE

-

Call premium = ₹90

-

Underlying price at initiation = ₹1,120

-

Call premium received = ₹45,000

-

Breakeven price of the strategy = ₹1,030 (1,120 - 90)

Now, let us assume a few scenarios in terms of where Reliance would be on the expiration date and the impact this would have on the profitability of the trade.

| Underlying price at Expiration | Net Profit/Loss | Notes |

| 900 | Loss of ₹65,000 | Payoff = 900 - 1120 + 90 - maximum of (900 - 1080, 0). As the underlying price at expiration is below the breakeven price, the writer will incur a loss |

| 950 | Loss of ₹40,000 | Payoff = 950 - 1120 + 90 - maximum of (950 - 1080, 0). As the underlying price at expiration is below the breakeven price, the writer will incur a loss |

| 1,000 | Loss of ₹15,000 | Payoff = 1000 - 1120 + 90 - maximum of (1000 - 1080, 0). As the underlying price at expiration is below the breakeven price, the writer will incur a loss |

| 1,030 | No Profit/No Loss | Payoff = 1030 - 1120 + 90 - maximum of (1030 - 1080, 0). As the underlying price at expiration is at the breakeven price, the writer will neither make a profit nor incur a loss |

| 1,050 | Profit of ₹10,000 | Payoff = 1050 - 1120 + 90 - maximum of (1050 - 1080, 0). As the underlying price at expiration is above the breakeven price, the writer will make a profit |

| 1,080 | Profit of ₹25,000 | Payoff = 1080 - 1120 + 90 - maximum of (1080 - 1080, 0). As the underlying price at expiration is above the breakeven price, the writer will make a profit |

| 1,100 | Profit of ₹25,000 | Payoff = 1100 - 1120 + 90 - maximum of (1100 - 1080, 0). As the underlying price at expiration is above the breakeven price, the writer will make a profit |

| 1,120 | Profit of ₹25,000 | Payoff = 1120 - 1120 + 90 - maximum of (1120 - 1080, 0). As the underlying price at expiration is above the breakeven price, the writer will make a profit |

| 1,200 | Profit of ₹25,000 | Payoff = 1200 - 1120 + 90 - maximum of (1200 - 1080, 0). As the underlying price at expiration is above the breakeven price, the writer will make a profit |

Notice in the above table that when the underlying price falls below the breakeven price, the writer suffers a loss, which increases the deeper the underlying price goes below the breakeven price. However, as the Call written is ITM, observe that the writer will earn maximum profit even if the underlying price drops from the strategy initiation price of ₹1,120 up to the strike price of ₹1,080. Also note that for the writer to suffer a loss, the underlying price must fall below the breakeven price, which is quite far when the Call chosen is ITM. As a result, an ITM Covered Call offers a greater protection to the writer as compared to writing an OTM Covered Call. However, it naturally follows that the higher the protection, the lower would be the reward. Because an ITM Covered Call is relatively safer than an OTM Covered Call, the profit potential is also relatively less than that offered by an OTM Covered Call.

Just to highlight again, below mentioned are the major differences between an OTM Covered Call and an ITM Covered Call:

| OTM Covered Call | ITM Covered Call | |

| Strategy type | Traditional | Alternate |

| Write when the view is | Moderately bullish | Neutral |

| Risk is | Higher than that for an ITM Covered Call | Lower than that for an OTM Covered Call |

| Maximum Reward is | Higher than that for an ITM Covered Call | Lower than that for an OTM Covered Call |

Covered Put

| Strategy Details | |

| Strategy Type | Cautiously Bearish |

| # of legs | 2 (Short the Underlying + Short the OTM Put) |

| Maximum Reward | Limited to the extent of the price at which the underlying is sold - strike price of the Put + Put premium received |

| Maximum Risk | Potentially unlimited, though the Put premium received will slightly reduce the losses suffered on the underlying position |

| Breakeven Price | Price at which the underlyingis sold +Put premium received |

| Payoff Calculation | Price at which the underlying is sold - Underlying price at expiry + Put premium received - Maximum of (Strike price - Underlying price at expiry, 0) |

Explanation of the Strategy

A Covered Put is the opposite of a Covered Call. Under this strategy, the writer would short the underlying asset (or short the futures on the underlying asset) and simultaneously write an equivalent number of OTM Put Options on that underlying. This strategy is a moderately bearish strategy, wherein the writer would benefit when the underlying price moves lower until expiration. How lower? Well, the sweetest spot to the writer would be when the underlying drops to the strike price, because at this level, the writer would be earning maximum profit. If the underlying price continues dropping and falls below the strike price, the seller will not earn more because the gains made in the underlying position would be offset by the losses incurred in the short Put position. On the other hand, the writer would be exposed to potentially unlimited losses in case the underlying price moves higher. The larger the rise in the underlying price, the larger would be the writer’s losses. Hence, care must be taken when initiating this strategy. On expiration, if the underlying price is below the strike price and the writer has not yet closed out his/her existing short Put position, the Put will get exercised, in which case the writer will have to buy the underlying asset from the Put buyer at the stated strike price.

Benefits of the Strategy

-

If traded properly, this strategy can act as a good income generation strategy

-

Because the option leg involves selling a Put option, Theta works in writer’s favour

-

Helps to partially offset the losses in case of an adverse price movement in the underlying

Drawbacks of the Strategy

-

This strategy is very risky because of the complexity involved in shorting the underlying

-

This strategy has a limited profit potential

-

This strategy has a potential for unlimited losses

-

Because of the limited profit, unlimited loss potential, this strategy is not suitable to all traders

-

As this strategy is a neutral to moderately bearish strategy, a rise in volatility could hurt the trader

-

Requires huge cash outlay, as the writer will have to sell an equivalent number of the underlying

Strategy Suggestions

-

Ensure that the price trajectory of the underlying is neutral to moderately bearish and that the price is trading below an important resistance level

-

Because this strategy involves writing a Put option, ensure that the time to expiration is limited, preferably a month or less

-

Keep in mind that Theta will decay rapidly during the last few days of the life of the Put option

-

If the objective of the strategy is purely from a trading perspective, reconsider the strategy in case the underlying rises and sustains above the breakeven price as the losses could amplify

-

Unless the writer is being more than moderately bearish on the underlying, write a Put option that is slightly OTM and not deep OTM

-

Although writing an ITM Putcan enable the trader to profit even when the underlying is sideways or is rising up to the strike price, keep in mind that the odds of such options getting exercised are higher

-

That said, if the writer intends to take delivery of the underlying from the Putholder, he/she can consider writing an ITM Put as the odds of such options getting exercised are higher

-

A general rule to remember about which strike to select for a Covered Put strategy is this:

-

If you expect the underlying to fall, write an OTM Put. The more you expect the underlying to drop, the deeper the OTM strike you can choose

-

If you expect the underlying to remain sideways, consider writing an ATM Put

-

If you expect the underlying to remain sideways or rise till the strike price, consider writing an ITM Put

-

-

Ensure that there is sufficient liquidity in the option in which you want to create a position

Option Greeks for Covered Put position

| Greek | Value is | Notes |

| Delta | Negative |

Delta is negative for a Covered Put position. Remember, the underlying short position has a Delta of -1 whereas selling a Put has Delta ranging between 0 and 1. As a result, the combined Delta is negative (assuming Delta of short Put is less than 1). Because the Delta is negative, a Covered Put position benefits when the underlying moves lower and up to the strike price. On the other hand, a rise in the underlying hurts the position. |

| Gamma | Negative |

Gamma is negative for a Covered Put position, meaning it can hurt the writer especially during times when its value is high and the underlying moves adversely. Remember, as a Covered Put writer, you would prefer a relatively stable Gamma without much impact on the option’s Delta. |

| Vega | Negative |

Vega is negative for a Covered Put position. As a result, rising IVs hurt the position, and vice versa. This is because rising IVs cause not only the Put premiums to rise, but also increases the volatility in the price of the underlying. Both these scenarios are ones which a writer wouldn’t prefer. Instead, the writer would want the IVs to reduce, as this would lower the Put premium and also cause the underlying price to remain steady rather than volatile. |

| Theta | Positive |

Theta is positive, meaning that the passage of time causes the Put premium to reduce, all else equal. |

| Rho | Positive |

Rho is positive for a Covered Put position. As a result, a rise in interest rates benefits the writer, and vice versa. However, this is the least significant of the five Greeks, because it has the least impact on the price of the strategy, especially ones that are shorter-dated. |

Payoff of Covered Put

-

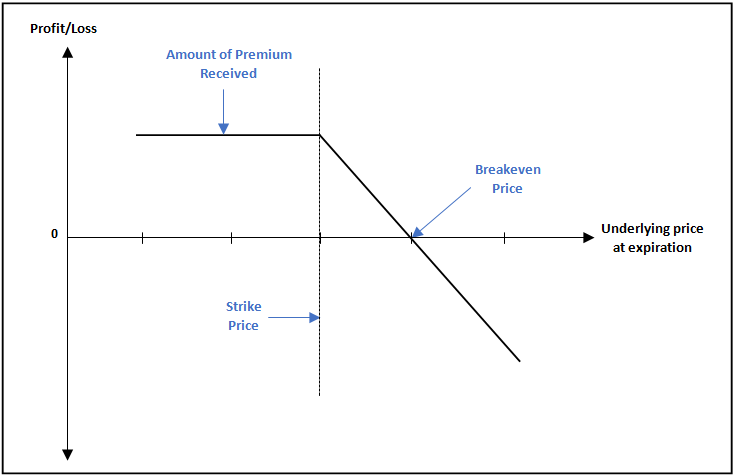

Payoff of the traditional Covered Put strategy:An OTM Covered Put

The above chart shows the payoff of an OTM Covered Put position. Because the Put that is written is OTM, to achieve maximum profit, the underlying price will have to drop to the strike price by expiration. As a result, this is a moderately bearish strategy. The lower the strike price is below the underlying price, the more will the latter have to fall to achieve maximum profit. On the other hand, a rise in the underlying price will hurt the trader, especially once it crosses the breakeven point. The higher the underlying price rises above the breakeven point, the larger will be the trader’s losses. Hence, care must be taken when a Covered Put strategy is initiated, especially if the underlying rises and moves above the breakeven price.

-

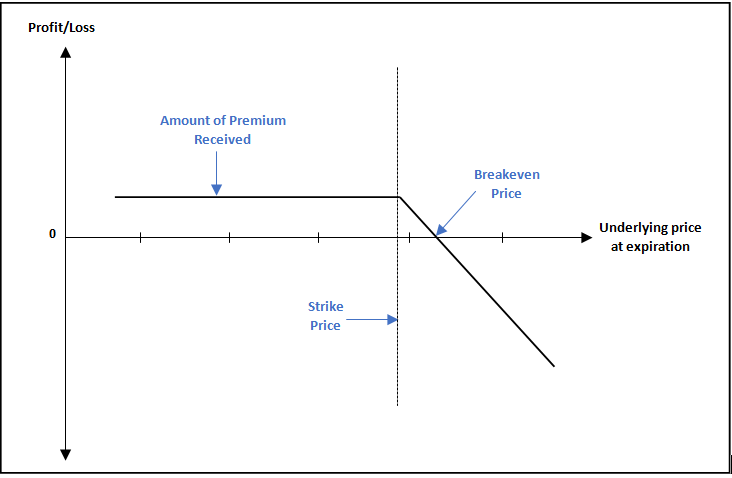

Payoff of the alternate Covered Put strategy:An ITM Covered Put

If the writer has a short exposure to the underlying instrument and wants to earn an income on it, he/she can consider writing an ITM Covered Put if the direction of the underlying is not so clear. Remember, an ITM Covered Put position will have a strike price that is above the underlying price.So, a writer taking such a position can earn maximum profit even if the underlying price stays unchanged or rises up to the strike price. Compare the above chart to that of the previous chart. It can be seen that an ITM Covered Put has a smaller maximum profit potential than an OTM Covered Put. However, an ITM Covered Put also offers a greater protection than an OTM Covered Put does, because it enables the writer to profit even when the underlying is sideways or is moving higher towards the strike price.

Example of an OTM Covered Put

Let us assume that SBI current month futures contract is currently trading at ₹245 and that the 240 strike Put option for the same month is trading at ₹5. Mr. X is bearish on the near-term outlook of SBI and wants to short 1 lot of SBI futures. However, to slightly safeguard his position from any unexpected rise in the share price, Mr.X also wants to sell 1 lot of SBI 240 Put option. Given the lot size of 3,000 shares, Mr.X writes a Covered Put position on SBI by selling 1 lot of SBI futures at ₹245 and simultaneously writing 1 lot of SBI 240 Put option at ₹5. The total premium proceeds that Mr.X would receive is ₹15,000 (₹5 * 3,000).

-

Strike price = 240PE

-

Put premium = ₹5

-

Underlying futures price at initiation = ₹245

-

Put premium received = ₹15,000

-

Breakeven price of the strategy = ₹250 (245+5)

Now, let us assume a few scenarios in terms of where SBI would be on the expiration date and the impact this would have on the profitability of the trade.

| Underlying price at Expiration | Net Profit/Loss | Notes |

| 280 | Loss of ₹90,000 | Payoff = 245 - 280 + 5 - maximum of (240 - 280, 0). As the underlying price at expiration is above the breakeven price, the writer will incur a loss |

| 270 | Loss of ₹60,000 | Payoff = 245 - 270 + 5 - maximum of (240 - 270, 0). As the underlying price at expiration is above the breakeven price, the writer will incur a loss |

| 265 | Loss of ₹45,000 | Payoff = 245 - 265 + 5 - maximum of (240 - 265, 0). As the underlying price at expiration is above the breakeven price, the writer will incur a loss |

| 260 | Loss of ₹30,000 | Payoff = 245 - 260 + 5 - maximum of (240 - 260, 0). As the underlying price at expiration is above the breakeven price, the writer will incur a loss |

| 255 | Loss of ₹15,000 | Payoff = 245 - 255 + 5 - maximum of (240 - 255, 0). As the underlying price at expiration is above the breakeven price, the writer will incur a loss |

| 250 | No Profit/No Loss | Payoff = 245 - 250 + 5 - maximum of (240 - 250, 0). As the underlying price at expiration is at the breakeven price, the writer will neither make a profit nor incur a loss |

| 245 | Profit of ₹15,000 | Payoff = 245 - 245 + 5 - maximum of (240 - 245, 0). As the underlying price at expiration is below the breakeven price, the writer will make a profit |

| 240 | Profit of ₹30,000 | Payoff = 245 - 240 + 5 - maximum of (240 - 240, 0). As the underlying price at expiration is below the breakeven price, the writer will make a profit |

| 235 | Profit of ₹30,000 | Payoff = 245 - 235 + 5 - maximum of (240 - 235, 0). As the underlying price at expiration is below the breakeven price, the writer will make a profit |

| 230 | Profit of ₹30,000 | Payoff = 245 - 230 + 5 - maximum of (240 - 230, 0). As the underlying price at expiration is below the breakeven price, the writer will make a profit |

| 220 | Profit of ₹30,000 | Payoff = 245 - 220 + 5 - maximum of (240 - 220, 0). As the underlying price at expiration is below the breakeven price, the writer will make a profit |

Notice in the above table that the higher the underlying price goes above the breakeven price, the larger will be the losses of the writer. Hence, it is very crucial to monitor the position closely, especially once the underlying price crosses above the strike price. The writer might even be better off by exiting both his/her positions (short underlying + futures) by taking a small loss, rather than holding on to his/her position and seeing the losses magnify. On the other hand, observe that as long as the underlying price is below the breakeven price, the writer is in a profitable position. However, also notice that no matter how lower the underlying price goes below the strike price, the writer’s profit potential in a Covered Put position will be capped. Because of this limited reward and unlimited risk potential, Covered Put strategy might not be suitable to all traders.

Example of an ITM Covered Put

Let us take the same example as above. However, let us now assume that Mr.X is neutral to slightly bearish on the stock price direction and broadly expects the underlying to trade in a range between ₹235 and ₹250 until expiry. Based on this, Mr.X decides to write a Covered Put position on SBI by selling 1 lot of SBI futures at ₹245 and simultaneously writing 1 lot of SBI 250 Put option at ₹9. The total premium proceeds that Mr.X would receive is ₹27,000 (₹9 * 3,000).

-

Strike price = 250 PE

-

Put premium = ₹9

-

Underlying futures price at initiation = ₹245

-

Put premium received = ₹27,000

-

Breakeven price of the strategy = ₹254 (245 + 9)

Now, let us assume a few scenarios in terms of where SBI would be on the expiration date and the impact this would have on the profitability of the trade.

| Underlying price at Expiration | Net Profit/Loss | Notes |

| 280 | Loss of ₹78,000 | Payoff = 245 - 280 + 9 - maximum of (250 - 280, 0). As the underlying price at expiration is above the breakeven price, the writer will incur a loss |

| 270 | Loss of ₹48,000 | Payoff = 245 - 270 + 9 - maximum of (250 - 270, 0). As the underlying price at expiration is above the breakeven price, the writer will incur a loss |

| 265 | Loss of ₹33,000 | Payoff = 245 - 265 + 9 - maximum of (250 - 265, 0). As the underlying price at expiration is above the breakeven price, the writer will incur a loss |

| 260 | Loss of ₹18,000 | Payoff = 245 - 260 + 9 - maximum of (250 - 260, 0). As the underlying price at expiration is above the breakeven price, the writer will incur a loss |

| 255 | Loss of ₹3,000 | Payoff = 245 - 255 + 9 - maximum of (250 - 255, 0). As the underlying price at expiration is above the breakeven price, the writer will incur a loss |

| 254 | No Profit/No Loss | Payoff = 245 - 254 + 9 - maximum of (250 - 254, 0). As the underlying price at expiration is at the breakeven price, the writer will neither make a profit nor incur a loss |

| 252 | Profit of ₹6,000 | Payoff = 245 - 252 + 9 - maximum of (250 - 252, 0). As the underlying price at expiration is below the breakeven price, the writer will make a profit |

| 250 | Profit of ₹12,000 | Payoff = 245 - 250 + 9 - maximum of (250 - 250, 0). As the underlying price at expiration is below the breakeven price, the writer will make a profit |

| 245 | Profit of ₹12,000 | Payoff = 245 - 245 + 9 - maximum of (250 - 245, 0). As the underlying price at expiration is below the breakeven price, the writer will make a profit |

| 240 | Profit of ₹12,000 | Payoff = 245 - 240 + 9 - maximum of (250 - 240, 0). As the underlying price at expiration is below the breakeven price, the writer will make a profit |

| 235 | Profit of ₹12,000 | Payoff = 245 - 235 + 9 - maximum of (250 - 235, 0). As the underlying price at expiration is below the breakeven price, the writer will make a profit |

| 220 | Profit of ₹12,000 | Payoff = 245 - 220 + 9 - maximum of (250 - 220, 0). As the underlying price at expiration is below the breakeven price, the writer will make a profit |

Compared to the OTM Covered Put example, notice in the above table that the selection of a higher strike price reduces the risk as the losses get partially reduced. Also observe that because the Put selected is ITM, the writer earns maximum profit even if the underlying rises a little and moves up towards the strike price. Hence, writing an ITM Covered Put gives a greater degree of protection to the writer than writing an OTM Covered Put. That said, the higher the protection, the lower will be the reward. Notice that the maximum profit potential for an ITM Covered Put is less than that for an OTM Covered Put. Hence, there will always be a trade-off between protection and reward.

Next Chapter

Comments & Discussions in

FYERS Community