Now that we know what the major currency pairs are, it’s time to discuss about cross currencies, which are also known as the Crosses or the Minors. In this chapter, we will focus on the Crosses in greater detail. Before discussing about some of the key crosses, we will first define what a cross currency is and then talk about how the cross currency values are calculated. So, let us get started.

Cross Currency defined

Any currency pair in which the dollar is not present is called a cross currency pair. For instance, EUR/GBP is a cross currency pair, and so are GBP/JPY, EUR/CHF, EUR/INR, etc.

Cross Currency calculation

The value of a cross currency is arrived from the respective Dollar pairs. For instance, the value of EUR/GBP is derived from the value of two currency pairs - EUR/USD and GBP/USD. Let us now see how the value of EUR/GBP is derived.

Example 1

Let’s assume that EUR/USD is currently trading at 1.1010 and GBP/USD is currently trading at 1.2412.

In the expression EUR/GBP, EUR is the base currency (numerator) and GBP is the quoted currency (denominator). Now looking at the two USD currency pairs, EUR is the base currency (or the numerator) in EUR/USD and GBP is also the base currencyin GBP/USD. That said, in case of EUR/GBP, GBP is the quoted currency (or the denominator). Hence, we would want to make GBP a quoted currency in GBP/USD as well, because to calculate the value of EUR/GBP, GBP must be on the quoted side.

Remember the mathematics we learned during our school times, especially a concept called the “Reciprocal”? If we were given the value of a fraction A÷B as 3, to find its reciprocal (i.e. the value of B÷A), we simply flip the fraction. So,

If A÷B = 3 …. (which is the same as 3÷1)

Then B÷A = 1÷3, or in other words 1/3

Same mathematical concepts apply to currency calculations too. To make GBP the quoted currency in the pair GBP/USD, simply flip the values. So,

If GBP/USD = 1.2412

Then USD/GBP = 1÷1.2412

Therefore, USD/GBP = 0.8057

Now, we have the values of EUR/USD and USD/GBP

Let us now calculate the value of EUR/GBP

EUR/GBP = EUR/USD * USD/GBP = 1.1010*0.8057 = 0.8871

Notice above that when EUR/USD is multiplied with USD/GBP, the USD on both sides cancel each other out (USD is denominator in case of EUR/USD and numerator in case of USD/GBP) and what is left over is EUR/GBP.

Example 2

Let us now take another example.

Let us now calculate the value of AUD/JPY. Notice here that AUD is the base currency and JPY is the quoted currency.

In order to do this, we would again need the values of two USD currency pairs, AUD/USD and USD/JPY in this case.

Let us assume the value of AUD/USD as 0.6836 and that of USD/JPY as 108.13.

Notice that in AUD/USD, AUD is the base currency; and in USD/JPY, JPY is the quoted currency. As such, we can directly calculate the value of AUD/JPY as,

AUD/JPY = AUD/USD * USD/JPY = 0.6836*108.13 = 73.92

Notice that in this example, we weren’t required to do as many calculations as we did in the earlier example. This is because there was no need to flip a currency pair asthe USD on both the currency pairs cancelled each other out directly. In the earlier example however, we were required to flip the value of one of the currency pair to ensure that the USD on both the currency pairs cancelled each other out.

Are Cross Currency rates readily available?

The question that might now arise in the reader’s mind is that is there a need to calculate the values of cross currency pairs? The answer is no. Cross currency rates are readily available on various Forex platforms. In fact, the crosses are traded heavily around the world (although not as much as the trading that takes place in pairs where USD is one of the currency). Some of the key crosses are mentioned below:

| Major Euro Crosses | ||

| Currency Pair Code | Calculation | Is flipping a pair needed? |

| EUR/GBP | EUR/USD * USD/GBP | Yes, for GBP/USD |

| EUR/CHF | EUR/USD * USD/CHF | No |

| EUR/JPY | EUR/USD * USD/JPY | No |

| EUR/CAD | EUR/USD * USD/CAD | No |

| EUR/AUD | EUR/USD * USD/AUD | Yes, for AUD/USD |

| EUR/NZD | EUR/USD * USD/NZD | Yes, for NZD/USD |

| Major Yen Crosses | ||

| Currency Pair Code | Calculation | Is flipping a pair needed? |

| EUR/JPY | EUR/USD * USD/JPY | No |

| GBP/JPY | GBP/USD * USD/JPY | No |

| CHF/JPY | CHF/USD * USD/JPY | Yes, for USD/CHF |

| CAD/JPY | CAD/USD * USD/JPY | Yes, for USD/CAD |

| AUD/JPY | AUD/USD * USD/JPY | No |

| NZD/JPY | NZD/USD * USD/JPY | No |

| Major Pound Crosses | ||

| Currency Pair Code | Calculation | Is flipping a pair needed? |

| EUR/GBP | EUR/USD * USD/GBP | Yes, for GBP/USD |

| GBP/CHF | GBP/USD * USD/CHF | No |

| GBP/JPY | GBP/USD * USD/JPY | No |

| GBP/CAD | GBP/USD * USD/CAD | No |

| GBP/AUD | GBP/USD * USD/AUD | Yes, for AUD/USD |

| GBP/NZD | GBP/USD * USD/NZD | Yes, for NZD/USD |

The Crosses

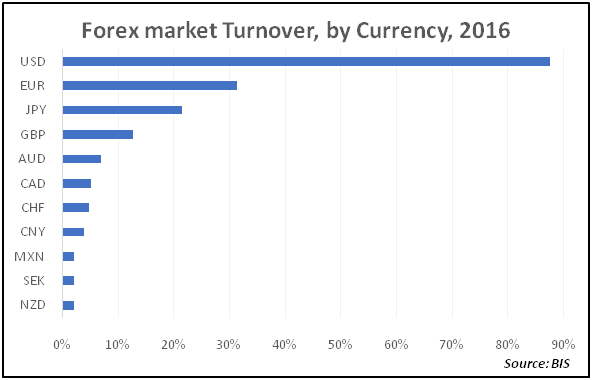

As per the Bank for International Settlements (BIS) report, the Dollar was on one side of almost 88% of all trades in April 2016. One reason why the Dollar is so heavily traded is that it is the world’s reserve currency. Also, almost all the global assets, such as commodities, are priced in terms of the Dollar and all international payments are also usually made in dollars. Hence, it is not surprising that the Dollar is so widely used as one of the currency in a currency pair. On the other hand, among currencies other than the Dollar, the most traded ones are the currencies that we talked about in the previous chapter. These include the Euro, the Yen, the Pound, the Franc, the Aussie (i.e. the Australian Dollar), the Loonie (i.e. the Canadian Dollar), and the Kiwi (i.e. the New Zealand Dollar). Even within these, the most common ones that are on one side of the trade are the Euro, the Yen, and the Pound. The chart on the right shows the Forex turnover for some of the key currencies for the period April 2016.Let us now talk about some of the key cross currencies that are traded around the world.

EUR/GBP

Among the crosses, the EUR/GBP is the most traded cross currency pair in the world. It is also the most traded and the most liquid Euro cross pair. In 2016, it constituted 2% of all Forex market transactions. The pair is strongly impacted by economic data from two regions, the Euro zone and Britain. Strong economic data from Euro zone tends to lift the pair higher and vice versa, while strong economic data from Britain tends to drag the pair lower and vice versa. Besides, the pair is also heavily influenced by two central banks, the ECB and the BoE. Generally, if the ECB is more hawkish than the BoE, the pair is likely to strengthen; while if the BoE is more hawkish than the ECB, the pair is likely to weaken.

As both the regions belong to the same continent, a lot of cross-border transactions take place between them in terms of goods and services. Hence, the economic health of either region has a strong bearing on the trajectory of the pair. Generally, if the Euro zone economy is stronger than the British economy, the pair is likely to strengthen; while if the British economy is stronger than the Euro zone economy, the pair is likely to weaken. As the pair is a cross between two Dollar-denominated currency pairs (i.e. EUR/USD and GBP/USD), news flows pertaining to the US can also have some impact on the pair. Hence, one needs to monitor news pertaining to the USD too when trading the EUR/GBP cross.

Some of the key factors to keep a track of when monitoring the pair include:

-

The ECB and the BoE monetary policy meeting.

-

The policy guidance of each of the two central banks.

-

The trajectory of the interest rate differential between the two regions.

-

Periodic comments from ECB and BoE officials.

-

Key Euro zone and UK economic data.

-

News flows and major economic development in each of the two regions.

EUR/JPY

The EUR/JPY is the second most traded Euro cross. The pair is strongly impacted by economic reports from two regions, the Euro zone and Japan. Strong economic data from Euro zone tends to lift the pair higher and vice versa, while strong economic data from Japan tends to drag the pair lower and vice versa. Besides, the pair is also influenced by two central banks, the ECB and the BoJ. Generally, if the ECB is more hawkish than the BoJ, the pair is likely to strengthen; while if the BoJ is more hawkish than the ECB, the pair is likely to weaken.

But besides the economic data and the central bank monetary policies of Euro zone and Japan, another factor that has a significant impact on the pair is the prevailing risk sentiment in the market. As we saw in the previous chapter, the Japanese currency is considered to be one of the safest currencies in the world, tending to appreciate during times of global uncertainties and risk aversion, and depreciate during times of global economic strength and higher risk appetite. Hence, in order to trade the pair, it is necessary to know how the prevailing risk appetite in the global markets is.

Some of the key factors to keep a track of when monitoring the pair include:

-

The ECB and the BoJ monetary policy meeting.

-

The policy guidance of each of the two central banks.

-

The trajectory of the interest rate differential between the two regions.

-

Periodic comments from ECB and BoJ officials.

-

Key Euro zone and Japanese economic data.

-

News flows and major economic development in each of the two regions.

-

Prevailing risk appetite around the world.

EUR/CHF

The EUR/CHF is the third most traded Euro cross. Both the currencies in this pair belong to regions that are from the same continent and are subject to a lot of cross border transactions involving various goods and services. Hence, movement in the pair is closely impacted by economic conditions prevailing in both the Euro area and Switzerland. Stronger economic conditions in the Euro zone are positive for the pair and vice versa; while stronger economic conditions in Switzerland are bearish for the pair and vice versa. Another factor that has a strong bearing on the pair is monetary policies of the ECB and SNB. Generally, a hawkish stance by the ECB is bullish for the pair and vice versa; while a hawkish stance by the SNB is bearish for the pair and vice versa.

Another factor that impacts this pair is the prevailing risk sentiment, especially within Europe. Strong risk appetite is bullish for the pair, while risk aversion is bearish. Because of the Franc’s safe haven status, the pair depreciated relentlessly from late-2007 to early-2015, first due to the Global Financial Crisis and then due to the Euro zone Sovereign Debt Crisis. The decline in the pair came even in the face of relentless intervention by the SNB, who tried curbing the decline in the pair to prevent it from damaging the export-driven Swiss economy. However, their actions didn’t havethe kind of impact that they had hoped foras weak economic conditions in the Euro zone continued to trigger relentless inflows into Switzerland. Hence, how the economic conditions between these two regions are tends to have a strong impact on the trend of the EUR/CHF pair.

Some of the key factors to keep a track of when monitoring the pair include:

-

The ECB and the SNB monetary policy meeting.

-

The policy guidance of each of the two central banks.

-

The trajectory of the interest rate differential between the two regions.

-

Periodic comments from ECB and SNB officials.

-

Key Euro zone and Swiss economic data.

-

News flows and major economic development in each of the two regions.

-

News flows and major economic developments in Europe.

-

Prevailing risk appetite around the world, especially in Europe.

AUD/JPY

The AUD/JPY pair is one of the favourite and one of the most transacted currency pairs for conducting carry trade transactions. The reason why this is so is because Japan has one of the lowest interest rates in the world, while Australia has one of the highest interest rates among the developed economies. As a result, yield-seeking investors often use the Japanese Yen as a funding currency to buy Australian Dollars, with the objective of profiting from the high interest rate differential between the two currencies. As such, the pair tends to be heavily influenced by the trajectory of interest rate differential between the two nations. Widening interest rate differential between Australia and Japan is positive for the pair as it increases the incentive of conducting carry trade transactions, while narrowing interest rate differential between the two nations is negative for the pair as it reduces the incentive to conduct carry trade transactions.

Besides, the pair is influenced by economic data from the two regions. Stronger economic data from Australia is positive for the pair and vice versa; while stronger economic data from Japan is negative for the pair and vice versa. Another factor that has a strong bearing on the pair is monetary policies of the RBA and the BoJ. Generally, a hawkish stance by the RBA is bullish for the pair and vice versa; while a hawkish stance by the BoJ is bearish for the pair and vice versa. Also, given that the Aussie is a risk-on currency while the Yen is a risk-off currency, movement in the pair is heavily impacted by prevailing risk sentiment in the market. Positive risk sentiment usually lifts the pair higher, while negative risk sentiment drags the pair lower.

Some of the key factors to keep a track of when monitoring the pair include:

-

The RBA and the BoJ monetary policy meeting.

-

The policy guidance of each of the two central banks.

-

The trajectory of the interest rate differential between the two regions.

-

Periodic comments from RBA and BoJ officials.

-

Key Australian and Japanese economic data.

-

News flows and major economic development in each of the two regions.

-

News flows and major economic developments in China.

-

The trajectory of commodity prices.

-

Prevailing risk appetite around the world.

Things to keep in mind

While movement among crosses is heavily influenced by the two currencies in the pair, do not forget that the Dollar can also impact the direction of the crosses. This is because a cross currency is derived from the values of two dollar based currencies. For instance, as we saw in the cross calculation earlier in this chapter, the value of the EUR/GBP cross is determined by multiplying the EUR/USD and the USD/GBP pair. Hence, any strong move in either or both these dollar based currency pairs will have an impact on the EUR/GBP cross as well. As such, it is always necessary to keep a close watch on the Dollar.

Alternatively, crosses can also be used to analyse and compare between dollar based currencies. For instance, if the EUR/GBP cross has given a breakout on the upside and so have EUR/USD and GBP/USD, it is likely that EUR/USD will outperform GBP/USD because the Euro is outperforming the Pound. Hence, if one had to trade only one of EUR/USD or GBP/USD on the long side, the EUR/USD would be a safer bet.

Meanwhile, the Majors and the Crosses can also be used to confirm whether the prevailing movement between the two pairs will sustain. For instance, if the cross EUR/CHF has given a break on the downside, while the major USD/CHF is rising, usually one of the two things will happen. Either the break in EUR/CHF will turn out to be a false signal and it will move in the direction of USD/CHF (which is rising), or the rally in USD/CHF will run out of steam and it will follow EUR/CHF lower. To see which of the two events will unfold, one will have to closely observe the price action between the two currency pairs.

Historical Charts

The above chart compares movements between EUR/CHF (blue line) and USD/CHF (green line). Notice that most of the times, the two pairs tend to move in sync - a fall in one pair is accompanied by a fall in the other, and vice versa. However, occasionally, there can be divergences. For instance, in the region highlighted in the chart using a rectangular box, notice that USD/CHF moved higher while EUR/CHF moved lower. This was because of the diverging paths of the US and the Euro area economy - the US economy has been strengthening during this period, while the Euro area economy has been weakening. Hence, the Swiss Franc has been underperforming the Dollar, but outperforming the Euro. This chart highlights why it is necessary to monitor the health of even the US economy when looking at cross pairs.

The above chart compares movement between EUR/CHF (blue line) and USD/CNY (green line). It can be seen that the two usually tend to move in the opposite direction. Notice in the regions highlighted that a top in one pair is usually accompanied by a bottom in the other pair. One of the reasons for the existence of a negative correlation between these two pairs is that Swiss Franc is a proxy for safe haven flows. Meanwhile, given how strong an impact China has on the world economy, a weakening Yuan negatively impacts the global trade, because it makes Chinese goods cheaper in the world markets, potentially hurting the exports of several other countries. Hence, during times the Yuan is weakening (or in other words, the USD/CNY is strengthening), there is an increase in safe haven flows, benefiting currencies such as Swiss Franc. Hence, it makes sense to keep a track of such correlations and macro-economic health when trying to spot trends among crosses (as well as majors).

The above chart compares movements between AUD/JPY (blue line) and USD/CNY (green line). It can be observed that the two usually tend to move in the opposite direction. Again, this has got to do with the risk flows emanating from China. A sustained weakening of the Chinese Yuan against the Dollar leads to risk aversion across the globe, boosting demand for the safety of the Japanese currency. As a result, the Aussie Dollar attracts selling pressure. Similarly, a strengthening Yuan against the Dollar boosts demand for high-yielding currencies, boosting demand for the Aussie Dollar. Notice in the chart above how the weakness in USD/CNY underpinned AUD/JPY until 2014. However, post this, observe that the sustained rally in USD/CNY led to a steady decline in AUD/JPY.

Next Chapter

Comments & Discussions in

FYERS Community

.png)

Anil kumar commented on November 16th, 2019 at 10:10 PM

what is the cross currency timing

tejas commented on December 3rd, 2019 at 10:11 PM

9 AM to 7.30 PM. The INR pairs close at 5 PM but cross pairs are kept open a little longer around the time when American trading hours begin.

Bharath commented on April 20th, 2020 at 7:52 AM

Is eurusd pair available for trading in fyers? If available, whether we would be buying and selling from Indian participants; are also from foreign participants wherever forex market is open?

Shriram commented on April 22nd, 2020 at 5:34 PM

H Bharath, Yes, it is available for trading on our platform.