24 Sep, 2025

24 Sep, 2025

4 mins read

4 mins read

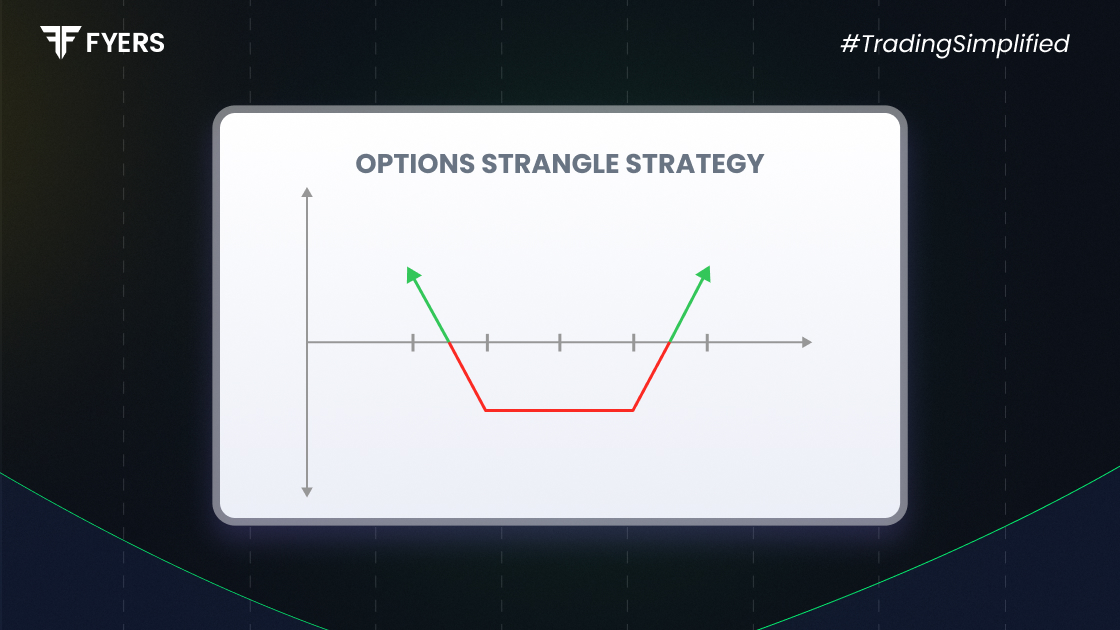

When the stock market turns unpredictable, traders often search for strategies that can help them benefit from volatility rather than fear it. One such popular approach in options trading is the strangle option strategy. If used wisely, it can generate strong returns when you expect a big price move but are unsure about the direction.

This guide explains what a strangle option is, how it works, its types, benefits, and the factors that influence it.

A strangle option is a strategy in options trading where an investor buys both a call option and a put option on the same underlying asset, with the same expiry date but different strike prices.

The call option usually has a strike price above the current market price.

The put option usually has a strike price below the current market price.

The goal is simple: instead of betting on a direction, the trader profits from a significant move either upwards or downwards.

Example:

If a stock is trading at ₹100, you may buy a call option at ₹105 and a put option at ₹95. If the stock moves strongly in either direction, the gains from one option can outweigh the cost of both.

The long strangle option strategy works best when you anticipate heightened volatility. You pay premiums for both the call and put.

If the stock price stays near the current level, both options may expire worthless, and the loss equals the total premium paid.

If the stock makes a sharp move up or down, one option becomes profitable, and gains can exceed the premiums, leading to net profit.

Strangle option strategy example:

Underlying asset price: ₹1,000

Buy 1 call at ₹1,050 (Premium ₹20)

Buy 1 put at ₹950 (Premium ₹25)

Total cost: ₹45

If the price rises to ₹1,120 → call worth ₹70 → net profit = ₹25

If the price falls to ₹880 → put worth ₹70 → net profit = ₹25

If the price stays between ₹950 and ₹1,050 → both worthless → loss = ₹45

Understanding these terms is essential when applying the strangle strategy in options trading:

Strike Price – The fixed price at which the option can be exercised.

Premium – The cost of buying the option.

Expiry Date – The contract’s end date.

Volatility – The degree of price fluctuations.

Out-of-the-Money (OTM) – Both call and put in a strangle are usually OTM at the time of purchase.

There are two primary types:

What it is: Buying both a call and a put option.

When to use: When expecting a large price movement but unsure of direction (earnings, policy changes, budget announcements).

Risk: Limited to premiums paid.

Reward: Unlimited upside; substantial downside profit.

What it is: Selling both a call and a put option.

When to use: When expecting low volatility and stable prices.

Risk: Unlimited potential loss if the price moves sharply.

Reward: Limited to premiums received.

Straddle: Same strike price for both call and put.

Strangle: Different strike prices (call above, put below).

Strangles are cheaper than straddles but require bigger price moves to be profitable.

Profit from volatility: Works well during market-moving events.

Limited downside in long strangle: Loss capped at the premium.

No need to predict direction: Only requires significant price movement.

These make the options strangle strategy popular among traders who want to speculate on volatility rather than market direction.

Key factors that impact both long and short strangles:

Volatility: Higher implied volatility increases premiums but raises profit potential.

Time to Expiry: Longer expiry allows more movement but costs more.

Strike Price Distance: Wider strikes are cheaper but need larger moves.

Liquidity: More liquid options reduce trading costs.

The Strangle option strategy is a flexible approach that empowers traders to capitalise on volatility, even when the market’s direction remains uncertain.

Long strangle: Safer, with limited loss and unlimited profit potential.

Short strangle: Riskier, with unlimited loss but steady returns in calm markets.

When used with proper risk management, strangles allow traders to take advantage of large market moves without committing to a directional bet. However, like all strategies, success depends on understanding the mechanics and risks involved.

It’s when you buy a call and a put with the same expiry but different strike prices, allowing you to profit if the price moves significantly either way.

In a straddle, both options have the same strike price. In a strangle, the call is above and the put is below the current price. Strangles are cheaper but need bigger price swings.

Yes, the strangle strategy in options trading is widely used in India, especially during events like earnings, RBI announcements, or the Union Budget.

Beginners can try the long strangle option strategy, since losses are limited to the premiums. The short strangle option strategy is riskier and better suited for experienced traders.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.