24 Sep, 2025

24 Sep, 2025

4 mins read

4 mins read

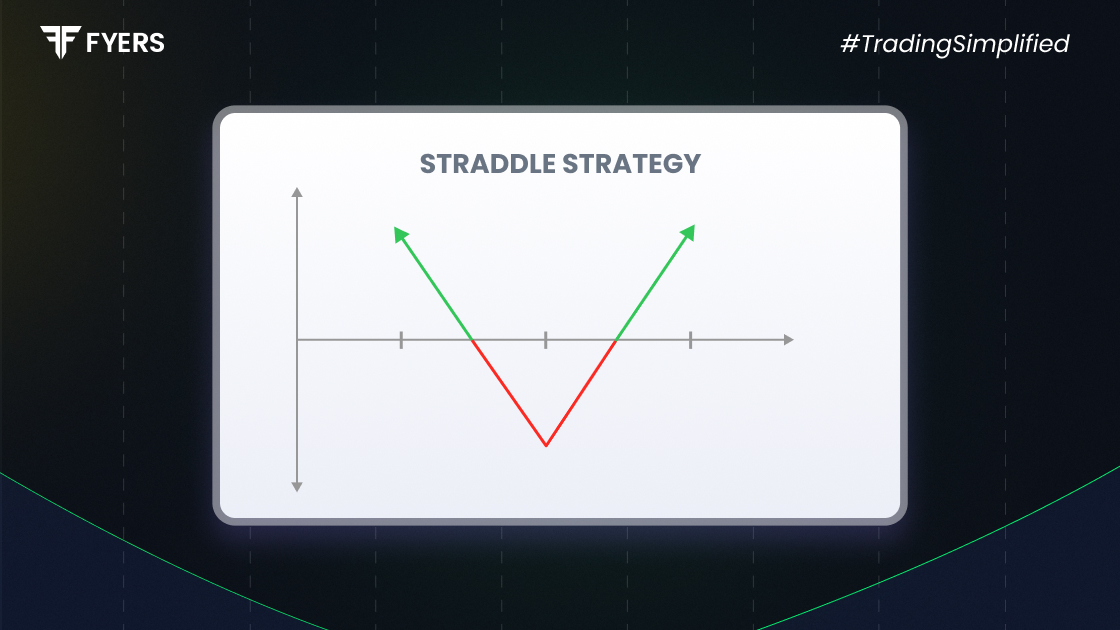

When market direction feels uncertain but you expect a big move, the straddle strategy in options trading can be a powerful tool. Unlike directional bets, this approach lets you benefit from volatility itself. As long as the price of the underlying asset shifts far enough, whether upward or downward, the straddle options strategy can deliver gains.

A straddle is an options trading strategy where a trader simultaneously buys (or sells) a call option and a put option on the same underlying asset, with the same strike price and expiry date.

The idea behind the straddle strategy is simple: if the asset makes a significant move in either direction, one of the options will generate profits that may exceed the total cost of both.

Straddle strategy example:

If a stock trades at ₹1,000, you can buy both a call and a put at the ₹1,000 strike price.

If the stock rises to ₹1,100, the call option becomes profitable.

If it falls to ₹900, the put option gains value.

If it stays near ₹1,000, both may expire worthless, and the maximum loss equals the premiums paid.

This approach is especially useful during periods of heightened uncertainty - like earnings announcements, policy changes, or global market events.

There are two main types of straddle:

Setup: Buy a call + buy a put at the same strike price and expiry.

Objective: Profit from sharp moves in either direction.

Maximum Loss: Limited to the total premium paid.

Maximum Profit: Unlimited on the upside; substantial on the downside.

Ideal Market View: High volatility expected but direction unknown.

Setup: Sell a call + sell a put at the same strike price and expiry.

Objective: Profit when the price remains stable and both options expire worthless.

Maximum Gain: Limited to the premiums received.

Maximum Loss: Unlimited if the stock makes a large move.

Ideal Market View: Expectation of low volatility or range-bound trading.

|

Feature |

Long Straddle |

Short Straddle |

|---|---|---|

|

View on Volatility |

Expect high volatility |

Expect low or no volatility |

|

Trade Setup |

Buy Call + Buy Put |

Sell Call + Sell Put |

|

Cost to Enter |

High (premiums paid) |

Low (premiums received) |

|

Risk |

Limited to premiums paid |

Unlimited |

|

Reward Potential |

Unlimited (upside) and high (downside) |

Limited to premiums |

|

Suitable For |

Traders anticipating a big move |

Advanced traders with range-bound view |

In short, a long straddle strategy suits retail traders during volatile conditions, while a short straddle strategy requires strong experience and risk management due to its unlimited risk.

In India, traders often use it during:

Quarterly earnings season – stock prices often jump or fall sharply.

Union Budget announcements – potential for market-wide volatility.

RBI monetary policy meetings – interest rate decisions can move banks, bonds, and equities.

Company-specific news – mergers, acquisitions, or leadership changes.

Global events – such as US Fed rate decisions or geopolitical tensions that impact Indian equities.

Before entering a straddle, always check premiums, implied volatility, and liquidity, especially for mid-cap or small-cap stocks where spreads can be wider.

The straddle strategy offers several advantages for traders:

Neutral View Advantage: Profit from volatility without predicting direction.

Defined Risk (Long Straddle): Loss is capped at premiums paid.

Profit from Volatility: Works well during big market events.

Flexibility: Traders can adjust positions mid-way as trends develop.

Clarity of Setup: Same strike and expiry keep the structure straightforward.

The straddle options strategy is a versatile way to trade volatility.

The long straddle strategy is ideal for retail traders with limited risk, unlimited profit potential, and best suited for periods of uncertainty.

The short straddle strategy can deliver steady returns in calm markets but carries unlimited downside risk, making it more appropriate for experienced traders.

In Indian markets, straddles are widely used during earnings, RBI policies, or the Union Budget, events that often trigger sharp price swings.

That said, always weigh the cost of premiums against expected movement, and have a disciplined risk management plan. Like any options strategy, straddles are most effective when combined with strong analysis and clear exit rules.

Yes, traders sometimes use the straddle strategy intraday during events like corporate announcements or policy decisions, where sharp price moves can happen within hours. However, premiums can be expensive, and timing becomes critical.

Breakeven points are:

Upside Breakeven: Strike Price + Total Premium Paid

Downside Breakeven: Strike Price – Total Premium Paid

The stock must move beyond either breakeven for the strategy to become profitable.

Avoid using a straddle when:

Volatility is already very high (premiums become expensive).

The market is likely to remain range-bound.

Liquidity in options contracts is low, leading to wider spreads and higher costs.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.