Introduction

After studying about the Dow Theory, support & resistance levels, price tools, and moving averages, we will now turn our focus towards another important aspect of technical analysis: price patterns. Price patterns can be of two types: reversal and continuation. If the breakout from the pattern leads to a reversal in trend, the price pattern is termed as a reversal pattern. Similarly, if the breakout from the pattern leads to a continuation in trend, the price pattern is termed as a continuation pattern.

Price Patterns

Below mentioned is the list of patterns that we will be discussing in this chapter:

-

Double top and Double bottom

-

Triple top and Triple bottom

-

Head & shoulder top

-

Inverse head and shoulder

-

Rectangle

-

Contracting triangle

-

Ascending triangle

-

Descending triangle

-

Expanding broadening pattern

-

Ascending broadening pattern

-

Descending broadening pattern

-

Flags and pennants

-

Rising wedge

-

Falling wedge

-

Rounding bottom

-

Rounding top

Note that price patterns can be applied to line chart, bar chart, or candle chart.

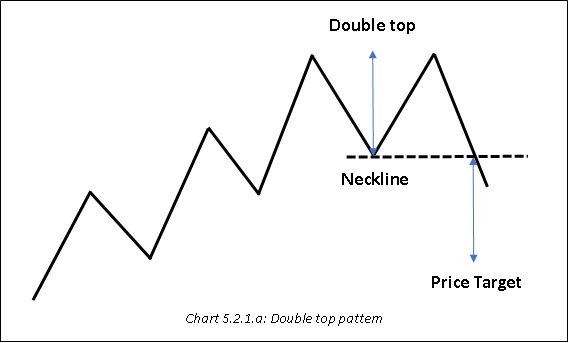

Double top (Pattern type: Bearish Reversal)

A double top is a bearish reversal pattern that appears after a rally in price. It comprises of two peaks that appear at identical levels. These two peaks are separated by a trough between them. The first peak should be the highest peak reached during the current leg of the up move, while the second peak should essentially be at the same level as the first peak (minor difference between the first peak and the second peak is acceptable). Preferably, the rally during the second peak should be accompanied by less volume than the rally during the first peak, while the decline from the top of the second peak should be accompanied by a higher volume than that seen during the decline from the top of the first peak.

So, essentially, what this pattern indicates is that the second peak was not able to make a new high, while being accompanied by less volume during the up move and more volume during the down move. This suggests that the rally is running out of steam and that supply is starting to exceed demand. The double top pattern is complete if the decline from the second peak breaks the intervening low between the first peak and the second peak. This breakdown must be accompanied by an increase in volume. Filters that can be used to confirm the validity of the break include: increase in volume, closing below the intervening low, closing below the intervening low for a few days, break below the intervening low by a certain percent etc.

Price Target: Once the break is confirmed, the chartist can project the price target of the pattern as: vertical distance between the two peaks and the intervening low, subtracted from the intervening low to arrive at the potential downside objective for the pattern.

Notice the double top pattern in the above chart. Although the second half of the pattern took more time to unfold than the first half of the pattern, that is still fine as long as it does not stretch too long. Also notice how volume declined during the first half of the pattern, increased during the second half, and further accelerated during the breakdown from the neckline. Such an increase in volume increases the likelihood of a reversal in trend.

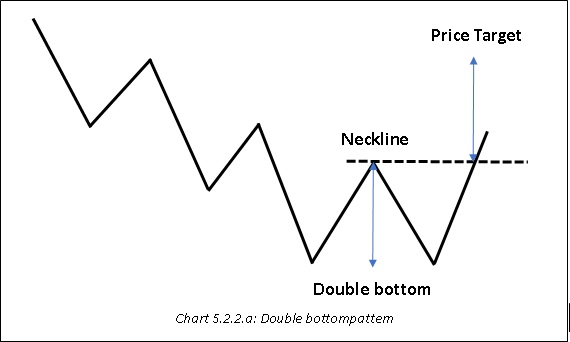

Double bottom (Pattern type: Bullish Reversal)

A double bottom is the opposite of a double top pattern. A double bottom is a bullish reversal pattern that appears after a decline in price. It comprises of two bottoms that appear at identical levels. These two bottoms are separated by a rally between them. The first bottom should be the lowest trough reached during the current leg of the down move, while the second bottom should essentially be at the same level as the first bottom (again, a minor difference between the first bottom and the second bottom is acceptable). Preferably, the decline during the second bottom should be accompanied by less volume than the decline during the first bottom, while the rally from the low of the second bottom should be accompanied by a higher volume than that seen during the rally from the low of the first bottom.

So, essentially, what this pattern indicates is that the second bottom was not able to make a new low, while being accompanied by less volume during the down move and more volume during the up move. This suggests that the sell-off is running out of steam and that demand is starting to exceed supply. The double bottom pattern is complete if the rally from the second bottom breaks the intervening high between the first bottom and the second bottom. This breakout must be accompanied by an increase in volume, as it suggests that demand is exceeding supply. Filters that can be used to confirm the validity of the break include: increase in volume, closing above the intervening high, closing above the intervening high for a few days, break above the intervening high by a certain percent etc.

Price Target: Once the break is confirmed, the chartist can project the price target of the pattern as vertical distance between the two bottoms and the intervening high, added to the intervening high to arrive at the potential upside objective for the pattern.

Notice the double bottom pattern in the above below. Notice how volume declined sharply during the first half of the pattern, while increasing sharply during the second half and then during the breakout from the neckline. Confirmation from the volume increases the probability of an up move once the neckline is broken.

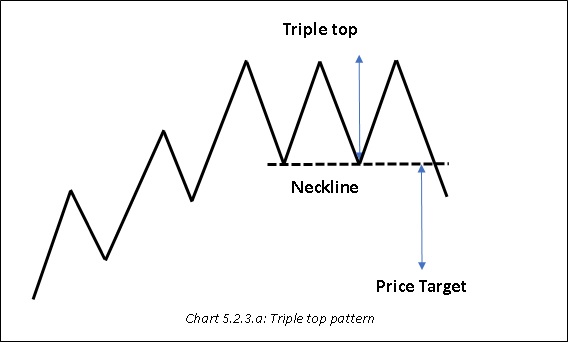

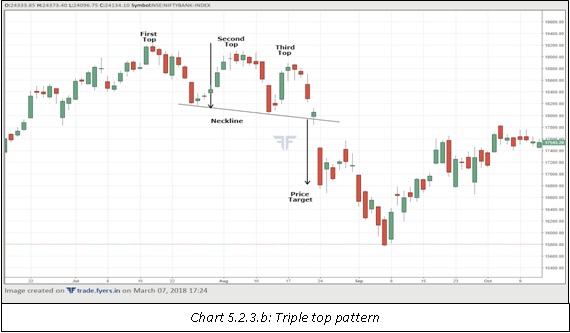

Triple top (Pattern type: Bearish Reversal)

A triple top is a bearish reversal pattern that appears after a rally in price. It is an extension of the double top pattern. While the double top pattern has two peaks and one intervening bottom, a triple top pattern has three peaks and two intervening bottoms. The first peak should be the highest peak reached during the current leg of the up move, while the second and the third peak should essentially be at the same level as the first peak (minor difference between the three peaks is acceptable). Preferably, the rally during the second peak should be accompanied by less volume than the rally during the first peak, while the rally during the third peak should be accompanied by even lesser volume than that during the second peak. Meanwhile, the decline from the top of the third peak should be accompanied by a higher volume as compared to that seen during the decline from the prior two peaks.

So, essentially, what this pattern indicates is that the second and the third peak were not able to move above the first peak, suggesting strong supply at identical levels. Less volume during the up move and increasing volume during the down move further reinforces resistance at higher levels and suggests that the rally is running out of steam. The triple top pattern is complete if the decline from the third peak breaks the neckline connecting the intervening bottoms between the three peaks. This breakdown must be accompanied by an increase in volume, as decline in price accompanied by an increase in volume suggests that supply is exceeding demand. Filters that can be used to confirm the validity of the break include: increase in volume, closing below the intervening lows, closing below the intervening lows for a few days, break below the intervening lows by a certain percent etc.

Price Target: Once the break is confirmed, the chartist can project the price target of the pattern as vertical distance between the three peaks and the neckline connecting the two intervening lows, subtracted from the neckline to arrive at the potential dowside objective of the pattern.

Finally, keep some flexibility when looking out for triple top patterns. Because we have an additional peak and an additional intervening bottom (compared to the double top), the peaks and troughs might not appear at identical levels. Sometimes, the peaks or the intervening bottoms might be slightly ascending or descending rather than flat. Such discrepancies are fine as long as they are small.

The chart above shows the triple top pattern. Notice each peak is slightly below its predecessor, while each bottom is also slightly below its prior bottom. This has resulted in a triple top pattern that is slightly titled to the downside rather than being horizontal. Again, this is fine given that the discrepancy is only minor. Always keep in mind that when looking out for price patterns, don’t always expect text-book type pattern to appear on the chart. Technical analysis is more of an art rather than science, and as such some form of leeway should be made.

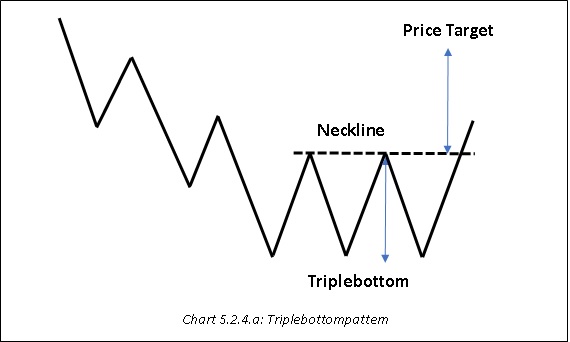

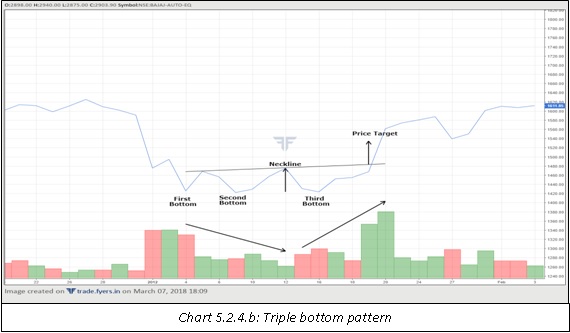

Triple bottom (Pattern type: Bullish Reversal)

A triple bottom is a bullish reversal pattern that appears after a decline in price. It is an extension of the double bottom pattern. While the double bottom pattern has two bottoms and one intervening high, a triple bottom pattern has three bottoms and two intervening highs. The first bottom should be the lowest trough reached during the current leg of the down move, while the second and the third bottoms should essentially be at the same level as the first bottom (minor difference between the three bottoms is acceptable). Preferably, the decline during the second bottom should be accompanied by less volume than the decline during the first bottom, while the decline during the third bottom should be accompanied by even lesser volume than that during the second bottom. Meanwhile, the rally from the low of the third bottom should be accompanied by higher volume as compared to that seen during the rally from the prior two bottoms.

So, essentially, what this pattern indicates is that the second and the third bottoms were not able to move below the first bottom, suggesting strong demand at identical levels. Less volume during the down move and increasing volume during the up move further reinforces support at lower levels and suggests that the decline is ebbing. The triple bottom pattern is complete if the rally from the third bottom breaks the neckline connecting the intervening highs between the three bottoms. This breakout must be accompanied by an increase in volume, as rally in price accompanied by an increase in volume suggests that demand is exceeding supply. Filters that can be used to confirm the validity of the break include: increase in volume, closing above the intervening highs, closing above the intervening highs for a few days, break above the intervening highs by a certain percent etc.

Price Target: Once the break is confirmed, the chartist can project the price target of the pattern as vertical distance between the three bottoms and the neckline connecting the two intervening highs, added to the neckline to arrive at the potential upside objective of the pattern.

Again, keep some flexibility when looking out for triple bottom patterns. It is relatively rare to find three bottoms and two intervening highs at exact levels. Sometimes, the bottom or the intervening peaks might be slightly ascending or descending rather than horizontal. Such discrepancies are fine as long as they are small.

Notice the triple bottom pattern in the above chart. As stated earlier, price patterns can also be plotted on line chart. Notice the three identical bottoms, and notice the two intervening lows that are ascending rather than horizontal. This is fine give that the second peak is only slightly above the first peak. Also notice how volume contracted during the first two bottoms but then expanded sharply during the advance from the third bottom.

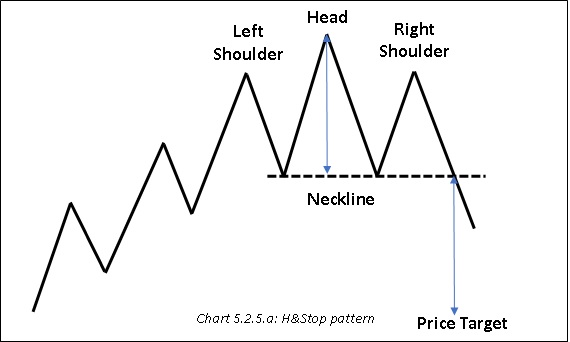

Head and Shoulder top (Pattern type: Bearish Reversal)

A Head and Shoulder (H&S) top is one of the most commonly talked about price patterns in technical analysis. It is one of the most reliable and easy to spot patterns of all. A H&S top is a bearish reversal pattern that appears after a rally in price. The pattern consists of three peaks. The first peak is called the left shoulder, the second peak is called the head, and the third peak is called the right shoulder. The first peak appears after a sustained rally in price. Once this peak is made, price usually retraces part of the advance before bottoming out. This completes the left shoulder. Price then advances from the low of the left shoulder, makes a new high, and then heads lower and back near the low of the left shoulder. This completes the head. Once the recovery begins from the low of the head, a chartist can draw an extended neckline connecting the low of the left shoulder and the low of the head. The recovery from the low of the head fails to break the previous peak before heading south again. This is the right shoulder. The pattern is complete and a reversal is indicated once price breaks below the neckline connecting the low of the left shoulder and the low of the head. The neckline could be upward sloping, horizontal, or downward sloping. Based on experience, an upward sloping or horizontal neckline is preferred over a downward sloping neckline.

Talking about volume characteristics, the volume during the rally of the head should preferably be lower than that during the rally of the left shoulder, while the volume during the rally of the right shoulder should preferably be lower than that during the rally of the head. Meanwhile, the volume during the decline of the head should ideally be higher than that during the decline of the left shoulder, while the volume during the decline of the right shoulder should ideally be higher than that during the decline of the head. Finally, the breakdown from the neckline should be accompanied by a marked increase in volume, suggesting that sellers are outpowering buyers.

Essentially, this pattern indicates a shift from buyers to sellers. Failure of price to make a new high during the formation of the right shoulder indicates that trouble lies ahead. Then, a break below the neckline suggests that the rally has ended. Declining volume during rallies and expanding volume during declines further strength the validity of the pattern.

Price Target: Once the price breaks below the neckline, the price target can be projected as vertical distance from the top of the head to the neckline, subtracted from the neckline to arrive at the downside price objective.

Notice above how the neckline is rising. Also, notice there was no marked pickup in volume during the breakdown. However, failure of price to move above the neckline more than offset this dull volume.

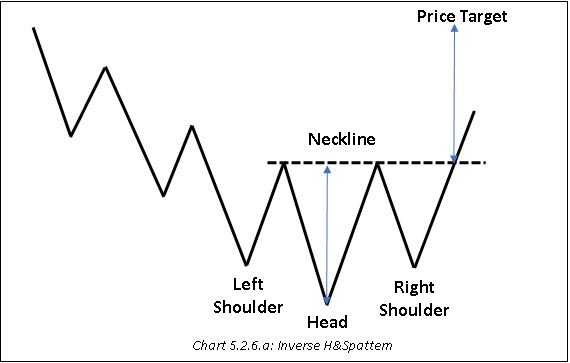

Inverse Head and Shoulder (Pattern type: Bullish Reversal)

An inverse H&S is a bullish reversal pattern that appears after a decline in price. The pattern consists of three troughs, just the opposite of its bearish counterpart. The first trough appears after a sustained drop in price. Once this bottom is made, price usually recovers part of the decline before finding resistance. This completes the left shoulder. Price then declines from the high of the left shoulder, makes a new low, and then heads higher and back towards the high of the left shoulder. This completes the head. Once the decline starts from the high of the head, a chartist can draw an extended neckline connecting the high of the left shoulder and the high of the head. The drop from the high of the head fails to break the previous bottom before heading higher again. This is the right shoulder. The pattern is complete and a reversal is indicated once price breaks above the neckline connecting the high of the left shoulder and the high of the head. The neckline could be downward sloping, horizontal, or upward sloping. Based on experience, a downward sloping or horizontal neckline is preferred over an upward sloping neckline.

Talking about volume characteristics, the volume during the decline of the head should preferably be lower than that during the decline of the left shoulder, while the volume during the decline of the right shoulder should preferably be lower than that during the decline of the head. Meanwhile, the volume during the rally of the head should be higher than that during the rally of the left shoulder, while the volume during the rally of the right shoulder should be higher than that during the rally of the head. Finally, the breakout of the neckline should be accompanied by a marked increase in volume, suggesting that buyers are outpowering sellers.

Essentially, this pattern indicates a shift from sellers to buyers. Failure of price to make a new low during the formation of the right shoulder indicates that selling is receding. Then, a break above the neckline suggests that the decline has ended. Receding volume during declines and expanding volume during rallies further strengthen the validity of the pattern.

Price Target: Once the price breaks above the neckline, the price target can be projected as: vertical distance from the low of the head to the neckline, added to the neckline to arrive at the upside price objective.

Notice in the chart above the marked pickup in volume during the breakout of the neckline. Keep in mind that volume is more important in case of an inverse H&S pattern than it is in case of a bearish H&S pattern. As a rule, volume during upward breakout is more important than volume during downward breakout. This is because price could drop just because of a lack of buyers. However, for price to move higher, there must be buying interest in the security. Without it, the breakout is unlikely to be successful. Also notice in the chart how, following the neckline breakout, price found support right near the vicinity of the neckline before heading back higher again. Such occurrence is quite common. A neckline once broken on the upside becomes a potential support on the way down, while a neckline once broken on the downside becomes a potential resistance on the way up.

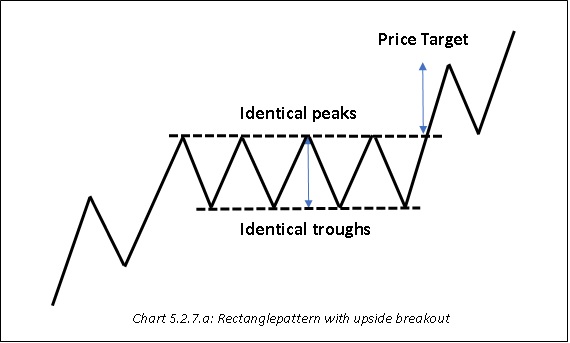

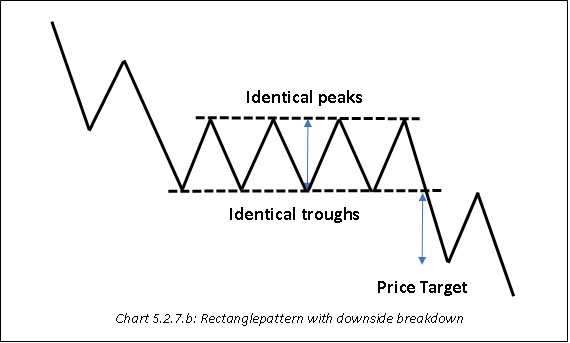

Rectangle (Pattern type: Bullish/bearish Continuation)

A rectangle is a continuation pattern that could appear during an uptrend or a downtrend. A rectangle represents a pause to the ongoing trend, during which the price broadly consolidates within a set range. The pattern comprises of at least two identical peaks and at least two identical troughs. The peaks can be connected using an upper trendline, while the troughs can be connected using a lower trendline. The upper and lower trendline tend to be parallel to each other and take the shape of a rectangle, hence the name. Rectangles are continuation patterns, hence the breakout usually happens in the direction of the prevailing trend. So, if the trend before entering the consolidation is up, the breakout is likely to be on the upside. And if the trend before entering the consolidation is down, the breakout is likely to be on the downside. Rarely, the rectangle pattern could act as a reversal pattern, especially if it appears near the end of an ongoing trend. What ever the form it takes, do not try to anticipate the direction of the breakout. Wait until the break happens before deciding to initiate a trade. Just keep in mind that rectangles are more likely to continue the prevailing trend rather than reverse it.

Talking about volume characteristics, volume tends to decline when within the consolidation. Sometimes, when price is trading within the rectangle, volume picks up modestly during rallies and fades during declines. This usually, but not necessarily, indicates that the break could be on the upside, especially if the trend before entering the pattern was up. Similarly, in some cases, when price is trading with the rectangle, volume picks up modestly during declines and fades during rallies. This usually, but not necessarily, indicates that the break could be on the downside, especially if the trend before entering the pattern was down. The break from the rectangle, however, must be accompanied by an increase in volume. Without this, the pattern will be vulnerable for a failure.

Price Target: Once the break occurs, the price target can be projected as: vertical distance between the upper and lower trendlines, added to (in case of an upside break) the upper trendline or subtracted from (in case of a downside break) the lower trendline.

Notice above that before entering into the consolidation, price was in a steady downtrend. The consolidation marked a temporary halt to this downtrend. Also notice the sharp increase in volume accompanying the breakdown.

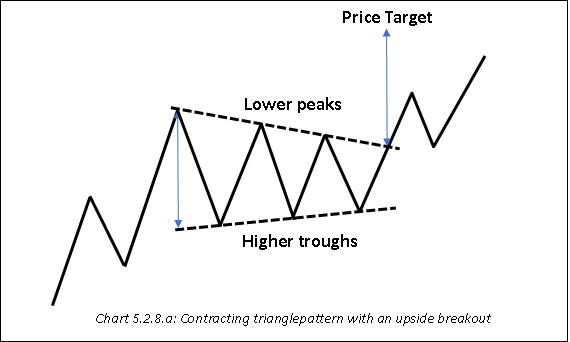

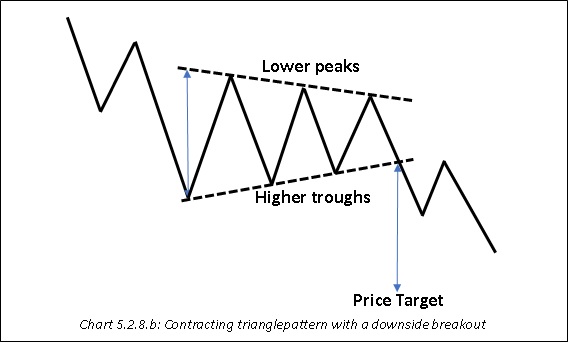

Contracting triangle (Pattern type: Bullish/bearish Continuation)

A contracting triangle is a continuation pattern that could appear during an uptrend or a downtrend. It is very similar to the rectangle pattern, but with two noticeable differences. While a rectangle pattern has parallel trendlines, a contracting triangle pattern has an upper trendline that is sloping downwards and a lower trendline that is sloping upwards. These two trendlines converge at some point in the future. A contracting triangle represents a pause to the ongoing trend, during which the price broadly consolidates within a set range. The pattern comprises of at least two bottoms and at least two highs, with the second bottom above the first bottom and the second top below the first top. The peaks can be connected using a downward sloping trendline, while the troughs can be connected using an upward sloping trendline. Contracting triangles are continuation patterns, hence the breakout usually happens in the direction of the prevailing trend. So, if the trend before entering the pattern is up, expect an upside breakout. And if the trend before entering the pattern is down, expect a downside breakdown. Occasionally, the contracting triangle pattern could act as a reversal pattern too, especially if it appears near the end of an ongoing trend. Whatever the form it takes, do not anticipate the direction of the break. Wait until the break happens before deciding to initiate a trade. Just keep in mind that contracting triangles are more likely to continue the prevailing trend rather than reverse it.

Talking about volume characteristics, volume tends to decline when within the triangle. Sometimes, when price is trading with the triangle, volume picks up modestly during rallies and fades during declines. This usually, but not necessarily, indicates that the break could be on the upside, especially if the trend before entering the pattern was up. Similarly, in some cases, when price is trading within the triangle, volume picks up modestly during declines and fades during rallies. This usually, but not necessarily, indicates that the break could be on the downside, especially if the trend before entering the pattern was down. The break from the triangle, however, must be accompanied by an increase in volume. Without this, the pattern will be vulnerable for a failure.

Price Target: Once the break occurs, the price target can be projected as the vertical distance between the widest part of the triangle, added to (in case of an upside break) the upper trendline or subtracted from (in case of a downside break) the lower trendline.

The chart below shows a contracting triangle pattern acting as a continuation pattern. The trend prior to entering the pattern was up, and the breakout also occurred to the upside along with an increase in volume. Notice the diminution in volume when price was within the triangle and how volume picked up once price broke out of the triangle. Also notice that the subsequent decline later on found support near the vicinity of the upper trendline, which then switched its role from resistance to support.

Ascending triangle (Pattern type: Bullish Continuation)

An ascending triangle is a bullish continuation pattern that appears during an uptrend. However, sometimes, an ascending triangle can also appear as a reversal pattern, especially when it develops after a prolonged rally or a prolonged decline in price. An ascending triangle represents a pause to the ongoing trend, during which the price broadly consolidates within a set range. The pattern comprises of at least two bottoms and at least two highs, with the second bottom being above the first bottom and the second top essentially at the same level as the first top. The peaks can be connected using a horizontal trendline, while the troughs can be connected using an upward sloping trendline. Both these trendlines converge at some point in the future. Although this is a bullish pattern, do not pre-empt that the break will happen on the upside. Wait until the price breaks out of the horizontal resistance line before deciding to initiate a trade. What makes an ascending triangle bullish is the structure of the pattern. Each low is above its preceding low, suggesting that the buyers are aggressively bidding up the price. Sensing that the buying pressure is increasing as lows are getting higher, sellers eventually stop defending their resistance level, which enables buyers to push through this upside barrier. Once the upside barrier is breached, expect this region to act as a support during any corrections (remember, change of polarity principle applies here too).

Talking about volume characteristics, volume tends to decline when within the triangle. However, being a bullish continuation pattern, when price is trading within the triangle, expect modest upticks in volume during rallies and downticks in volume during declines. Such a development enhances the likelihood of an upside breakout. Meanwhile, the breakout from the triangle must be accompanied by an increase in volume. Without this, the pattern is vulnerable for a failure. In some cases, the pattern will break on the downside. If this happens, and if volume has picked up after the breakdown, then a move lower can be expected.

Price Target: Once the break occurs, the price target can be projected as vertical distance between the widest part of the triangle, added to the horizontal trendline. In case of a downside breakout, this distance must be subtracted from the lower trendline.

The above chart shows an ascending triangle pattern acting as a bullish continuation pattern. Notice the upticks in volume as the price heads higher inside the triangle. However, also notice that there was hardly any increase in volume at the time of the breakout on the first occasion. As such, the subsequent move back inside the triangle was not surprising. However, notice the huge volume when price broke above the horizontal resistance line during its second attempt. Such a sharp pickup in volume during breakout of a resistance highlights the determination of bulls to buy at higher levels and thereby increase the odds of price heading higher. That is what exactly happened. This example highlights how essential it is for a resistance breakout to be accompanied by increase in volume. Without volume, always treat breakouts with caution.

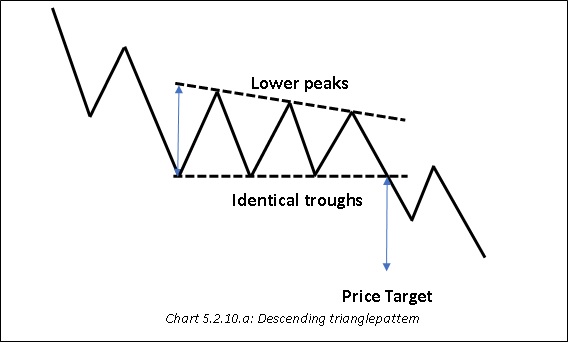

Descending triangle (Pattern type: Bearish Continuation)

A descending triangle is a bearish continuation pattern that appears during a downtrend. However, sometimes, a descending triangle can also appear as a reversal pattern, especially when it develops after a prolonged rally or a prolonged decline in price. A descending triangle represents a pause to the ongoing trend, during which the price broadly consolidates within a set range. The pattern comprises of at least two highs and at least two bottoms, with the second high being lower than the first high and the second bottom essentially at the same level as the first bottom. The bottoms can be connected using a horizontal trendline, while the peaks can be connected using a downward sloping trendline. Both these trendlines converge at some point in the future. Although this is a bearish pattern, do not pre-empt that the break will happen on the downside. Wait until the price breaks below the horizontal support line before deciding to initiate a trade. What makes a descending triangle bearish is the structure of the pattern. Each high is lower than its preceding high, suggesting that the sellers are aggressively offering the price at lower levels. Sensing that the selling pressure is increasing as highs are getting lower, buyers eventually stop defending their support level, which enables sellers to push through this downside barrier. Once the downside barrier is breached, expect this region to act as a resistance during any recoveries.

Talking about volume characteristics, volume tends to decline when within the triangle. However, being a bearish continuation pattern, when price is trading with the triangle, expect modest upticks in volume during declines and downticks in volume during advances. Such a development enhances the likelihood of a downside break. Preferably, the breakdown from the triangle must be accompanied by an increase in volume. However, pickup in volume at the time of breakdown in case of this pattern is not as important as pickup in volume at the time of breakout in case of an ascending triangle pattern. Meanwhile, in some cases, the pattern will break on the upside. If this happens, and if volume has picked up after the breakout, then a move higher can be expected.

Price Target: Once the break occurs, the price target can be projected as vertical distance between the widest part of the triangle, subtracted from the horizontal trendline. In case of an upside breakout, this distance must be added to the upper trendline.

The above chart shows a descending triangle pattern acting as a bearish continuation pattern. Notice how volume decreased steadily when price was within the triangle. Also notice the pickup in volume at the time of breakdown and an acceleration in volume as price headed lower post the breakdown.

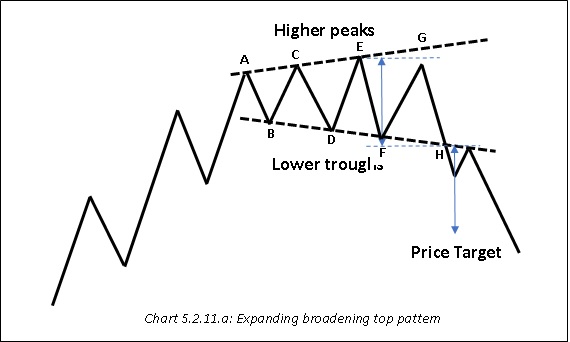

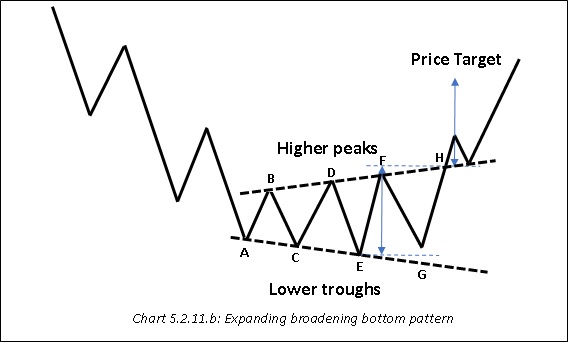

Expanding broadening pattern (Pattern type: Bullish/bearish Reversal)

An expanding broadening pattern is a reversal pattern that appears either at the end of an uptrend or at the end of a downtrend. This pattern is the opposite of a contracting triangle pattern. While a contracting triangle pattern has two trendlines that are converging, an expanding broadening pattern has two trendlines that are diverging. This pattern is characterized by lows getting lower and highs getting higher. When the lows are connected, we have a downward sloping trendline. And when the highs are connected, we have an upward sloping trendline. If the pattern appears near the end of an uptrend, it is termed as an expanding broadening top pattern. And if the pattern appears near the end of a downtrend, it is termed as an expanding broadening bottom pattern. Either ways, this pattern is a reversal pattern in most of the cases. To draw trendlines, at least two higher highs and two lower lows are needed. Once the highs and lows are identified, lower and upper lines can be drawn.

Of all the patterns that we will be discussing in this chapter, an expanding broadening pattern is arguably the most difficult to trade. This is because by the time the break occurs a lot of move would already have occurred and hence it might be too late to initiate a trade. As such, it is important to look where this pattern has occurred. Has it occurred at the termination point of an uptrend or a downtrend? If yes, this pattern can be traded upon post its break as it usually signals a trend reversal and indicates price continuing in the direction of the break. If no, this pattern is better avoided. It is also worth keeping an eye on the price at extreme points. Usually, but not always, in case of an expanding broadening top pattern, price may fail to reach the upper line on the third (or any subsequent) rally. This may be construed as a warning that the rally is running out of steam. If the subsequent decline drags the price to decisively break the lower line, it can be construed as a trend reversal. Similarly, in case of an expanding broadening bottom pattern, price may fail to reach the lower line on the third (or any subsequent) decline. This may be construed as a warning that the selling is ebbing. If the subsequent rally lifts the price to decisively break the upper line, it can be construed as a trend reversal.

Talking about volume characteristics, volume is quite random during the formation of this pattern. On some occasions, the volume expands sharply, while on the other occasions, the volume remains abysmally low. The break, however, must be accompanied by heavy volume. This is especially true in the case of an expanding broadening bottom pattern.

Price Target: Once the break occurs, the price target can be projected as the difference between the highest high and lowest low within the pattern, subtracted from the lowest low (in case of a downward break) or added to the highest high (in case of an upside break).

Notice that in chart 5.2.11.a, the downside price target is calculated as: difference between point E and point H, subtracted from point H. Similarly, in chart 5.2.11.b, the upside price target is calculated as: difference between point E and point H, added to point H.

Notice in the above chart how uneven the volume distribution was when the pattern was forming. Also notice the pickup in volume after the breakdown from the pattern, increasing the probability of price heading lower. In this case, the price target was exactly achieved before a reversal took place. One thing to keep in mind is that the peaks and troughs in case of a broadening pattern are not clearly defined. What this means is often the peaks or troughs will overshoot or undershoot the trendlines before reversing. This is largely down to the volatile nature of this pattern. As such, always keep some leeway when drawing trendlines in case of broadening patterns.

While the traditional way of trading the expanding broadening pattern is to initiate a position after a break, there is an alternate way of trading this pattern when the price is within the pattern. Once two higher highs and two lower lows are identified and trendlines are drawn connecting them, a short position can be initiated when price touches the upper line on any subsequent rally and then reverses to the downside. These short positions can be held until the price approaches the lower trendline or shows some signs of bottoming. Similarly, a long position can be initiated when price touches the lower line on any subsequent decline and then reverses to the upside. These long positions can be held until the price approaches the upper trendline or shows some signs of topping. This alternate approach of trading expanding broadening patterns remains valid as long as price is trading within the pattern and the lower and upper lines act as areas of support and resistance, respectively.

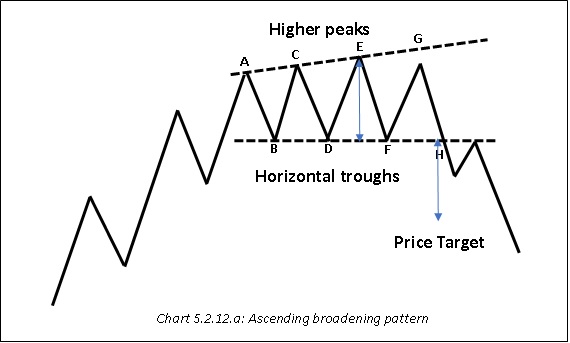

Ascending broadening pattern (Pattern type: Bearish Reversal)

An ascending broadening pattern is a bearish reversal pattern that usually appears at the end of an uptrend. This pattern looks similar to an ascending triangle pattern but there is a big difference between the two: instead of the lows getting higher, this pattern has highs getting higher. So, the result is that the two trendlines divergence rather than converge at some point in the future. An ascending broadening pattern consists of at least two higher peaks and two horizontal troughs. Once the higher peaks and horizontal troughs are identified, trendlines can be drawn to connect them. The higher peaks can be connected using a trendline than points higher to the right, while the horizontal troughs can be connected using a trendline that runs parallel to the X-axis. In most of the cases, this pattern appears after a strong rally and usually marks an end to that uptrend. In rare cases though, it might appear during a decline, in which case it usually continues the trend lower. Don’t let the ascending nature of this pattern compel you into thinking this is a bullish pattern. What makes this pattern bearish is the structure of the pattern. Each high goes beyond the previous high indicating that buyers are outpowering the sellers and aggressively bidding prices higher. Meanwhile, the lows being horizontal suggest that there is strong buying interest at a fixed price. Once all the buying is absorbed, sellers test the buyers’ resolve by pushing prices lower again. However, with buying enthusiasm fading, price fails to hold the horizontal trendline support this time around, thereby leading to a breakdown below the trendline.

Talking about volume characteristics, volume is quite random during the formation of the pattern. On some occasions, the volume expands sharply, while on other occasions, the volume remains abysmally low. However, this being a bearish pattern, it will be good to see volume contracting on the final leg of the up move and then expanding on subsequent declines as such a development increases the probability of a downside break. The break, meanwhile, must preferably be accompanied by an increase in volume.

Price Target: Once the break occurs, the price target can be projected as: difference between the highest high and horizontal support line, subtracted from the horizontal support line to project the downside price objective.

Notice in the below chart how supply is coming in at higher and higher levels, while demand is coming in at a fixed level. Also notice how uneven the volume distribution was when the pattern was forming. The first half of the pattern was characterized by strong volume, but the second half was characterized by low volume, until the breakdown point. Notice the uptick in volume at the time of breakdown from the pattern, suggesting that selling pressure in starting to increase. The price objective was exceeded in this case, before a sharp reversal took place.

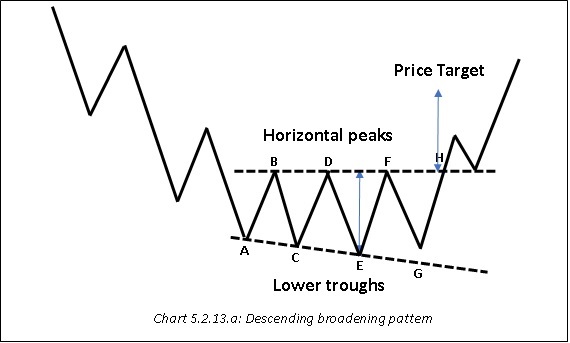

Descending broadening pattern (Pattern type: Bullish Reversal)

A descending broadening pattern is a bullish reversal pattern that usually appears at the end of a downtrend. This pattern looks similar to a descending triangle pattern but there is a big difference between the two: instead of the highs getting lower, this pattern has lows getting lower. So, the result is that the two trendlines divergence rather than converge at some point in the future. A descending broadening pattern consists of at least two lower troughs and two horizontal peaks. Once the lower troughs and horizontal peaks are identified, trendlines can be drawn to connect them. The lower troughs can be connected using a trendline than points lower to the right, while the horizontal peaks can be connected using a trendline that runs parallel to the X-axis. In most of the cases, this pattern appears after a strong decline and usually marks an end to that downtrend. In rare cases though, it might appear during a rally, in which case it usually continues the trend higher. Don’t let the descending nature of this pattern compel you into thinking that this is a bearish pattern. What makes this pattern bullish is the structure of the pattern. Each low goes beyond the previous low indicating that sellers are outpowering the buyers and aggressively offering prices at lower levels. Meanwhile, the highs being horizontal suggest that there is strong selling interest at a fixed price. Once all the selling is absorbed, buyers test the sellers’ resolve by pushing prices higher again. However, with most of the selling being absorbed, price fails to hold the horizontal trendline resistance this time around, thereby leading to a breakout above the trendline.

Talking about volume characteristics, volume is quite random during the formation of the pattern. On some occasions, the volume expands sharply, while on other occasions, the volume remains abysmally low. However, this being a bullish pattern, it will be good to see volume contracting on the final leg of the down move and then expanding on subsequent rallies as such a development increases the probability of an upside break. The break, meanwhile, must be accompanied by a marked increase in volume. If volume is not strong during the break above the horizontal resistance line, the pattern will remain vulnerable for a false break.

Price Target: Once the break occurs, the price target can be projected as the difference between the horizontal resistance line and the lowest low, added to the horizontal resistance line to project the upside price objective.

Notice in chart above how demand is coming in at lower and lower levels, while supply is coming in at a fixed level. Notice the deceleration in volume during the first half of the pattern. Also notice the sharp pickup in volume as price rallied from the second trough. This indicates accumulation is taking place at lower levels and increases the probability of an upside breakout. Finally, notice that the breakout of the pattern was accompanied by an explosion in volume, significantly increasing the odds of a valid breakout.

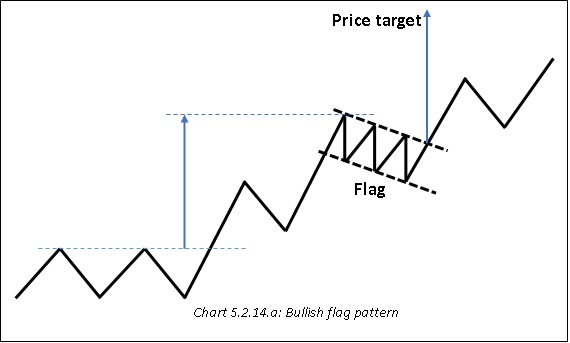

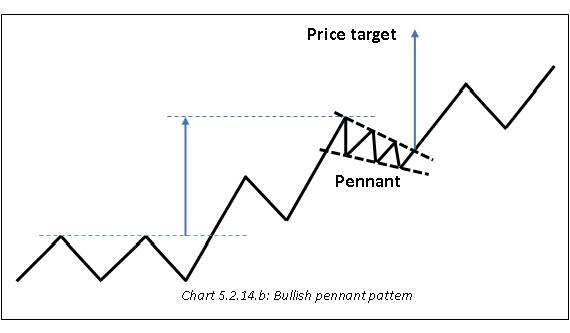

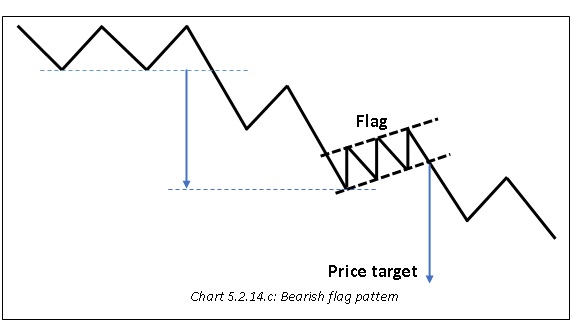

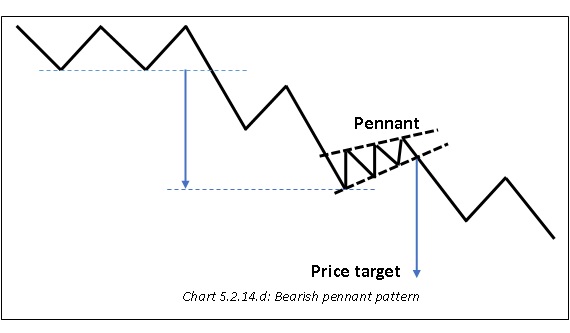

Flag and Pennant (Pattern type: Bullish/bearish Continuation)

Flags and Pennants are continuation patterns that, after a brief pause, either extend an uptrend or extend a downtrend. These patterns develop after a strong rally or a strong decline in price. While these are two different patterns, their characteristics and implications are the same, and hence they have been clubbed into one section. The only difference between the two is their shape: a flag takes the shape of two parallel lines that slope against the direction of the prevailing trend, while a pennant takes the shape of two converging lines that slope against the direction of the prevailing trend. In other words, if the small consolidation after a sharp up or down move takes the shape of a parallel channel, it is a flag; and if it takes the shape of a triangle or wedge, it is a pennant. As already mentioned, a prerequisite for flags and pennants is that these patterns must be preceded by a sharp move, either up or down. The basic idea behind these patterns is that after a sharp rally or a decline, price usually takes a breather for a few days, before proceeding in the direction of the earlier trend. It is akin to saying bulls taking a brief rest after a period of sustained up move before resuming their buying interest again, or bears taking a brief rest after a period of sustained down move before resuming their selling interest again. The consolidation within the pattern must last only for a brief period of time. Once the price breaks out of this pattern, the period of consolidation ends, and the prevailing trend resumes.

Talking about the volume characteristics, flags and pennants must be preceded by strong volumes. When price is consolidating within the flag or pennant, there must be a marked diminution in volume, representing a pause in trend. Then, once price breaks out of this pattern, it must again be accompanied by strong volumes. This is especially important in case of a bullish flag/pennant breakout. Without an increase in volume, the pattern will remain susceptible for a failure.

Price target: Once the break occurs, the price target can be projected as: difference between the start of the trend and the start of the flag or pennant, added to the breakout level (in case of bullish continuation) or subtracted from the breakdown level (in case of a bearish continuation).

Notice in each of the preceding four charts that the price projection is done from the start of the trend right until the start of the consolidation (i.e. the flag or pennant) formation. This distance is then measured from the point of break to arrive at the price objective.

In the chart 5.2.14.e, notice the strong rally along with strong volume before the formation of the pennant against the direction of the prevailing trend. Also notice how strongly the volume picked up on the breakout of the pattern, increasing the validity of a bullish break. Similarly, in the chart 5.2.14.f, notice the sharp fall along with strong volume before the formation of the pennant against the direction of the prevailing trend. Also notice how strongly the volume picked up on the breakdown from the pattern, increasing the validity of a bearish break.

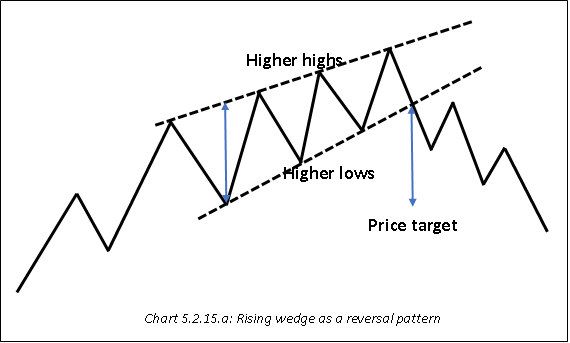

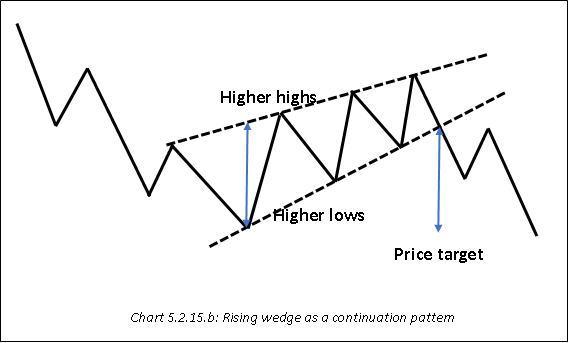

Rising wedge (Pattern type: Bearish Reversal/Continuation)

A rising wedge can appear either as a bearish reversal pattern following a rally in price or as a bearish continuation pattern following a decline in price. If it appears as a bearish reversal pattern, it will slope in the direction of the trend, while if it appears as a bearish continuation pattern, it will slope against the direction of the trend. Regardless of whether a rising wedge appears as a reversal or continuation pattern, what is certain is that this pattern is bearish in purport and in majority of the cases, the break will occur on the downside. A rising wedge comprises of higher lows and higher highs, but with a differing angle of ascent. The lows will slope at a steeper angle while the highs will slope at a gentler angle. Because of this, when the lows and the highs are connected using trendlines, we have two trendlines that are sloping in the same direction but with differing angles of ascent: the lower trendline sloping upwards at a steeper angle and the upper trendline also sloping upwards but at a gentler angle. Because both the trendlines slope upwards in the same direction, they will converge at some point in the future. What makes a rising wedge bearish is the structure of the pattern. Each high goes above the previous high, suggesting that buying interest is coming at higher levels. However, the gentler angle of ascent suggests that the buying interest is drying down with each rally. Once there are not many buyers left, sellers start to test the buyer’s resolve by pushing the prices lower. Eventually, price breaks below the lower line, causing selling to accelerate.

Talking about the volume characteristics, the volume will usually decline when the price is within the wedge, indicating at uncertainty over the rising prices. The breakdown from wedge, however, will usually be accompanied by a pickup in volume, suggesting the selling pressure is starting to absorb all the buying interest.

Price target: Once the break occurs, the price target can be projected as the vertical distance between the widest portion of the wedge, subtracted from the breakdown level. In most cases, the price will decline to the lowest low of the wedge formation, if not more.

The above chart shows rising wedge acting as a reversal pattern. Notice the failure of price to touch the upper trendline during the final up move within the pattern. This indicates weakness. Notice how the selling accelerated once price broke below the lower trendline. The presence of a gap between the breakdown candle and the immediately following candle further validates the bearishness of this break.

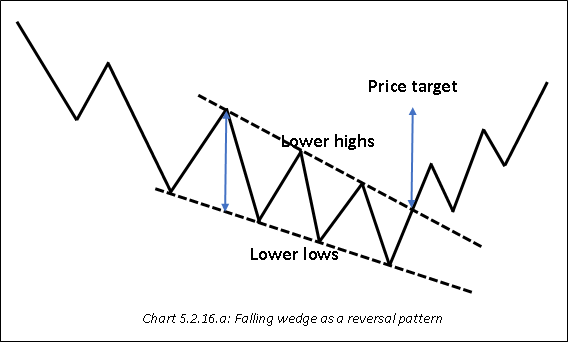

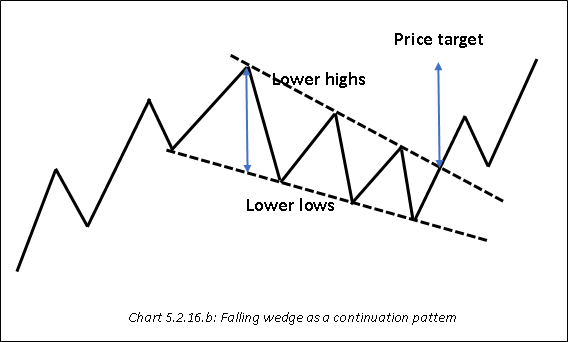

Falling wedge (Pattern type: Bullish Reversal/Continuation)

A falling wedge can appear either as a bullish reversal pattern following a decline in price or as a bullish continuation pattern following a rally in price. If it appears as a bullish reversal pattern, it will slope in the direction of the trend, while if it appears as a bullish continuation pattern, it will slope against the direction of the trend. Regardless of whether a falling wedge appears as a reversal or continuation pattern, what is certain is that this pattern is bullish in purport and in majority of the cases, the break will occur on the upside. A falling wedge comprises of lower peaks and lower troughs, but with a differing angle of descent. The peaks will slope at a steeper angle while the troughs will slope at a gentler angle. Because of this, when the lows and the highs are connected using trendlines, we have two trendlines that are sloping in the same direction but with differing angles of descent: the upper trendline sloping downwards at a steeper angle and the lower trendline also sloping downwards but at a gentler angle. Because both the trendlines slope downwards in the same direction, they will converge at some point in the future. What makes a falling wedge bullish is the structure of the pattern. Each low goes below the previous low, suggesting that selling interest is coming at lower levels. However, the gentler angle of descent suggests that the selling interest is ebbing with each new low. Once there are not many sellers left, buyers start to test the seller’s resolve by pushing the prices higher. Eventually, price breaks above the lower line, causing buying to accelerate.

Talking about the volume characteristics, volume will usually decline when price is within the wedge, indicating at uncertainty over the falling prices. The breakout from wedge, however, must be accompanied by a pickup in volume, suggesting the buying pressure is starting to absorb the selling interest. If the breakout is not accompanied by higher volume, the pattern will be vulnerable for a failure.

Price target: Once the break occurs, the price target can be projected as: the vertical distance between the widest portion of the wedge, added to the breakout level. In most cases, the price will rally to the highest high of the wedge formation, if not more.

The above chart shows a falling wedge acting as a continuation pattern. Notice the strong pickup in volume once price broke above the upper trendline. Such an expansion in volume during and after breakout increases the probability of price heading higher in the future.

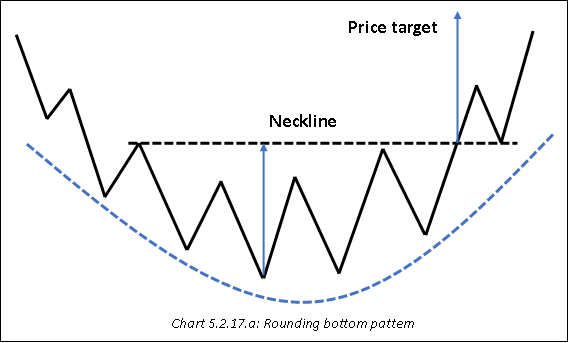

Rounding bottom (Pattern type: Bullish Reversal)

A rounding bottom is a bullish reversal pattern that appears at the end of a downtrend. This pattern marks an end to the prevailing downtrend as it represents a gradual shift from supply to demand. A rounding bottom comprises of three parts. The first part belongs to the sellers as price continues to head south. The second part shows an equilibrium between sellers and buyers, and provides the first hint that selling pressure is starting to ebb as price moves in a horizontal range. The third part belongs to the buyers as demand starts to gradually pick up and exceed supply. The reversal is signalled once price breaks above the high that was registered during the start of the pattern. The entire formation takes the shape of a ‘U’, and hence is called a rounding bottom.

Talking about the volume characteristics, volume should usually be high during the first part of the pattern when price is declining. Volume should then flatten out during the second part of the pattern, suggesting that there is an equilibrium between buyers and sellers. Finally, volume must increase during the third part of the pattern when price is rising. The rise in volume during the third part along with rising price suggests that buying interest is picking up. Finally, the breakout must be accompanied by a sharp pickup in volume, without which, the validity of the breakout will be in question.

Price target: Once the break occurs, the price target can be projected as the vertical distance between the lowest low and the high that was registered during the start of the pattern, added to the breakout level. Having said that, deciding the high during the start of the pattern is very subjective and varies between one chartist to the other. The neckline in case of a rounding bottom pattern is not as clear as it is in case of other price patterns.

In the above chart, notice the gradual shift from supply to demand. Notice how the first part saw a gradual decline, the second part saw an equilibrium between sellers and buyers, and the third part saw a gradual rally along with rising volume. Finally, the breakout was accompanied by a marked pickup in volume, increasing the possibility of a trend reversal from down to up.

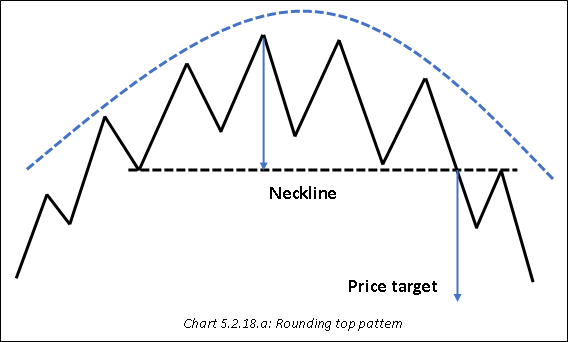

Rounding top (Pattern type: Bearish Reversal)

A rounding top is a bearish reversal pattern that appears at the end of an uptrend. This pattern marks an end to the prevailing uptrend as it represents a gradual shift from demand to supply. A rounding top comprises of three parts. The first part belongs to the buyers as price continues to rally. The second part shows an equilibrium between buyers and sellers, and provides the first hint that buying interest is starting to recede as price moves in a horizontal range. The third part belongs to the sellers as supply starts to gradually pick up and exceed demand. The reversal is signalled once price breaks below the low that was registered during the start of the pattern. The entire formation takes the shape of an inverted ‘U’, and hence is called a rounding top.

Talking about the volume characteristics, volume should usually be high during the first part of the pattern when price is rising. This indicates the uptrend remains intact. Volume should then flatten out during the second part of the pattern, suggesting that there is an equilibrium between buyers and sellers. Finally, volume must increase during the third part of the pattern when price is declining. The rise in volume during the third part along with falling price suggests that selling interest is picking up. Finally, the breakdown must preferably be accompanied by a noticeable pickup in volume.

Price target: Once the break occurs, the price target can be projected as: the vertical distance between the highest high and the low that was registered during the start of the pattern, subtracted from the breakdown level. Having said that, deciding the low during the start of the pattern is very subjective and varies between one chartist to the other. The neckline in case of a rounding top pattern is not as clear as it is in case of other price patterns.

In the chart below, notice the gradual shift from demand to supply. Notice how the first part saw a steady rally, the second part saw an equilibrium between sellers and buyers during which neither of the parties were able to gain an upper hand, and the third part saw a steady decline. Finally, the breakdown signalled a reversal in trend from up to down and triggered a steady decline in price in the days ahead.

Things to keep in mind

-

Price patterns are not foolproof. A chartist will occasionally encounter pattern failures despite most of the qualifying criteria being met. If a pattern is not working as was initially anticipated, it is always better to exit the trade and limit the losses rather than holding on to a losing position based on hope. After all, risk management is the most important part of technical analysis.

-

Once price breaks out of a pattern, either on the upside or on the downside, a chartist can use several filters to estimate the validity of the break. Some of these filters include: waiting for price to close beyond the breakout area, applying a time filter such as waiting for price to settle beyond the breakout area for two or more days, applying a percent filter such as waiting for price to exceed the breakout area by a certain percent, waiting for volume to pickup in the direction of the break etc.

-

Once a position is initiated post the break from a pattern, monitor the price movement regularly. Once sufficiently in-the-money, maintain a trailing stop to protect the winning position. If the price touches the pattern target, either exit the position or hold on to it in case the prevailing trend is expected to continue. At all costs, keep trailing the stop loss and protect the winning position.

Summary

-

A double top is a bearish reversal pattern that appears after a rally in price. It comprises of two peaks that appear at identical levels. These two peaks are separated by a trough between them.

-

A double bottom is a bullish reversal pattern that appears after a decline in price. It comprises of two bottoms that appear at identical levels. These two bottoms are separated by a rally between them.

-

A triple top is a bearish reversal pattern that appears after a rally in price. It comprises of three peaks that appear at identical levels. These three peaks are separated by two troughs between them.

-

A triple bottom is a bullish reversal pattern that appears after a decline in price. It comprises of three troughs that appear at identical levels. These three troughs are separated by two peaks between them.

-

A Head & Shoulder top is a bearish reversal pattern that appears after a rally in price. The pattern consists of three peaks. The first peak is called the left shoulder, the second peak is called the head, and the third peak is called the right shoulder.

-

An inverse Head & Shoulder is a bullish reversal pattern that appears after a decline in price. The pattern consists of three troughs. The first trough is called the left shoulder, the second trough is called the head, and the third trough is called the right shoulder.

-

A rectangle is a continuation pattern that could appear during an uptrend or a downtrend. A rectangle represents a pause to the ongoing trend, during which the price broadly consolidates within a set range.

-

A contracting triangle is a continuation pattern that could appear during an uptrend or a downtrend. A contracting triangle pattern has an upper trendline that is sloping downwards and a lower trendline that is sloping upwards.

-

An ascending triangle is a bullish continuation pattern that appears during an uptrend. The pattern comprises of at least two bottoms and at least two highs, with the second bottom being above the first bottom and the second top essentially at the same level as the first top.

-

A descending triangle is a bearish continuation pattern that appears during a downtrend. The pattern comprises of at least two tops and at least two bottoms, with the second top being below the first top and the second bottom essentially at the same level as the first bottom.

-

An expanding broadening pattern is a reversal pattern that appears either at the end of an uptrend or at the end of a downtrend. An expanding broadening pattern has two trendlines that are diverging. This pattern is characterized by lows getting lower and highs getting higher.

-

An ascending broadening pattern is a bearish reversal pattern that usually appears at the end of an uptrend. An ascending broadening pattern has two trendlines that are diverging. This pattern is characterized by higher highs and horizontal lows.

-

A descending broadening pattern is a bullish reversal pattern that usually appears at the end of a downtrend. A descending broadening pattern has two trendlines that are diverging. This pattern is characterized by lower lows and horizontal highs.

-

Flags and Pennants are continuation patterns that, after a brief pause, either extend an uptrend or extend a downtrend.

-

A rising wedge can appear either as a bearish reversal pattern following a rally in price or as a bearish continuation pattern following a decline in price. This pattern comprises of lows that slope upwards at a steeper angle and highs that slope upwards but at a gentler angle.

-

A falling wedge can appear either as a bullish reversal pattern following a decline in price or as a bullish continuation pattern following a rally in price. This pattern comprises of highs that slope downwards at a steeper angle and lows that slope downwards but at a gentler angle.

-

A rounding bottom is a bullish reversal pattern that appears at the end of a downtrend. This pattern marks an end to the prevailing downtrend as it represents a gradual shift from supply to demand.

-

A rounding top is a bearish reversal pattern that appears at the end of an uptrend. This pattern marks an end to the prevailing uptrend as it represents a gradual shift from demand to supply.

Next Chapter

Comments & Discussions in

FYERS Community

Yajman commented on March 14th, 2019 at 2:25 PM

Sir, this very detailed nd informative but it is very long. it would be better to have different chapters

yashas commented on March 14th, 2019 at 2:27 PM

Hi Yajman. Thanks for your feedback. We will keep this in mind going forward

mohsinkhan commented on May 11th, 2019 at 4:33 AM

great job but all chapters provide in pdf format also if possible so its easily download.

tejas commented on May 14th, 2019 at 5:14 PM

Hi there, we don't intend to provide it in PDF as the content may undergo updates and changes from time to time. Also, PDFs are not interactive :-)

Upendra Kumar commented on May 27th, 2019 at 6:10 PM

Informative writeup. Thanks

tejas commented on May 29th, 2019 at 4:47 PM

Thanks, Upendra!

Upendra Kumar commented on May 27th, 2019 at 6:10 PM

Informative writeup. Thanks

Shriram commented on January 26th, 2020 at 5:09 PM

Thank you Upendra!

Asha commented on June 13th, 2019 at 8:52 PM

Good Information. Very knowledgeable .

Shriram commented on January 26th, 2020 at 5:13 PM

Thank you Asha!

Milind commented on August 16th, 2019 at 1:56 PM

Hi

I have read almost all the chapters in School of stocks. Thanks for it. I was knowing nothing about share market before 3 months. My friend advised reading this. If I want to see the market, charts, indicators; all live for free just to understand it, where can I see it?

Shriram commented on January 26th, 2020 at 5:17 PM

Hi Milind, we do provide access to live charts on our website.

milind joshi commented on February 19th, 2020 at 9:38 PM

access to live charts on website? were we have to go

Rakesh Kumar commented on January 23rd, 2020 at 9:38 PM

Very will explained

Shriram commented on January 26th, 2020 at 5:15 PM

Thank you Rakesh!

Shriram commented on January 23rd, 2020 at 10:02 PM

Thank you Rakesh! Hope you find other chapters and modules beneficial

Satish Ramdurg commented on January 26th, 2020 at 7:32 AM

Very informative. Would like to read more on stock markets. Can you provide the links to enable me to read them. Thanks and regards

Shriram commented on February 20th, 2020 at 11:04 AM

Thank you Satish. You could refer to the various modules available on our School of Stocks

rajiv commented on April 2nd, 2020 at 4:27 AM

very good job i am confident that what you have included in technical analysis is worth thousands of rupees book available in market. then also not explained properly. Best material

Shriram commented on April 2nd, 2020 at 7:23 PM

Thanks Rajiv for such a valuable feedback!

Shriram commented on April 2nd, 2020 at 7:22 PM

Thanks Rajiv for such a valuable feedback!

Aniruddha Bordawekar commented on July 12th, 2020 at 1:37 AM

A very good, informative, and detailed write-up. All diagrams shown with real-time examples. Definitely helpful for traders. Thanks.

Abhishek Chinchalkar commented on July 15th, 2020 at 7:51 AM

Hi Aniruddha, thank you for the valuable feedback!

Sanju Yadav commented on August 29th, 2020 at 6:23 PM

Very informative & Well explained, Thanks

Abhishek Chinchalkar commented on August 31st, 2020 at 8:19 AM

Hi Sanju, thank you for your valuable feedback!

aYlNlfdX commented on October 24th, 2024 at 9:04 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:35 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:35 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:38 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:38 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:39 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:40 PM

555

aYlNlfdX'" commented on October 24th, 2024 at 9:40 PM

555

@@CEDSY commented on October 24th, 2024 at 9:40 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:41 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:42 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:46 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:46 PM

555'"

aYlNlfdX commented on October 24th, 2024 at 9:47 PM

@@ioNEw

aYlNlfdX commented on October 24th, 2024 at 9:47 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:48 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:50 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:50 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:50 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:51 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:51 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:52 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:56 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:56 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:56 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:56 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:56 PM

555

aYlNlfdX commented on October 24th, 2024 at 9:57 PM

555

aYlNlfdX commented on October 24th, 2024 at 10:00 PM

555

aYlNlfdX commented on October 24th, 2024 at 10:01 PM

555

aYlNlfdX commented on October 24th, 2024 at 10:02 PM

555

aYlNlfdX commented on October 24th, 2024 at 10:07 PM

555

aYlNlfdX commented on October 24th, 2024 at 10:07 PM

555

aYlNlfdX commented on October 25th, 2024 at 12:52 AM

555

aYlNlfdX commented on November 9th, 2024 at 5:09 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:20 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:20 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:22 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:25 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:26 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:27 AM

555

aYlNlfdX'" commented on November 9th, 2024 at 6:27 AM

555

@@LymTa commented on November 9th, 2024 at 6:28 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:28 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:29 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:29 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:30 AM

555'"

aYlNlfdX commented on November 9th, 2024 at 6:31 AM

@@AV4NF

aYlNlfdX commented on November 9th, 2024 at 6:31 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:31 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:32 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:32 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:32 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:32 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:32 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:33 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:33 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:33 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:33 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:34 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:34 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:34 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:35 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:36 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:36 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:37 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:38 AM

555

aYlNlfdX commented on November 9th, 2024 at 6:52 AM

555

GRLpGpAG commented on November 13th, 2024 at 1:40 AM

555

GRLpGpAG commented on November 13th, 2024 at 1:40 AM

555

GRLpGpAG commented on November 13th, 2024 at 2:02 AM

555

GRLpGpAG commented on November 13th, 2024 at 2:02 AM

555

GRLpGpAG commented on November 13th, 2024 at 2:04 AM

555

GRLpGpAG commented on November 13th, 2024 at 2:05 AM

555