Since the turn of the century, financial markets have experienced strong bouts of volatility. We have witnessed four major events that have had severe implications on the prices of all tradeable asset classes. These events included the 2000 Dot Com Bubble, the 2007-08 Global Financial Crisis, the 2010-11 European Debt Crisis, and the 2020 Covid-19 crisis. Market reaction in the aftermath of each of these events highlights how critical risk management is and why it is necessary to be aware of the risks you are exposed to when deploying capital in the financial markets. Imagine the hit a portfolio would have taken had one not paid attention to risk management during the market fall in the first quarter of 2020.

In this chapter as well as in the next, we will talk about the various types of risks that investors are exposed to. It is important to be aware of these risks and understand the kind of impact they can have on various asset classes. So, let us jump in right away.

Two Types of Risks: Systematic and Unsystematic

Broadly speaking, risks can be classified into two categories:

- Systematic Risk

- Unsystematic Risk

Based on the two, total risk can be defined as:

Total Risk=Systematic Risk+Unsystematic Risk

Systematic Risk

This is a type of risk that affects the entire market and not just one particular sector or industry. And because the entire market is affected, this type of risk cannot be completely diversified. Accordingly, systematic risk is also known as Undiversifiable Risk. The four major events of the 21st century, which we mentioned earlier in the chapter, are examples of systematic risk, as each of these affected the entire global markets and economy and not just one sector or industry. Keep in mind that systematic risk might not have the same kind of impact on all asset classes. That is, the prices of some assets could fall, while that of some others could rise. Some of the key systematic risks that you need to be aware of include:

- Market Risk

- Interest Rate Risk

- Inflation Risk

- Exchange Rate Risk

- Commodity-price Risk

- Political Risk

Unsystematic Risk

This is a type of risk that affects only a particular sector, industry, or company. As such, these risks can be diversified by spreading your portfolio across different market sectors and industries. Accordingly, unsystematic risk is also known as Diversifiable Risk. The entry of Reliance Jio into the telecom space, for instance, can be considered an unsystematic risk because it impacted just telecom stocks rather than the entire market. Product launches, important company announcements, regulatory changes etc. are some of the risks that a company/sector is exposed to rather than the market as a whole. Some of the key unsystematic risks that you need to be aware of include:

- Business Risk

- Credit Risk

- Operational Risk

- Liquidity Risk

- Regulatory Risk

- Reputation Risk

Let us move ahead and talk about each of the systematic risk in further detail.

Market Risk

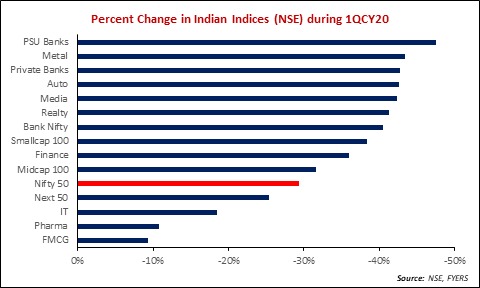

As the name suggests, market risk is a risk that affects the entire stock market and not just one sector of the stock market. It is caused by macro-economic factors such as economic slowdown, recession, ballooning inflation, surging interest rates, political uncertainty, trade wars etc. Besides, sky high stock market valuations and bubbles can also give rise to market risk, like the one that unfolded in the US towards the turn of the 21st century (the bursting of the dot com bubble). The most recent example of market risk is the 2020 Covid-19 crisis. When this crisis hit in the first quarter of last year, all sectors of the stock market tumbled together, including defensives such as Pharma and FMCG. The table below highlights the Indian stock market performance during the first quarter of 2020.

Notice above that all the sectors of the market fell during this period, with cyclicals falling the most and defensives the least, which is a typical bear market behaviour. See that having exposure to defensive sectors during such periods can help in limiting portfolio losses to some extent, but not entirely. What can one do to mitigate market risks in a portfolio? Well, one strategy that can be used is to hedge your portfolio using derivatives, such as Futures and Options. Alternatively, one could also diversify across asset classes, by deploying some percent of capital in instruments that typically tend to benefit during times of falling stock markets, such as gold and government bonds. We shall talk about hedging and diversification across assets later in this module.

Interest Rate Risk

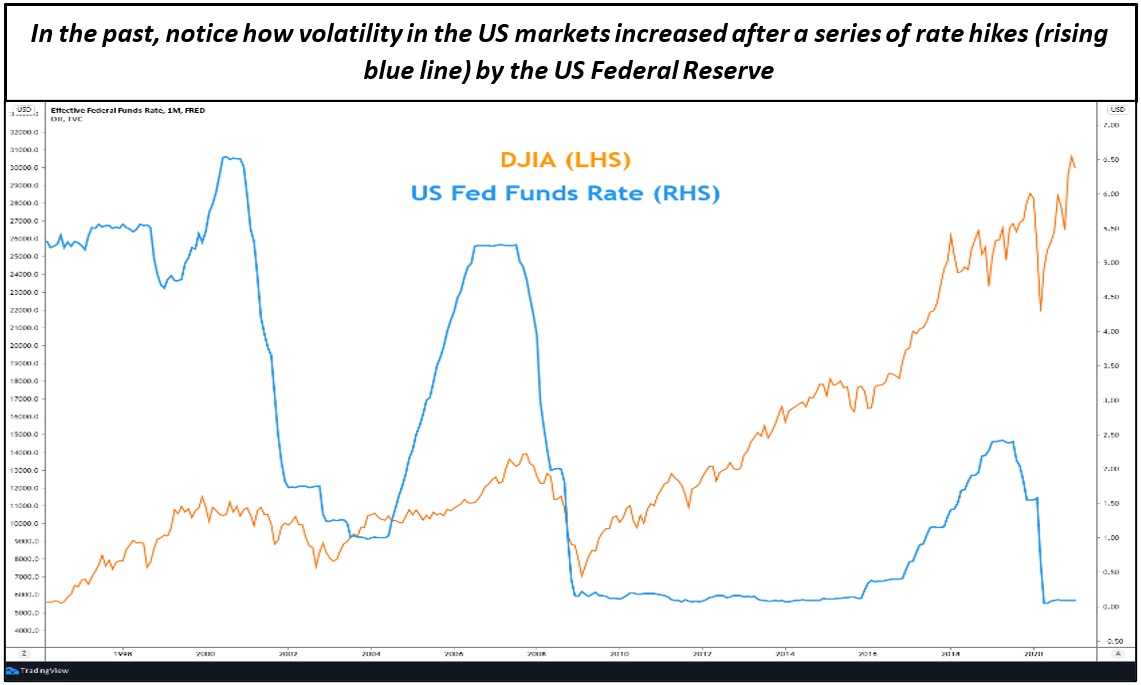

Interest rate risk exists when changes in interest rates affect the price of a security. This is a systematic risk because it affects securities across multiple asset classes – bonds, equities, commodities, currencies, mutual funds, ETFs etc. Changes in interest rates affect equities and commodities indirectly. Let me explain how. As interest rates climb, there is a tendency for people to spend less and save more. Besides, the cost of borrowing also increases for both corporates and individuals, hurting the demand for loans. Subsequently, as savings increase and spending and investments decrease, businesses tend to slow down, in turn negatively impacting equity and commodity prices. This impact is reversed when interest rates start falling. That said, do note that there can be a lag between changes in interest rates and the time it starts impacting equity and commodity prices. Also, there has to be a series of interest rate changes for it to eventually impact corporate earnings and the demand for commodities. Stock market is the summation of leading indicators, while GDP is the summation of lagging indicators.

Meanwhile, an asset class that tends to be the most sensitive to changes in interest rates is bonds. Bond prices are directly impacted by changes in interest rates. As interest rates rise or are expected to rise, demand for old bonds tends to reduce, making it difficult for existing bondholders to find buyers for their bonds. Why does this happen? Because, reflecting the rise in interest rates, newer bonds having similar characteristics would provide higher coupon rates. As an example, if older bonds were issued with a coupon rate of 5% while new bonds issued post the rise in interest rate are offering a 6% coupon rate, the latter will be more attractive to potential buyers than the former because of the higher periodic income stream that they would provide, all else equal. Furthermore, existing holders of old bonds might also prefer selling them to buy the newer bonds. All this will cause the price of old bonds to fall. Hence, as you can see, bond prices and interest rates are inversely linked. A rise in interest rates leads to a drop in bond prices, and vice versa.

What can one do to mitigate interest rate risk in a portfolio? While changes in interest rates affect all asset classes, it tends to have the most impact on fixed income instruments, such as bonds. Hence, to reduce the impact of interest rate risk, one needs to have a well-diversified portfolio comprising not only of bonds but also equities. As said earlier, equities are not directly impacted by changes in interest rates. Furthermore, until the time economic growth and corporate earnings remain firm, equities could continue rising even if interest rates are moving higher. Also, bonds with long durations tend to be much more sensitive to changes in interest rates than bonds with short durations. Hence, during periods of fluctuating interest rates, one could reduce exposure to bonds that have long durations and increase exposure to bonds having short durations.

Inflation Risk

This is a risk that arises due to an increase in the price level of goods and services in an economy. Inflation affects everyone by lowering the purchasing power of money over time. To understand this better, let us take a simple example. Today, petrol prices in India have touched ₹100/litre. If you go to a petrol pump and pay ₹100, the attendant will give you 1 litre of petrol. However, a year ago, the same ₹100 would have fetched you 1.25 litres of petrol, as the price back then was ₹80/litre. This is nothing but inflation. Notice how the purchasing power of money has eroded over time (in this case one year). In India, the two measures of inflation are Consumer Price Index (CPI) and Wholesale Price Index (WPI). The former measures inflation at the consumer level, while the latter measures inflation at the producer level. If rising prices are not met by a corresponding increase in income level of people, they would have less disposable income in hand, causing their standard of living to deteriorate. Inflation not only makes purchasing goods and services more expensive, but it also raises borrowing costs. This is because as inflationary pressures increase, interest rates also tend to move higher. Hence, inflation has a strong bearing on a nation’s interest rate trajectory.

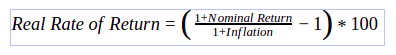

Inflation risk affects various investors. However, the most impacted are those having investments in fixed income securities, such as bonds, debentures, fixed deposit, PPF etc. This is because the rates offered by these instruments are typically fixed and nominal in nature rather than real. Before proceeding, let me quickly explain the concept of nominal and real rate of return. Nominal return is the return offered by most securities. This return does not take into consideration the effects of inflation. Meanwhile, real return is the return that is adjusted for inflation. This is the rate of return that matters more to investors. Real rate of return can be calculated using the following formula:

For instance, if the nominal return on a 1-year fixed deposit is 10% and the prevailing rate of inflation in the economy (as measured by CPI) is 6%, then the real rate of return, based on the above formula, is 3.77%. This means after adjusting for inflation, the investor would have earned around 3.77% on his/her investment. When looking out for investment opportunities, it is important to focus on the real rate of return and not just the nominal rate. An instrument might give a nominal rate of 5% but if the prevailing rate of inflation in the economy is more than 5%, then the real return would be negative. In this case, although the investor would make money on the investment, he/she would still lose out when the return is adjusted for inflation.

What can one do to reduce inflation risk in a portfolio? Well, one needs to have a well-diversified portfolio that includes tangible assets such as commodities and/or real estate. Tangible assets tend to provide a natural hedge against inflation, as their values typically tend to go up during inflationary periods. Meanwhile, certain stocks such as commodity stocks, energy stocks, FMCG stocks, etc. also tend to do well during inflationary times and as such, are worth considering for investment.

Exchange Rate Risk

Exchange rate risk arises due to fluctuations in the value of the currency of one country vis-à-vis others. In the context of India, this refers to volatility in the value of the rupee (INR) against the dollar (USD). Currency risk affects an economy in various ways, depending on whether the home currency is appreciating or depreciating against the foreign currency. Let me explain this using the context of India. A depreciating rupee (which means an appreciating USD/INR) makes imports of goods and services more expensive to Indians as they will have to shell out more rupees for every dollar that they buy. Furthermore, a lot of commodities, such as crude oil and metals, are imported from overseas and tend to be relatively demand inelastic. Hence, a steady depreciation of the rupee raises the import bill and can stoke inflationary pressures if the impact of higher commodity prices costs is passed on to end consumers. That said, a depreciating rupee makes Indian products and services more attractive globally, thereby benefiting the export sector. Meanwhile, an appreciating rupee has the opposite impact, providing benefits to imports but hurting exports in the process.

Exchange rates have an impact not only on end consumers but also on corporates, especially those with global exposure. A depreciating rupee hurts Indian companies that tend to be net importers of goods, services, and commodities. This is because if the demand for the goods and services that these companies sell is price sensitive, they may not be able to completely pass on the cost of higher imports to consumers. This in turn could squeeze their profit margins. Similarly, a depreciating rupee benefits Indian companies who are net exporters of goods and services. This is because Indian goods and services become more attractive globally, which potentially helps in driving higher export volumes and subsequently higher revenues. Meanwhile, an appreciating rupee has the opposite impact.

Finally, exchange rates have an impact on the flows of foreign money into a nation’s stock and bond markets too. This is because foreign investors are impacted not only by movements in stock prices but also by fluctuations in the exchange rate. A depreciating rupee (i.e., an appreciating USD/INR) reduces the earnings potential of foreign investors in dollar terms, while an appreciating rupee has the opposite impact. It is for this reason that a steadily depreciating rupee tends to increase volatility in the domestic stock and bond markets, and vice versa. Similarly, if an Indian investor intends to invest a certain portion of his/her capital in, say, the US markets, he/she needs to have a view not only on the US markets but also on the USD/INR exchange rate. Once invested, if the dollar appreciates over time, the investor’s earnings in rupee terms would be higher, and vice versa. Hence, exchange rate is a critical factor that needs to be considered when making investments overseas.

What can one do to reduce exchange rate risk in a portfolio? Well, exchange rate risk can be reduced by diversifying portfolio across stocks that comprise of companies having not only global exposure but also only domestic exposure. This would help limit portfolio volatility in case of unfavourable swings in exchange rate. Meanwhile, an international investor could reduce exchange rate risk by spreading his/her portfolio across countries rather than limiting to just one country overseas. If the portfolio exposure to exchange rate is significant, one could also fully or partially hedge such exposure using exchange-traded currency futures and options contracts.

Commodity Price Risk

This risk arises when there are severe fluctuations in the price of commodities due to major imbalances between demand and supply. Depending on the direction of the price move, this risk can affect producers as well as consumers of commodities. For example, a sustained rise in copper prices can boost the revenues of copper producing companies such as Glencore and Hindustan Copper as well as increase the export revenues of major copper exporting nations such as Chile and Peru. At the same time, it can hurt the bottom line of companies that use copper as raw material such as telecommunication, transportation, and housing companies as well as hurt nations that are net importers of copper by increasing their import bill. On the other hand, a sustained decline in the price of commodities would have an opposite impact.

Another impact of commodity price is on inflation. A sustained increase in the price of commodities, such as crude oil, industrial metals, wood, agricultural commodities, etc. can be passed on to end consumers, which in turn could fuel inflationary pressures in a country. For instance, a sustained rise in copper price would increase the costs of new homes as copper is widely used in a range of home construction activities. Similarly, a sustained rise in crude oil price would increase transportation costs as well as manufacturing costs, impacting inflation both directly as well as indirectly. On the other hand, too much of a fall in commodity prices could pose deflationary risks.

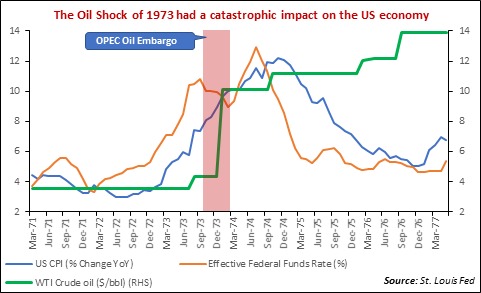

One commodity that tends to post a significant risk to global stability is crude oil, given its widespread application across sectors. As an example, when the OPEC imposed an embargo on oil exports between October 1973 and March 1974, it caused oil prices in the US to quadruple during this period. This had a catastrophic impact on the US economy – inflation and interest rates surged to double digits, and the economy fell into a recession that lasted until March 1975. Meanwhile, the US stock markets also crashed and experienced a period of lost decade, as it barely offered any noticeable returns until late-1982. Similarly, the oil price crash between 2014 and 2016 had a profound negative impact on oil producing companies and nations whose major exports comprise of crude oil. At the same time, it was a boon to India, a major oil consuming nation, as it helped improve the macro-economic health and lower inflation expectations.

What can one do to reduce commodity price risk in a portfolio? Well, one must include commodity-related stocks in his/her portfolio and tweak the allocation during commodity bull and bear markets. For instance, during commodity bull markets, a higher weight could be assigned to commodity stocks, as these tend to outperform other sectors. Similarly, during commodity bear markets, the weight could be reduced to avoid portfolio underperformance. Commodities also tend to offer a natural hedge against inflation. Hence, having commodity stocks can be beneficial during inflationary times. Finally, one could also gain exposure to commodities directly by buying or selling commodity futures and options listed on an exchange, by buying physical commodities (such as gold and silver), or by buying financial commodities (such as gold ETF and gold bond). Having gold in your portfolio is a great way to diversify portfolio risk, given the various benefits gold offers (hedge against stock market volatility, hedge against inflation, hedge against currency devaluation etc).

In the next chapter, we will discuss different types of unsystematic risks that investors are exposed to.

Next Chapter

Comments & Discussions in

FYERS Community