Settlement of commodity contracts

So far, we have talked about the various aspects relating to contract specifications for commodities that are traded on the domestic bourses. We will now turn our discussion to the settlement aspect of commodities. Broadly speaking, there are two ways in which commodity contracts can be settled on expiration:

Cash settlement: Some contracts are settled in cash on the day of the contract expiration at the final settlement price specified by the exchange. In case of such a settlement, the final MTM is adjusted in cash by debiting/crediting the respective accounts of the parties to the trade.

Physical delivery: Some contracts are settled by way of physical delivery, wherein the seller delivers the underlying commodity to the exchange-designated warehouse and the buyer takes delivery of the commodity from the exchange-designated warehouse.

Let’s now discuss about how the physical delivery mechanism takes place. Usually, most of the outstanding positions are settled and closed out before the start of the tender period. Open positions that are not closed out before the start of the tender period will be marked for delivery on a day leading to the expiry of the contract. In case of “both option” based contracts, both the seller and the buyer must submit to the exchange their intention to give and take delivery on or before the expiry day. In case of “seller’s option” based contracts, the seller has the option to submit to the exchange his or her intention to give delivery within a stipulated time frame. If the seller submits the intention, the exchange will assign the delivery to a buyer having an outstanding long position, who will then have to compulsorily take delivery of the commodity. In case of “compulsory delivery” based contracts, post the expiry of the contract, both the seller and the buyer will have to compulsorily give and take delivery, even if they have not submitted their delivery intention to the exchange during the tender period.

Once the exchange has received the delivery intention and has marked the delivery, the seller will have to deliver the underlying commodity to the specified exchange-designated warehouse. The underlying commodity must match the quality and quantity criteria specified by the exchange. Also, the underlying commodity can be delivered only in certain cities and during a certain time period mentioned in the contract specification. Once all the criteria are met and the warehouse has accepted the delivery from the seller, the buyer will have to pay the total contract value as specified by the exchange on the “pay-in” day. The seller will then receive the funds on the “pay-out” day. Once the pay-in is done and all formalities completed, the buyer would be able to take delivery of the underlying commodity from the exchange-designated warehouse.

Given that there could be minor variations in certain aspects of commodities (such as quality and quantity), the exchange provides tolerance limit to account for these variations. The seller must ensure that all the aspects of the commodity fall within the tolerance range specified by the exchange. If it falls outside this range, it would not be accepted by the warehouse. Also, depending upon the level of variation, the buyer will have to either pay a premium or get a rebate on taking the delivery. These premium/rebate amounts are fixed by the exchange.

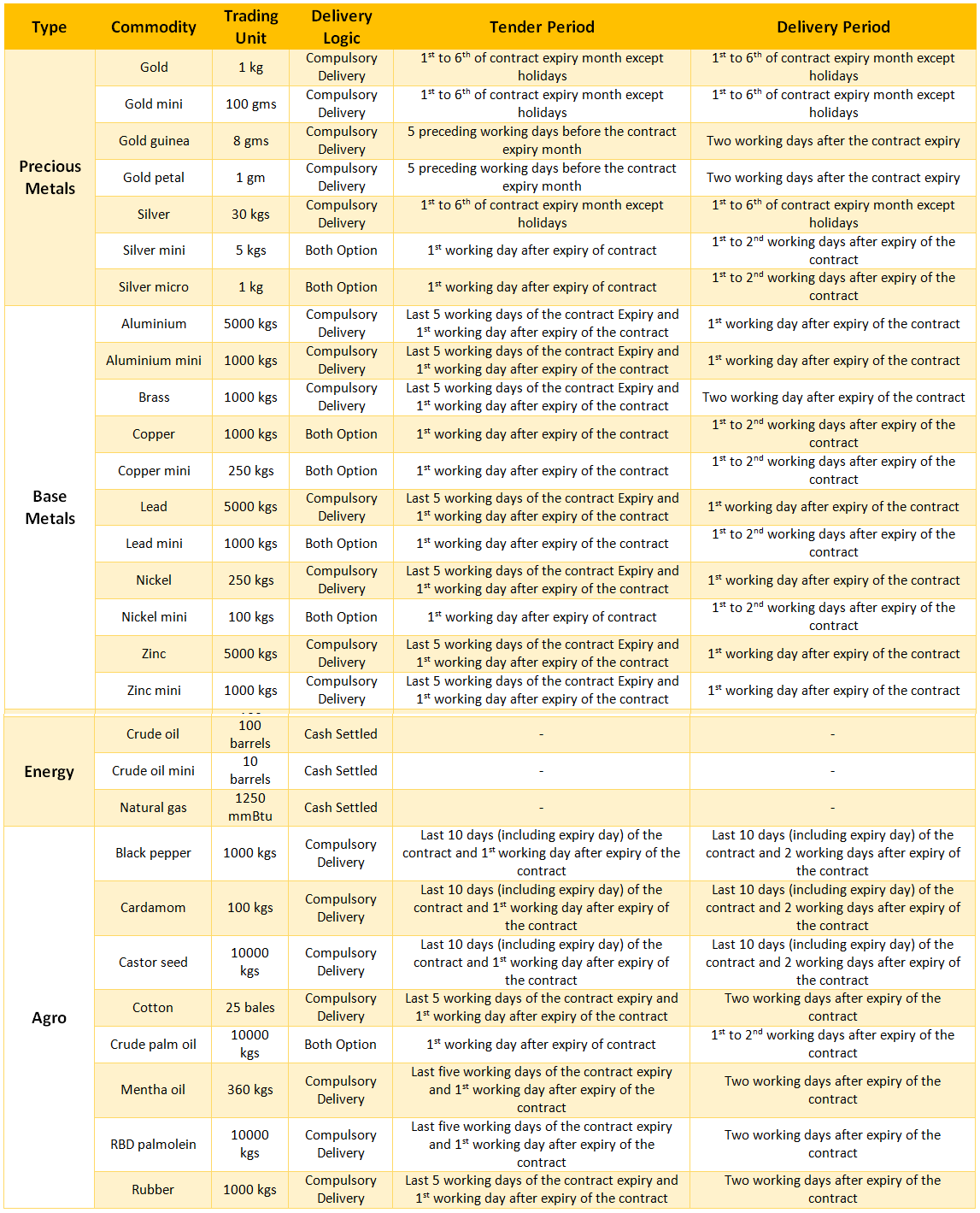

The table below shows the settlement-related details pertaining to commodity futures on the MCX:

Note: Kindly note that all the details which have been mentioned above pertaining to the settlement aspects of commodity futures contracts are subject to change from time to time as per the policies of the exchange. For latest and updated information on contracts settlements, readers are advised to view the MCX circulars that are periodically displayed on the exchange website.

Next Chapter

Comments & Discussions in

FYERS Community

Kiran KS commented on June 16th, 2019 at 7:14 AM

How does it work for traders who just want to trade on the compulsory delivery contracts? The above table suggests that last 5 days are tender period for the base metal contracts.. Will the contracts be liquidated by brokerages before the tender period ?

tejas commented on June 17th, 2019 at 3:02 PM

Hi Kiran, it depends on the brokers' policies. We do square off the positions before the tender period in case traders have not done it themselves. This is because most retail traders are not interested in taking delivery of the commodities and do not have sufficient margin. Speculators don't have delivery intent.

Suresh commented on June 24th, 2019 at 11:23 PM

How does this comRIS works and how to understand this by a trader?

tejas commented on July 1st, 2019 at 7:41 PM

Hey Suresh, could you re-phrase your question?