28 Jul, 2025

28 Jul, 2025

4 mins read

4 mins read

Understanding financial ratios helps investors assess whether a stock is fairly priced. One such ratio is the Price-to-Book (P/B) ratio, which is used to compare a company’s market value with its book value. In this blog, we explore the meaning, relevance, calculation, and limitations of the P/B ratio.

The P/B ratio is a financial metric that compares a company’s current market price to its book value. Book value is essentially the company’s total assets minus its total liabilities. It reflects what would remain for shareholders if the company were liquidated.

|

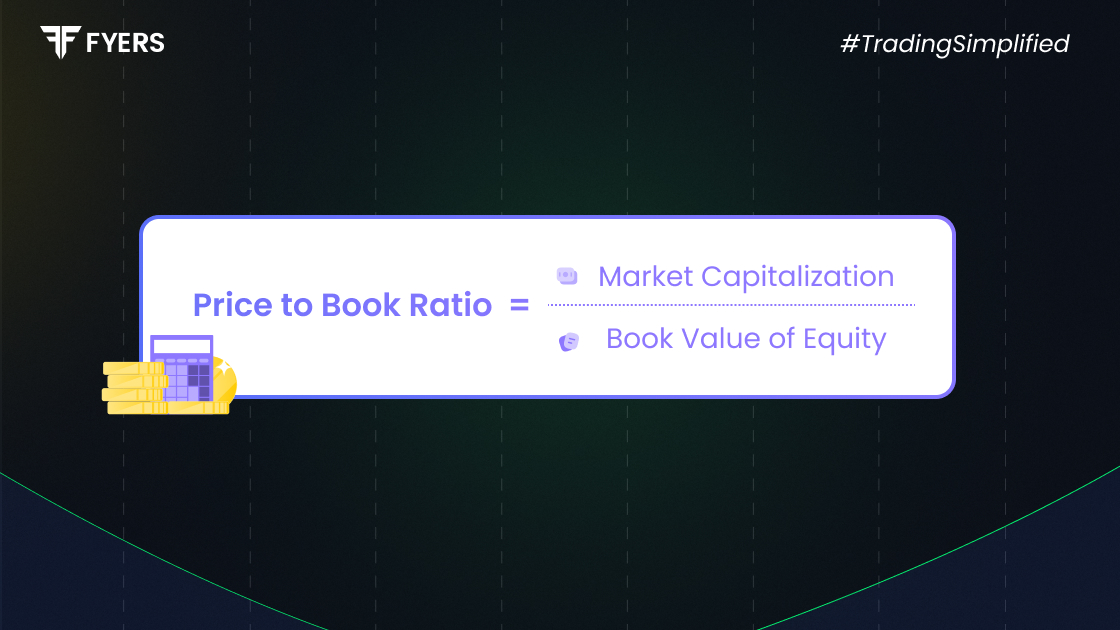

P/B ratio = Market Price per Share / Book Value per Share |

This ratio shows how much investors are willing to pay for each rupee of the company’s net assets. It is commonly used to evaluate companies in sectors such as banking and manufacturing, where tangible assets play a major role.

The P/B ratio offers several useful insights for investors:

Valuation Check: A low P/B may indicate that the stock is undervalued, while a high P/B could suggest overvaluation.

Comparison Tool: It helps compare companies within the same sector or industry.

Risk Insight: A very low P/B might signal issues with the company’s health or earnings.

Tangible Asset Focus: It is helpful when evaluating businesses that rely heavily on physical assets, like banks, utilities, or manufacturing firms.

Conservative Measure: Unlike other metrics, it uses accounting values, which are often more stable than market-based ones.

To calculate the P/B ratio, you need:

Market price per share (from stock exchange data)

Book value per share = (Total Assets - Total Liabilities) / Number of Outstanding Shares

Formula:

P/B Ratio = Market Price per Share ÷ Book Value per Share

Example:

Let’s say a company’s share is trading at ₹600 and its book value per share is ₹300. The P/B ratio would be:

600 ÷ 300 = 2.0

This means investors are willing to pay ₹2 for every ₹1 of the company’s net asset value.

The interpretation of the P/B ratio depends on the industry and the company’s fundamentals:

P/B < 1: The stock is trading for less than its book value. It may be undervalued, but could also reflect deeper financial problems.

P/B = 1: The market believes the company is fairly valued in terms of its net assets.

P/B > 1: Investors expect the company to grow, earn high returns, or possess intangible assets not reflected on the balance sheet.

P/B must always be assessed in the context of other financial metrics and the company’s performance.

Although useful, the P/B ratio has several drawbacks:

Ignores Intangibles: It does not account for intellectual property, brand value, or goodwill.

Sector Bias: It is less effective for companies in technology or services where intangible assets dominate.

Accounting Practices: Book values can vary depending on accounting standards, asset depreciation, or write-downs.

Outdated Asset Values: Some assets may be recorded at historical cost and not reflect current market value.

Doesn’t Reflect Profitability: A low P/B doesn't mean the company is profitable or efficient.

Therefore, investors should not rely on the P/B ratio alone. It should be used along with ratios like Price-to-Earnings (P/E), Return on Equity (ROE), and Debt-to-Equity.

The Price-to-Book ratio is a simple yet valuable tool for assessing a company’s valuation relative to its net assets. It helps investors spot potentially undervalued or overvalued stocks, especially in asset-heavy industries. However, like all financial ratios, it works best when used with other metrics and qualitative analysis. Investors should look at the bigger picture before making investment decisions.

The P/B ratio tells how much investors are paying for each rupee of a company’s net assets. It helps assess whether a stock is overvalued or undervalued.

There is no fixed good or bad value. A P/B below 1 may indicate undervaluation, while a P/B above 1 suggests the market expects growth. It depends on the industry and company performance.

The P/E ratio compares the stock price to earnings per share, focusing on profitability. The P/B ratio compares the price to book value, focusing on the company’s net worth. Both are useful but highlight different aspects of a company.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.