31 Aug, 2025

31 Aug, 2025

4 mins read

4 mins read

When investing in mutual funds or ETFs, it’s important to understand the cost of managing those investments. That’s where the expense ratio comes in. It’s a simple yet powerful metric that tells you how much of your investment is being used to cover the fund’s operating expenses. Knowing how to calculate it, where to find it, and how to reduce its impact can help you make smarter investment choices.

The expense ratio represents the annual cost of managing a mutual fund or exchange-traded fund (ETF), expressed as a percentage of its total assets. It includes fund management fees, administrative costs, and other operating expenses.

For example, if a fund has an expense ratio of 1.5%, it means ₹1.50 out of every ₹100 you’ve invested is used to cover these expenses annually. This directly affects your returns, so even a small difference in expense ratios can add up over time.

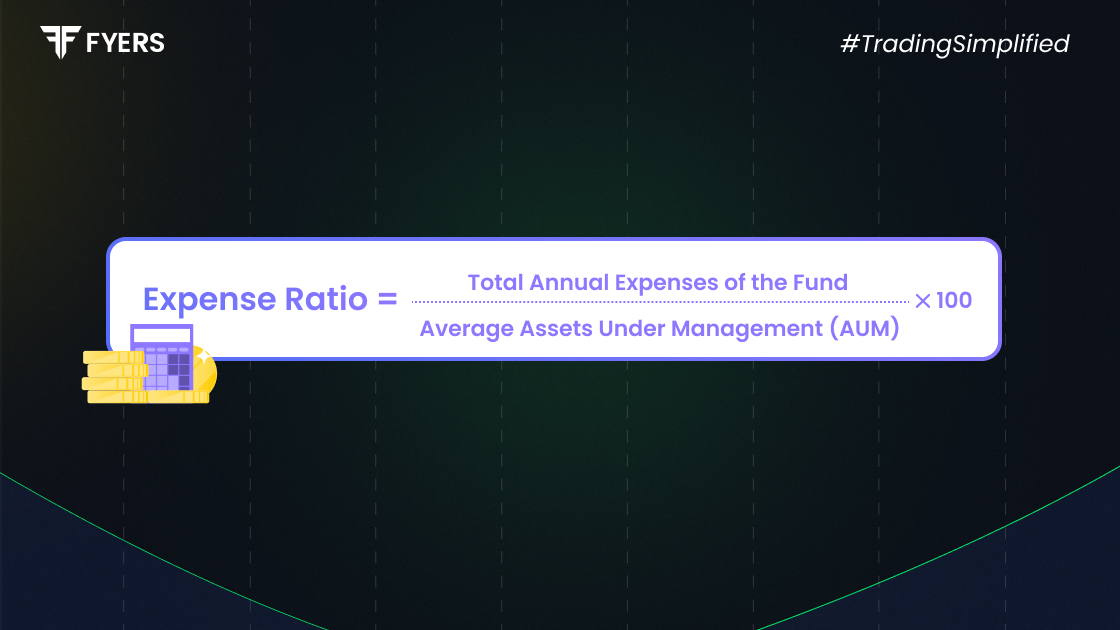

The basic formula to calculate expense ratio is:

|

Expense Ratio = (Total Fund Operating Expenses / Average Assets Under Management) × 100 |

Where:

Operating Expenses include fund management fees, audit costs, marketing fees, and administrative charges.

Assets Under Management (AUM) is the average value of total assets managed by the fund during a given period.

If a mutual fund has ₹50 crore in AUM and total annual expenses of ₹75 lakh:

Expense Ratio = (0.75 / 50) × 100 = 1.5%

This means the investor pays ₹1.5 for every ₹100 invested in the fund each year.

The expense ratio may seem small, but it plays a big role in long-term wealth creation. Here’s why it matters:

Affects Net Returns: Higher expenses reduce your investment returns over time.

Compounds Over the Years: Even a 0.5% difference can lead to significant gaps in your final corpus.

Indicator of Fund Efficiency: Lower expense ratios often indicate cost-effective management, especially in passive or index funds.

Helps in Comparison: It allows you to compare similar funds and choose the one offering better value.

In India, SEBI regulates the maximum expense ratio that mutual fund houses can charge, especially for equity and debt schemes.

Checking the expense ratio of a mutual fund in India is easy and transparent. You can find it through:

Fund Fact Sheet: Published monthly by mutual fund houses, includes detailed costs.

Fund’s Website: Expense ratio is listed under the fund's features or performance summary.

AMFI Website: The Association of Mutual Funds in India regularly updates this information.

Investment Platforms: Most brokerages and investment apps show the current expense ratio.

Always make sure you check the most recent data as expense ratios can change over time.

You can’t eliminate the expense ratio, but you can reduce its effect on your investment performance:

Choose Direct Plans: In India, direct mutual fund plans have lower expense ratios compared to regular plans because they exclude distributor commissions.

Prefer Index Funds or ETFs: These typically have lower fees due to passive management.

Invest for the Long Term: A long investment horizon can help absorb the impact of costs more effectively.

Compare Similar Funds: Don’t just look at returns; check the expense ratio while comparing two funds in the same category.

Review Periodically: Expense ratios can increase, so monitor your funds and consider switching if needed.

Fund A (Active Equity Fund)

AUM: ₹500 crore

Annual Expenses: ₹10 crore

Expense Ratio: (10 / 500) × 100 = 2.0%

Fund B (Index Fund)

AUM: ₹1,000 crore

Annual Expenses: ₹3 crore

Expense Ratio: (3 / 1000) × 100 = 0.3%

Though both funds may generate good returns, Fund B’s lower expense ratio allows more of the return to stay with the investor. That’s why it’s essential to evaluate cost along with performance.

Understanding the expense ratio is essential for anyone investing in mutual funds or ETFs. Even though it might appear to be a small percentage, it has a compounding effect on your returns over time. By checking the expense ratio, comparing similar funds, and opting for cost-effective options like direct plans and index funds, investors in India can optimise their portfolios and enhance long-term growth.

The next time you evaluate a fund, look beyond returns. A low-cost, well-managed fund could make a bigger difference in the long run.

It is the annual fee you pay to a fund house for managing your investment. The fee is a small percentage of your total invested amount and is deducted from your returns.

For actively managed equity funds in India, an expense ratio below 2% is generally acceptable. For index funds or debt funds, anything under 1% is considered good.

You can find it on the mutual fund's official website, AMFI portal, monthly fact sheets, or through investment platforms and apps.

The expense ratio includes fund management fees, administration charges, marketing costs, legal fees, and other operating expenses related to running the fund.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.