19 Sep, 2025

19 Sep, 2025

3 mins read

3 mins read

Options trading can seem complex at first, but once you understand the basics of in the money options, it becomes easier to see how they fit into trading strategies. One of the most important types is the ITM call option.

This guide explains what ITM call options are, how to calculate their value step-by-step, their advantages, risks, and when traders typically use them.

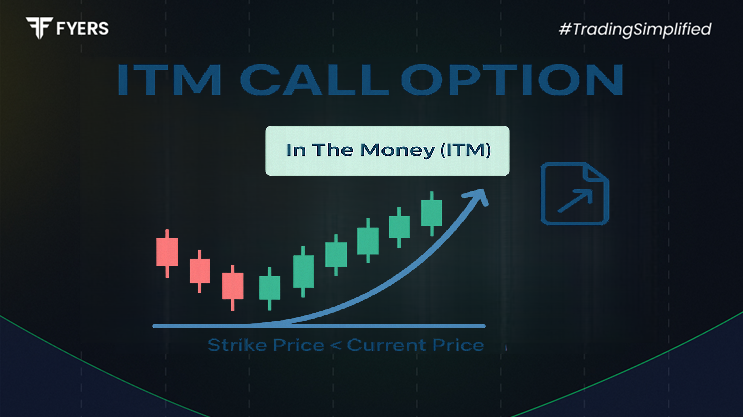

An ITM (In the Money) Call Option is a type of options contract where the strike price is lower than the current market price of the underlying asset.

For example, if a stock is trading at ₹1,000 and you have a call option with a strike price of ₹950, the option is “in the money.”

ITM (In the Money Call Options): Strike < Current Price → Has intrinsic value.

ATM (At the Money Options): Strike ≈ Current Price → Little to no intrinsic value.

OTM (Out of the Money Options): Strike > Current Price → No intrinsic value.

Because in the money call options already have intrinsic value, they are usually more expensive than ATM or OTM options, but also more likely to generate profit.

The value of an ITM call option has two components:

Intrinsic Value = Current Market Price − Strike Price

This represents the premium paid for the possibility of further price movement before expiry.

Step-by-Step Example:

Current Stock Price = ₹1,200

Strike Price = ₹1,100

Premium Paid = ₹120

Calculate Intrinsic Value:

1,200 – 1,100 = ₹100

Determine Option Premium Paid:

₹120

Breakdown:

Intrinsic Value = ₹100

Time Value = Premium – Intrinsic Value = ₹120 – ₹100 = ₹20

So, the ITM call option has an intrinsic value of ₹100 and a time value of ₹20.

Higher Probability of Profit – Since the option is already in the money, it requires less movement to be profitable.

Intrinsic Value – Unlike OTM options, ITM contracts have real value.

Hedging Opportunities – Useful for protecting existing short positions.

Less Affected by Time Decay – Time decay impacts ITM options less compared to OTM ones.

Higher Cost – Premiums are more expensive due to intrinsic value.

Limited Leverage – Compared to OTM options, the percentage returns can be lower.

Market Risk – If the stock price falls below the strike, losses can still occur.

Liquidity Issues – In some cases, certain ITM strike prices may have lower trading volumes.

Bullish Outlook – When you expect the stock price to rise steadily, not just sharply.

Conservative Strategy – For traders who prefer higher probability trades over speculative bets.

Hedging Strategy – To protect short equity positions or balance portfolio risk.

Earnings & Events – When strong movements are expected but you want lower risk compared to OTM calls.

ITM call options are one of the most reliable types of in the money options because they combine real intrinsic value with profit potential. While they cost more upfront, their higher probability of profit and lower exposure to time decay make them a preferred choice for traders who want a balance of risk and reward.

By understanding what ITM call options are and how to calculate them, beginners and experienced traders alike can use them more effectively in their trading strategies.

An ITM call option is one where the strike price is lower than the current market price, meaning it has real value.

You subtract the strike price from the current market price to find the intrinsic value. The total premium = intrinsic value + time value.

ITM options are more expensive but have higher probability of profit, while OTM options are cheaper but riskier.

Yes, beginners can trade ITM options as they are more stable and less speculative than OTM options, but they must manage costs and risks carefully.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.