24 Sep, 2025

24 Sep, 2025

4 mins read

4 mins read

The acid test ratio is like a financial stress test for businesses. It answers a critical question: can a company pay its short-term debts without touching its inventory? By focusing only on the most liquid assets, this ratio cuts through the noise and gives a sharper picture of financial strength. Investors, lenders, and business owners rely on it to gauge how well-prepared a company is to handle immediate obligations.

The acid test ratio, also called the quick ratio, measures a company’s ability to meet short-term liabilities using only its most liquid assets. Inventory and prepaid expenses are excluded since they may not be easily converted into cash.

The name “acid test” reflects the idea of a strict test, designed to show if a company can handle its obligations without depending on stock sales.

This ratio is a signal of financial resilience.

If the ratio is above 1, the company has more quick assets than liabilities, which reflects healthy liquidity.

If the ratio is below 1, the company may struggle to pay short-term obligations without selling inventory or borrowing.

Because it relies on assets that can quickly turn into cash, it is particularly useful during uncertain times or for businesses prone to seasonal fluctuations.

Understanding the importance of acid test ratio can help in decision-making.

Liquidity Position: It gives a conservative yet realistic view of financial health.

Operational Efficiency: Strong ratios usually indicate better cash and receivables management.

Risk Assessment: Banks and lenders use it when evaluating creditworthiness.

Compared to the current ratio, it is stricter because it excludes inventory and prepaid expenses, making it a tougher but more reliable measure.

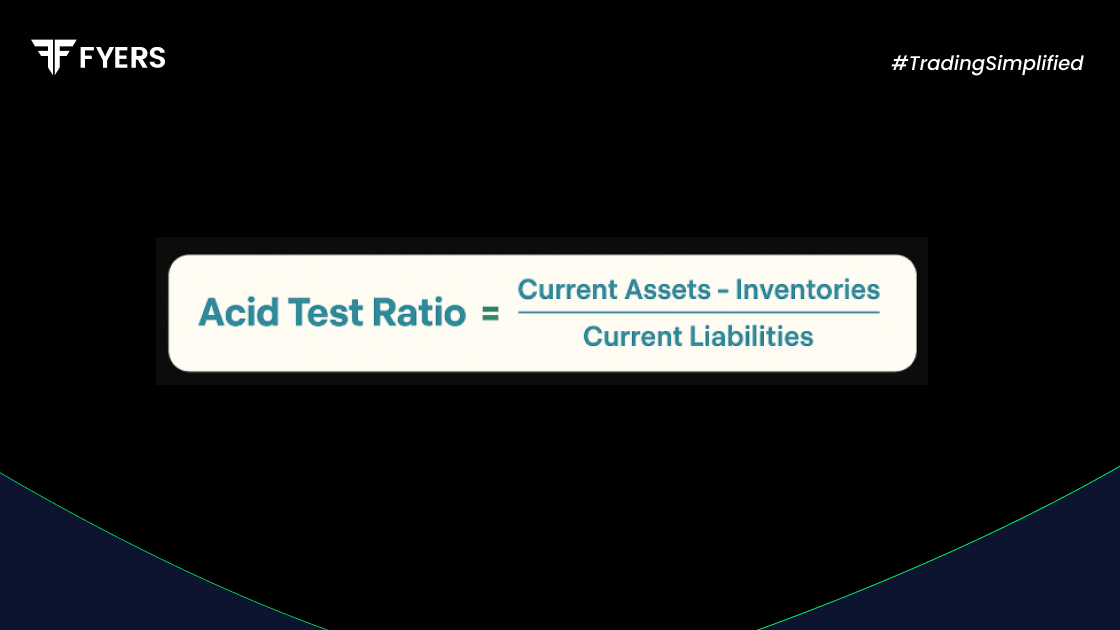

The acid test ratio formula is:

| Acid Test Ratio = (Cash + Marketable Securities + Accounts Receivable) ÷ Current Liabilities |

Components:

Cash and Cash Equivalents: Cash on hand, bank balances, short-term deposits

Marketable Securities: Investments that can be sold quickly

Accounts Receivable: Money owed by customers

Current Liabilities: Payables, short-term loans, and other obligations due within a year

By excluding inventory and prepaid expenses, the formula focuses only on assets that can be quickly turned into cash.

If your ratio is low, here are some strategies to strengthen it:

Speed Up Receivables: Offer discounts for early payments or tighten credit terms

Manage Expenses: Negotiate longer payment terms with suppliers

Increase Cash Reserves: Build up liquid assets for flexibility

Limit Excess Inventory: Avoid locking up capital in slow-moving stock

Sell Idle Assets: Free up liquidity by offloading non-core assets

These steps can help improve not only the acid test ratio but also overall financial agility.

Consider a company with these balance sheet figures:

Cash: ₹50,000

Marketable Securities: ₹30,000

Accounts Receivable: ₹20,000

Inventory: ₹100,000 (excluded from calculation)

Current Liabilities: ₹80,000

Acid Test Ratio = (50,000 + 30,000 + 20,000) ÷ 80,000 = 100,000 ÷ 80,000 = 1.25

This means the company has ₹1.25 in liquid assets for every ₹1 of short-term liability. The result suggests strong liquidity without relying on inventory sales.

The acid test ratio is one of the most practical tools for analysing short-term liquidity. By zeroing in on truly liquid assets, it avoids overestimating a company’s strength and offers a conservative but reliable measure of financial health.

Whether you are a business owner managing operations or an investor evaluating opportunities, keeping the ratio above 1 is usually a sign of sound management and preparedness for uncertainties.

An ideal acid test ratio is 1 or higher, showing that liquid assets are enough to cover current liabilities. Ratios well above 1 may indicate strong liquidity, but extremely high numbers can also suggest idle assets.

Liquidity can be improved by:

Collecting receivables faster

Reducing short-term liabilities

Cutting non-essential expenses

Managing inventory efficiently

Increasing cash reserves

The current ratio includes all current assets, such as inventory and prepaid expenses, which may not be easily converted into cash. The acid test ratio excludes them, making it stricter and more conservative.

Businesses should track it quarterly as part of financial reviews. Those with tighter cash cycles or in fast-changing industries may benefit from monthly monitoring.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.