So far, we have talked about copper and aluminium. These are two of the most widely produced and consumed non-ferrous metals in the world. Zinc is not produced and consumed as much as these two metals are, but nonetheless is an important commodity that has been used since ages for various purposes. Zinc not only has industrial uses, but also finds its uses in making decorative works. Moreover, zinc, in the form of a trace element, is also an important part of the human body and is necessary for maintaining a healthy immune system. A shortage of zinc would make a person more vulnerable to diseases.

So far, we have talked about copper and aluminium. These are two of the most widely produced and consumed non-ferrous metals in the world. Zinc is not produced and consumed as much as these two metals are, but nonetheless is an important commodity that has been used since ages for various purposes. Zinc not only has industrial uses, but also finds its uses in making decorative works. Moreover, zinc, in the form of a trace element, is also an important part of the human body and is necessary for maintaining a healthy immune system. A shortage of zinc would make a person more vulnerable to diseases.

Zinc is traded on the LME, COMEX and SHFE in the form of derivatives. In India, zinc futures are available for trading on the MCX. Recently, MCX modified the contract specification for zinc futures (and for aluminium futures too) by making it a compulsory delivery contract. Prior to this, the delivery of zinc was optional i.e. either it could be settled in cash or by delivery.

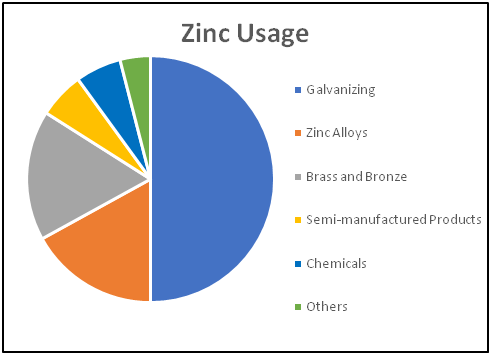

Zinc usage

Zinc has a wide range of industrial and non-industrial applications. Half of the metal’s demand goes into galvanizing i.e. coating the surface of ferrous metals,such as steel. One of the major benefits of zinc is that it resists corrosion and rusting, thereby slowing down this process of corrosion significantly over time. Steel by itself cannot resist corrosion and as such, must be coated with some other metal. The metal that is most used to do this job is zinc. By coating steel with zinc, athin protective layer is formed over steel which prevents oxygen and water from entering underneath this coating, thereby preventing it from rusting.On average, when steel is coated with zinc, it lasts 12 times longer than when it is uncoated. As such, in order to increase longevity, zinc finds its usage in almost all applications where steel or other ferrous metals are used.

The next area where zinc is widely used is in making alloys. Zinc is known to easily combine with other metalsto form durable alloys. The most widely known alloy in which zinc is used is brass (which contains on average 67% copper and 33% zinc). The usage of zinc in brass makes itan alloy that is very strong and corrosion resistant. Because of these features, brass is widely used in musical instruments as well as in hardware applications. Other widely known alloy of zinc is bronze, which contains predominantly copper. This includesamong others commercial bronze (which contains around90% copper and 10% zinc) and architectural bronze (which contains around 57% copper, 40% zinc, and 3% lead). Bronze is widely used in making coins & medals, sculptures, bearings & bushings, and architectural applications. Besides being alloyed with copper, zinc is also alloyed with other metals. For instance, zinc is alloyed with lead or tin to make solder, an alloy having a relatively low melting point, which enables it to be used for joining various electrical& electronic devices and other metallic products.

Zinc is also used in makingvarious chemicals. The most prevalent zinc chemical is zinc oxide.It is widely used in making rubber to disburse heat and prevent fungi formation. Zinc oxide is known to treat a variety of skin-related ailments and hence is used in making skin ointments. It is also used in various cosmetic products such as anti-dandruff shampoo, antiseptic ointments, baby lotions, bath soaps etc. The other prevalent zinc chemicals are zinc chloride (which is widely used in dry cell batteriesto increase longevity and maintain steady voltage), zinc sulphide (which is used in luminous paint, leather, x-ray screens etc.), and zinc sulphate (which is used in dyes & pigments, medicines etc.).

Zinc is known to possess medical values too. In fact, zinc is an important trace elementin the human body and is necessary to maintain a healthy immune system. A shortage of zinc canreduce the strength of the immune system and make a person more vulnerable to diseases.While zinc is naturally found in some of the foods that we consume, it is also used in making dietary supplements, which are especially useful to those who face the problem of zinc deficiency in their body. Besides helping to maintain a healthy immune system, zinc is helpful in treating conditions such as diarrhoea, common cold, wounds etc. Because of the several health benefits that zinc possesses and the problems that could occur due to its deficiency, zinc finds its usage in the medical fraternity too.

Factors that impact the price of zinc

Zinc is an industrial metal that is impacted by a lot of factors. Some of the global macro factors that impact the price of non-ferrous metals also impact the price of zinc in a similar way. These include the US dollar and market risk sentiment. We have already seen in the last couple of chapters that non-ferrous metals tend to move in the opposite direction of the dollar, and that non-ferrous metals usually strengthen in price when risk sentiment is positive and vice versa. Meanwhile, we have also seen how non-ferrous metals are affected by inventories at major exchanges, especially those at the LME. Zinc is also impacted by inventories in a similar manner in which copper and aluminium are impacted by their respective inventory levels. Given that we have spoken about these factors in earlier chapters, we will not be covering them again here. Besides these factors, the other important factors that impact the price of zinc are mentioned below:

Economic conditions in China and its impact on steel demand

China occupies the top spot in zinc consumption, accounting for half of the global refined output each year. As we have already seen in this chapter, a major portion of zinc’s demand comes from galvanizing it with ferrous metals, primarily steel. As such, higher the demand for steel, higher would be the demand for zinc, and vice versa. China is the world’s largest consumer of steel, accounting for half of the global output. Steel is used in virtually every manufacturing activity (such as in the making of vehicles, electronic and electrical devices etc.) as well as in construction, infrastructure, and powersector. If economic conditions in China are slowing down, there would naturally be a slowdown in demand for steel as well. And given the slowdown in demand for steel, there would be a corresponding reduction in demand for zinc too. Similarly, if economic conditions in China are strengthening, demand for steel will go up. And if demand for steel would go up, so would demand for zinc. As such, economic conditions in China, especially in the manufacturing, construction and infrastructure sector, play a crucial role in determining the demand for steel and subsequently the demand for zinc.

Monetary and fiscal policy, especially of China

One of the key factors that influences the level of economic activity in any nation is the fiscal and monetary policy of that nation. A tighter policy usually tends to lower the level of economic activity, which in turn reducesthe demand for metals, and vice versa. For instance, if the government increases taxes, it would reduce the disposable income of households, which in turn could lower consumer spending. Similarly, if the government lowers its spending on the nation’s infrastructure, it would reduce the level of employment as well as the number of infrastructure projects. Also, if the central bank of a nation tightens its monetary policy, the level of money supply in the economy would reduce, which in turn would increase the cost of borrowing for both consumers and corporates, potentially lowering overall demand.These three factors – increase in taxes, reduction in infrastructure spending, and tightening of monetary policy – can slowdown the pace of economic activity in a nation and thereby reduce demand for metals, such as steel and zinc. Conversely, reduction in taxes, increase in infrastructure spending, and an easing of monetary policy would have a beneficial impact on the level of economic activity and thereby increase demand for metals. As China is the bellwether of steel and zinc demand, its fiscal and monetary policy can influence the level of economic activity and correspondingly have a significant impact on the demand for steel and zinc.

Supply from China

China is also the world’s largest producer of zinc, accounting for around 45% of the world output. Not only does China dominate the mine supply, but it also dominates the secondary supply. As such, the level of the nation’s output also plays a crucial role in impacting the price of zinc. Given that China consumes half of the global production each year, reduction in Chinese supplies can cause the demand-supply balance to tighten, especially if demand remains stable or increases. This in turn would benefit zinc price. Alternatively, increase in Chinese supplies relative to that in demand could cause the zinc markets to swell, which in turn could supress zinc prices. Some of the factors that could influence the level of zinc production in China are government policies, environmental norms, refiner and smelter margins, changes in mining and smelting capacity and utilization rates etc. Each of these factors can influence the level of output from China and impact prices accordingly.

Price spreads

Zinc prices are also impacted by price spreads, i.e. the difference between spot price and futures price or one futures price with another futures price. This can then be compared with inventory levels to understand the state of the physical markets. For instance, if the spot price of zinc is trading above the futures price, it indicates a market that is in backwardation. If such a scenario is also accompanied with low inventory levels at major exchanges (such as LME and SHFE), it indicates tightness in the physical market, a scenario which could benefit zinc prices in the near-term. Similarly, if the spot price of zinc is trading below the futures price, it indicates a market that is in contango. If such a scenario is also accompanied with rising or high inventory levels, it indicates the physical markets are amply supplied, a scenario which could pressurize zinc prices in the near-term. Hence, the price spreads and the level of inventories are an important factor that can influence zinc prices, especially in the short-term.

How to trade zinc

When trading zinc, some of the key things to keep a track of are as mentioned below:

-

Monitor LME data regularly in order to identify trends in inventories and to know if they are at an extreme or are reversing.

-

Keep a track of demand for steel, especially in China, as a major portion of zinc output goes into galvanizing steel.

-

Monitor economic data from China to gauge the health of its manufacturing, infrastructure, construction, and power sector.

-

Monitor the monetary and fiscal policy, primarily of China, to understand whether economic conditions are accommodative or tightening.

-

Keep a track on movements in global equities and other commodities to understand the prevailing sentiment in the market.

-

Keep a watch on the medium-term and long-term trend of the dollar, given the negative correlation between the two.

-

Compare LME inventories with LME price spreads, as this gives clues as to the prevailing tightness of zinc in the physical markets.

Next Chapter

Comments & Discussions in

FYERS Community

Giridhar commented on June 25th, 2019 at 11:14 PM

Which is best to trade to amoung Zinc, Alluminium and Nickel

Shriram J commented on January 27th, 2020 at 9:16 PM

Hi Giridhar, there is no definitive answer for this. Each of these are major base metals that are heavily traded around the world. They usually tend to move in sync, but sometimes individual demand-supply situation could cause one to outperform or underperform the others.

sandeep pattar commented on July 8th, 2019 at 9:54 PM

The low inventory levels in major exchanges will indicate the zinc price moves up or it indicates a downtrend.

Shriram commented on January 27th, 2020 at 9:18 PM

Hi Sandeep, low inventory levels indicate at supply tightness and hence are usually bullish for prices. Note that i have used the word 'usually' here, because there are a plethora of factors that impact prices at any point in time, and inventory is just one of them.

jithendra patel commented on July 8th, 2019 at 10:53 PM

How we can track the monetary and fiscal policy of China and other important data of China.