Margins play a very crucial role in derivatives (Futures and Options) trading. To understand margin shortfalls, it is very important to understand the role of margin trading in the derivatives market.

To trade in futures in the F&O segments, brokerages provide the leverage as per their policies. In fact, these derivative positions are quite risky due to their volatile nature and a small upfront amount required to trade, therefore, any adverse movement in price can lead to enormous losses to the trader, broker and counterparty as well. To ensure smooth settlements, a certain upfront amount is payable to hold the futures position this is known as margin and further shortfall in the upfront amount due to adverse price variation is commonly known as margin shortfall.

As per exchange stipulated norms upfront margin (Initial margin) consists of SPAN margin and Exposure margin which can be calculated using our margin calculator. The margin requirement for all the segment futures scrips is calculated here which lets you know the margin required to hold overnight position and by mocking your position in our SPAN calculator. It allows you to get margin required for shorting options or other FNO strategies where you get margin benefit. The SPAN system uses strike prices, risk-free interest rates, changes in prices of the underlying securities, changes in volatility and time-value to calculate the worst possible move in the security. For the exchanges, the SPAN margin covers almost the entire risk for the day, minimising the systemic risk due to margin pressures.

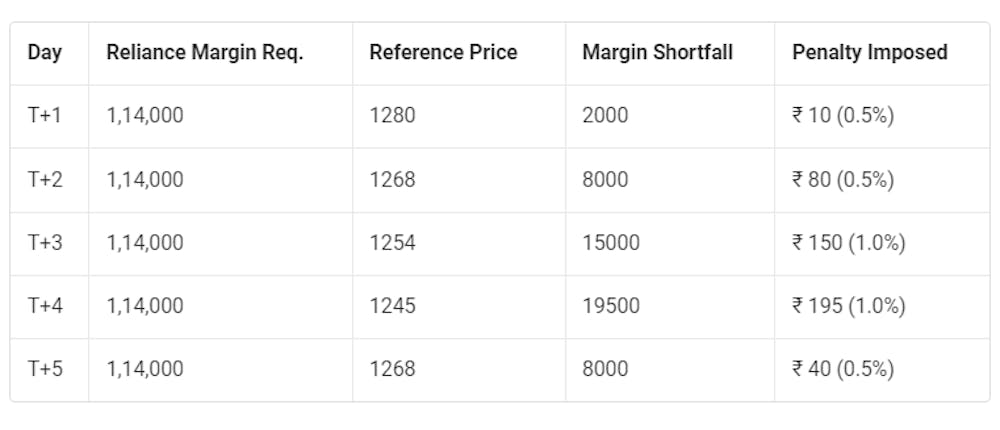

Let's interpret how margin shortfall and Market to Market works for your futures position. Let's assume you own Reliance futures position with a buy price of 1284, the margin required is approximately ₹114,000 which a predetermined percentage of the contract value i.e. 500*1284=₹6,42,000. Here lot size is 500. And hence, any variation in price is reflected through daily MTM. Marking to market, or mark to market (MTM) is a mere accounting practice that involves adjusting the profit or loss you have made for the day. MTM is calculated by marking each transaction in the contract to the closing price of the security at the end of the trading day. In case the security has not been traded on a particular day, the latest available closing price at the exchange is considered as the closing price.

As long as you hold the futures contract, MTM is applicable. Hence it is a long position, therefore if the price goes below the buy price means bearing a loss in the position where it is shown as margin shortfall of ₹ 15,000 on T+3 day and hence margin shortfall penalty is imposed of ₹ 150. The mark to market margin (MTM) is collected from the member before the start of the trading of the next day and the same has been adjusted in their ledger account. To avoid margin shortfall, need to add funds therefore, Margin call appears with margin shortfall ignoring will be penalized as per the exchange stipulated policies.

Margin Shortfall Penalties –

Margin shortfall penalty will be levied by the exchanges when there is a margin shortfall on overnight positions held without sufficient margin as prescribed by the exchanges. Margin shortfall penalties are applicable only for overnight margin shortfall though, it does not apply for intraday positions. Margin shortfall is applicable to equity, commodity and currency futures of all segments including NSE, BSE and MCX.

If the overnight margin is less than 1 lakh AND the margin shortfall is less than 10% of applicable margin then, 0.5% of penalty is levied and in case if the margin exceeds 1 lakh OR the margin shortfall exceeds 10% of applicable margin then, 1% margin is levied on the margin shortfall amount.

If short/non-collection of margins for a client continues for more than 3 consecutive days, then penalty of 5% of the shortfall amount shall be levied for each day of continued shortfall beyond the 3rd day of shortfall.

If short/non-collection of margins for a client takes place for more than 5 days in a month, then penalty of 5% of the shortfall amount shall be levied for each day, during the month, beyond the 5th day of shortfall.

Let’s understand this with an example, for an overnight future position of stock ABC Bank with the specified margin requirement of ₹ 50,000 on T day. Due to adverse movement in price, the trading account is debited with the MTM loss of Rs.6000 on the same day. In this scenario, though the margin shortfall amount is less than 1 lac, the deficit is greater than 10% of the specified margin requirement. Hereafter, a 1% penalty will be levied on the shortfall amount i.e. ₹ 60 on T+1 day. On each day till T+3 day, the margin shortfall penalty will be levied w.r.t the shortfall. If the margin shortfall continuous, then fromT+4 day the debt amount would be 5% of the respective shortfall amount.

As per exchange regulations, the margin statement is sent with the intention of informing a client about his margin status is i.e. what free margins are available in his account in order to take new positions without incurring penalty or charges. Here, all obligations will be adjusted against the funds i.e. if there is a credit (profits) it will be added & if there is a debit (loss, charges) it will be deducted from the available funds.

Lack of awareness about Margin Shortfall

We found that there is a lack of awareness about margin shortfall, especially among the new traders. As this information is not sought after until one experiences a margin shortfall situation and penalties are levied, the topic does not get the deserved attention. However, if you feel that others can benefit from the information in this post, do feel free to share it with other fellow traders. I hope the examples used were helpful to understand. If you need any clarifications you can reach out to me in the comments section below.

Happy Trading!