28 Jul, 2025

28 Jul, 2025

6 mins read

6 mins read

Return on investment is one of the most commonly used ways to measure how profitable an investment is. Whether you’re putting money into stocks, a marketing campaign, or property, ROI helps you understand what you’re getting in return. It’s quick to calculate, simple to understand, and useful for both individuals and businesses.

In this guide, we’ll explain what is return on investment, how to use the ROI formula with examples, why it’s useful, and what its limitations are.

It’s a way to measure how much money you’ve made (or lost) compared to how much you initially spent. Think of it as a performance score for your money.

Let’s say you invest ₹1,00,000 in a mutual fund. After one year, your investment grows to ₹1,20,000. Your return on investment is 20%, because you’ve earned ₹20,000 over your original amount.

This percentage helps investors, financial advisors, and business owners compare how different investments perform. It's a handy tool for making decisions based on results, not guesses.

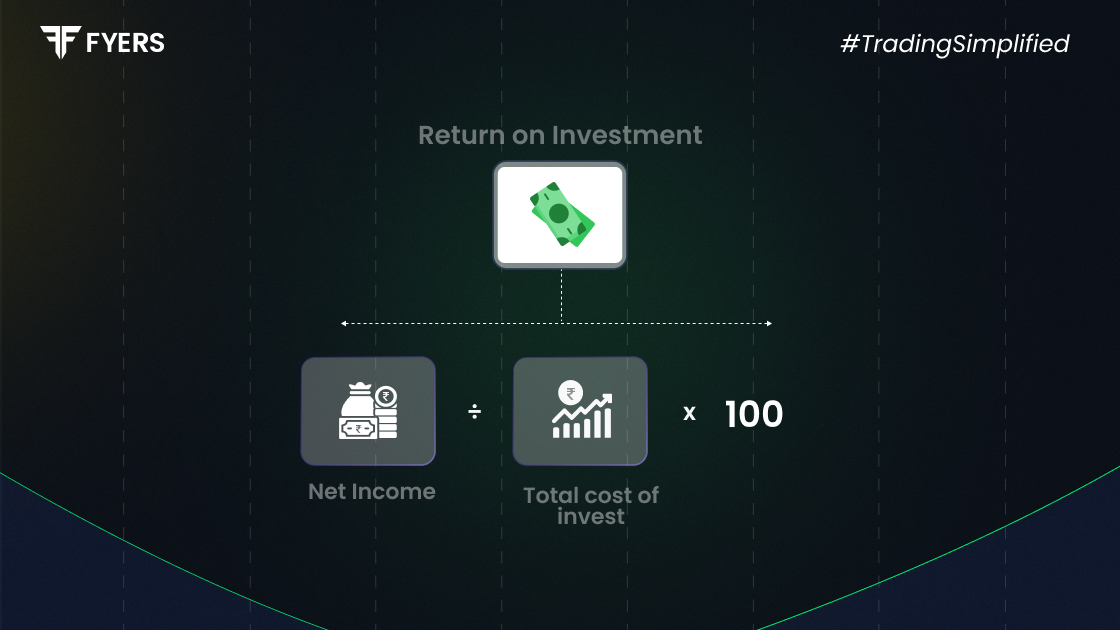

So, how to calculate ROI? It’s very simple:

You take the profit you've made from the investment, divide it by the original amount you invested, and multiply the result by 100 to get a percentage.

The result tells you how efficiently your money was used.

Here’s the standard ROI formula:

|

ROI = (Net Profit / Cost of Investment) × 100 |

Let’s go through a basic ROI formula with example:

Cost of Investment = ₹2,00,000

Value After One Year = ₹2,50,000

Net Profit = ₹50,000 (₹2,50,000 – ₹2,00,000)

ROI = (₹50,000 / ₹2,00,000) × 100 = 25%

This means your investment gave you a return on investment of 25%.

Here’s another situation. Imagine a company spends ₹5,00,000 on a marketing campaign. As a result, they earn ₹7,00,000 in new sales. That’s a net gain of ₹2,00,000.

ROI = (₹2,00,000 / ₹5,00,000) × 100 = 40%

This example shows how return on investment isn’t just for portfolios or shares, but also can be used to measure the success of internal projects.

The importance of ROI lies in how it helps you make smart choices. Here’s why people rely on it:

Decision-making tool: Want to know where to put your money? ROI helps you see which option may give you the best bang for your buck.

Comparative analysis: You can use return on investment to compare stocks, mutual funds, real estate, or even equipment for your company.

Performance tracking: Over time, ROI helps track how well your investments are doing so you can adjust your strategy if needed.

Simplicity: Unlike many financial ratios, ROI is easy to use even if you’re not a finance expert.

Resource allocation: Businesses use ROI to decide where to put their budgets such as in marketing, tech upgrades, training, and so on.

In short, the importance of ROI is that it brings clarity. It helps both individuals and businesses stay efficient and focused.

Once you understand your return on investment, the next step is improving it. Here are a few practical ways to get a better ROI:

Minimise costs: Reduce expenses related to the investment. This could mean cutting delivery charges, finding cheaper suppliers, or reducing transaction fees.

Improve efficiency: Whether it’s your operations or marketing, streamline processes so you get better results with fewer inputs.

Make informed decisions: Research thoroughly before investing. Avoid hype and choose options backed by data.

Reinvest wisely: Use your profits to support areas that have proven success in order to compound your returns.

Use leverage smartly: Borrowing to invest can boost ROI, but only if your returns are higher than the interest you pay.

Negotiate better terms: In business, better deals on payment terms or supplier contracts can lead to higher capital efficiency.

These strategies are about either making more money or spending less to get the same results. Both will help raise your return on investment.

Despite being helpful, ROI isn’t perfect. Let’s look at the limitations of ROI:

Ignores time factor: A 20% ROI over one year is very different from 20% over five years. ROI alone doesn’t show how long it takes to earn that return.

No standardisation: There are different ways to define “profit” (gross vs. net) so two people may calculate ROI differently on the same investment.

Short-term focus: ROI often encourages a focus on quick wins instead of long-term growth or stability.

Risk is overlooked: A high ROI might look attractive, but it says nothing about how risky the investment was.

Non-financial benefits ignored: ROI only focuses on money. It doesn’t consider things like brand value, employee satisfaction, or customer loyalty.

Tax and inflation: These factors can affect your real returns, but ROI doesn’t include them.

Because of these limitations of ROI, smart investors also look at other metrics like IRR (Internal Rate of Return), ROE (Return on Equity), NPV (Net Present Value), and the Payback Period. These give a fuller picture, especially when comparing complex or long-term investments.

If you’re comparing ROI vs IRR, the key difference is that IRR considers the time value of money, which ROI does not. That makes IRR more suitable for long-term planning.

Return on Investment is one of the simplest yet most effective tools for evaluating the profitability of an investment. Whether you're an individual investor or a business decision-maker, ROI helps you understand whether your money is being put to good use. It allows for easy comparison, supports informed decision-making, and highlights areas where performance can be improved.

It’s a way to measure how much money you made compared to how much you spent. Think of it like a score that tells you if your investment was worth it.

Use this formula:

ROI = (Net Profit / Cost of Investment) × 100.

Just subtract your original cost from your current value, then divide and multiply to get a percentage.

There’s no fixed rule, but a good ROI percentage is often considered to be 15% to 20% or more. That said, it depends on the type of investment, the risk, and how long it takes to earn the return

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.