4 Dec, 2024

4 Dec, 2024

4 mins read

4 mins read

The landscape of investing has evolved significantly, and Pre-IPO (Pre-Initial Public Offering) investing has emerged as an exciting frontier for investors looking to access high-growth companies before they hit public markets. By purchasing shares in a company before its public listing, investors can unlock opportunities for exponential growth, albeit with considerable risks.

This guide delves into the nuances of pre-IPO investing, offering insights into its benefits, risks, and strategies to navigate this high-potential yet volatile investment domain.

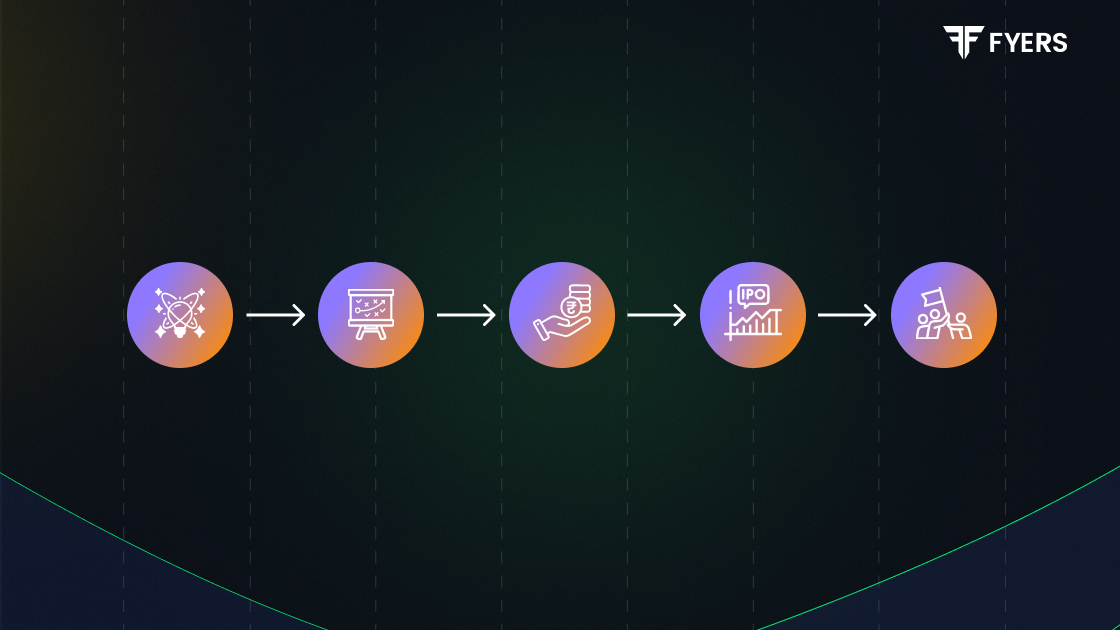

At its core, pre-IPO investing involves buying shares of a company during its private funding rounds before it lists on the stock exchange. These investments typically occur during late-stage funding rounds, where companies raise capital to scale operations, innovate, or prepare for an IPO.

Historically, pre-IPO investing was restricted to institutional investors, private equity firms, and venture capitalists. However, increasing democratization of financial markets now allows retail investors to participate through SEBI-registered brokers or dedicated platforms.

Pre-IPO investments provide exposure to startups and mid-stage companies with innovative business models poised for rapid growth. For example, companies like BYJU’s or Swiggy attracted significant pre-IPO investments due to their disruptive approaches to education and food delivery, respectively.

Investors often gain at discounted prices during pre-IPO rounds, which can result in impressive profits when the company’s valuation increases post-IPO.

Case in Point: Early investors in Nykaa saw their pre-IPO investments skyrocket as the company’s IPO garnered massive market interest.

Adding pre-IPO shares to your portfolio offers diversification beyond traditional asset classes. These investments typically have lower correlation with publicly traded markets, thus acting as a hedge against volatility.

Unlike publicly traded stocks, pre-IPO shares lack liquidity. Investors may need to wait years for the company to go public or secure buyers in the private market.

Determining the true value of pre-IPO shares is challenging due to limited transparency in financial reporting. Overvaluation can lead to disappointing post-IPO returns.

Example: Some investors in WeWork’s pre-IPO shares faced significant losses as the company’s valuation dropped dramatically before its IPO.

Regulatory frameworks often impose a six-month lock-in period on pre-IPO shares after a company lists. During this time, investors cannot sell their holdings, even if market conditions are unfavorable.

Start by evaluating the company’s:

Invest through SEBI-registered brokers or platforms that allow pre-IPO investments.

A Demat account is essential for holding pre-IPO shares. Ensure the platform or broker facilitates smooth transfer of shares to your account.

Pre-IPO shares are traded in the over-the-counter (OTC) market. Prices can fluctuate based on demand, supply, and market sentiment.

Given the risks, allocate only a portion of your portfolio to pre-IPO investments. Diversification across sectors and companies further reduces risk.

This online pharmacy platform raised significant pre-IPO funding by showcasing a robust growth trajectory in India’s burgeoning healthcare market.

As India’s leading stock exchange, NSE’s pre-IPO shares attracted considerable interest due to its strong revenue model and market dominance.

Investing in pre-IPO stocks can feel like walking a tightrope between risk and reward. While the potential for high returns is enticing, the associated risks require investors to exercise caution and conduct in-depth research.

|

Aspect |

Pre-IPO Shares |

Post-IPO Shares |

|---|---|---|

|

Liquidity |

Low |

High |

|

Pricing |

Discounted |

Market-Determined |

|

Risk Level |

High |

Moderate |

|

Access |

Selective |

Open to All |

The Securities and Exchange Board of India (SEBI) regulates pre-IPO investments to protect investors. Key rules include:

As India’s startup ecosystem continues to thrive, the pre-IPO market is poised for growth. With increasing participation from retail investors and platforms offering better access, this space is becoming more dynamic than ever.

Pre-IPO investing is not just about chasing returns; it’s about identifying high-potential companies that align with your financial goals and risk appetite. While it offers opportunities for exponential growth, the risks demand careful analysis and strategic planning.

Interested in exploring the world of pre-IPO investing? Open a Demat account with FYERS and gain access to India’s most promising companies before they go public.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.