25 Jul, 2025

25 Jul, 2025

4 mins read

4 mins read

In investing, it’s not just about whether you make a profit—it's about how much you gain relative to your investment. This is where percentage gain becomes a vital tool. Whether you're evaluating stock returns, mutual fund performance, or your overall portfolio, understanding percentage gain helps you make more informed financial decisions.

In this blog, we’ll break down what percentage gain means, how to calculate it, and how it compares with other profit measurement metrics.

Percentage gain refers to the increase in the value of an investment, expressed as a percentage of the original amount invested. It shows how much return you've earned compared to what you put in.

For example, if you invest ₹10,000 in a stock and its value rises to ₹12,000, the ₹2,000 profit represents a 20% gain. This percentage figure gives context to your profits and allows you to compare performance across different assets or timeframes.

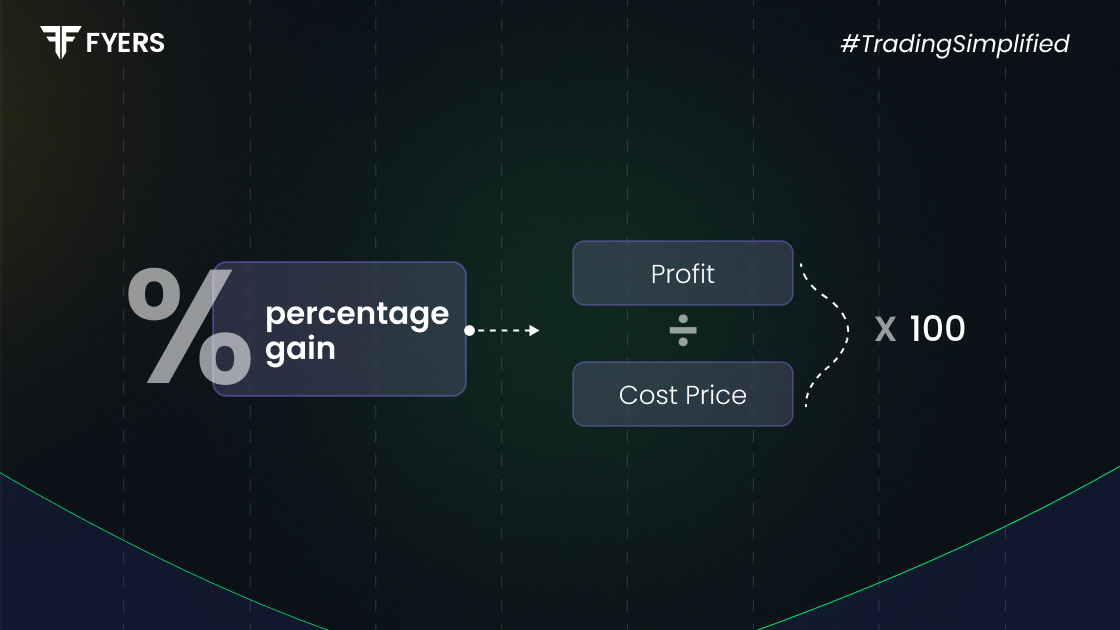

The percent gain formula is simple and widely used in both short-term and long-term investment tracking:

Percentage Gain = [(Final Value - Initial Value) / Initial Value] × 100

Example:

If you bought a stock for ₹500 and sold it for ₹650:

Percentage Gain = [(₹650 - ₹500) / ₹500] × 100 = 30%

This formula helps investors calculate percent gain with consistency, making it easier to assess returns.

Let’s break down the process using a step-by-step guide:

Determine Initial Value: This is the price you paid to purchase the asset.

Determine Final Value: This is the price at which you sold or the current market value.

Apply the Formula: Use the percent gain formula explained above.

You can also include any transaction costs, brokerage fees, or taxes if you want a more accurate figure.

Tip: Some investors also use online tools or brokerage platforms to auto-calculate gains, but knowing how to do it manually ensures you understand your portfolio’s performance.

While both percentage gain and absolute profit show the growth of your investment, they serve different purposes:

Absolute Profit: Shows how much money you made (e.g., ₹2,000).

Percentage Gain: Shows the efficiency of that investment (e.g., 20%).

This distinction is crucial when comparing investments of different sizes. A ₹10,000 gain on a ₹1 lakh investment (10%) is more efficient than a ₹5,000 gain on a ₹1 lakh investment (5%).

In short, profit gain formula gives you a nominal figure, while percentage gain adds perspective.

In India, long term capital gains percentage refers to the tax applicable on profits from assets held for more than a year. For example:

For listed equities and equity mutual funds, gains above ₹1 lakh are taxed at 10%.

For debt mutual funds and other assets, the taxation structure may differ.

While capital gains tax doesn’t change how you calculate percentage gain, it affects your net returns, which is something every investor should factor into long-term strategies.

Here are a few errors that often lead to inaccurate results:

Ignoring transaction costs: Brokerage fees or taxes can significantly reduce actual gains.

Not adjusting for dividends: These add to your return but are often overlooked.

Wrong initial value: Failing to include reinvested profits or cumulative investment costs skews your calculations.

Confusing absolute gain with percentage gain: This leads to incorrect comparisons between investments.

Always use the correct percent gain formula and factor in all variables for a true picture of performance.

Whether you're a beginner or a seasoned investor, understanding how to calculate percentage gain is a fundamental financial skill. It enables:

Better portfolio tracking

Comparison across asset classes

Informed decision-making

In a dynamic market, percentage gain helps you assess performance beyond rupee figures and ensures you’re building a data-driven investing mindset.

Percentage gain is more than just a calculation—it’s a window into the performance and efficiency of your investments. From day traders to long-term investors, everyone can benefit from knowing how to calculate percent gain correctly and apply that knowledge to optimise their strategies.

With a clear grasp of this concept and the tools to compute it, you're better positioned to assess profits, manage risk, and grow your wealth effectively.

Percentage gain is the increase in an investment's value expressed as a percentage of its original cost. It shows how much return you’ve earned compared to your initial investment.

Use this formula:

Percentage Gain = [(Final Value - Initial Value) / Initial Value] × 100

Capital gains tax doesn’t change the percentage gain itself but reduces your net returns, especially for long-term holdings exceeding tax-free limits.

Profit is the actual amount of money earned, while percentage gain expresses that profit relative to the investment size, providing a clearer comparison between different investments.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.