31 Aug, 2025

31 Aug, 2025

2 mins read

2 mins read

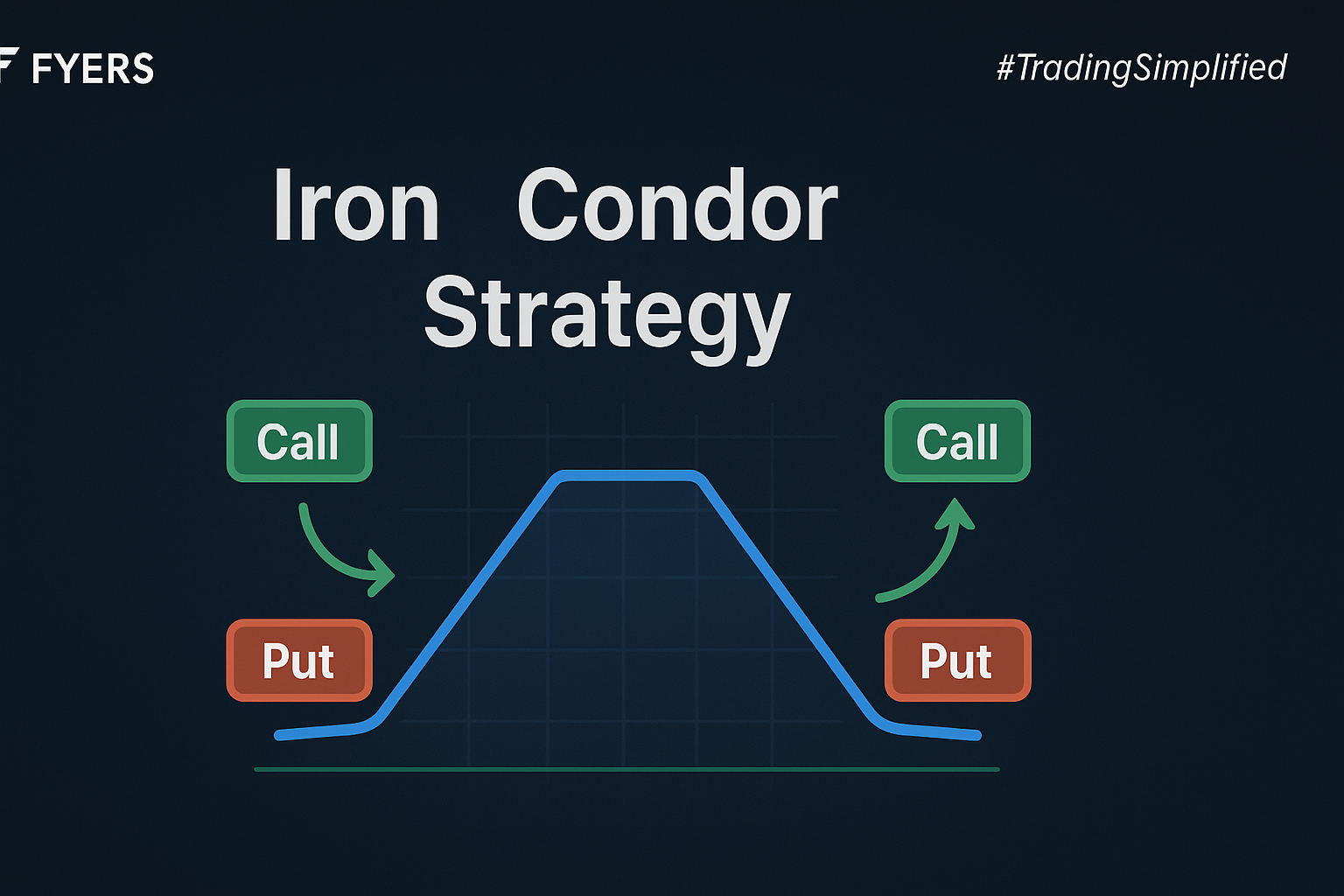

Options trading often involves strategies that help traders generate income while keeping risk limited. One such approach is the iron condor strategy, a popular non-directional options spread designed for range-bound markets. It combines both call and put spreads to capture profits when the price of the underlying asset stays within a defined range.

An iron condor is an advanced options spread where a trader simultaneously sells one call and one put, while buying another call and put at further strike prices. This creates two credit spreads—one on the call side and one on the put side—resulting in limited risk and limited reward.

In simple terms, this neutral options strategy allows traders to profit when the underlying security remains stable.

The setup consists of:

Sell 1 out-of-the-money (OTM) call

Buy 1 higher strike OTM call

Sell 1 OTM put

Buy 1 lower strike OTM put

Together, these four legs form a multi-leg spread strategy with defined risk and reward.

Short Iron Condor – The most common variation. Traders receive a net credit and aim to profit from time decay when the asset trades within a set range.

Long Iron Condor – A less common version. Here, traders pay a net debit and benefit from large price movements, essentially betting on volatility.

This distinction helps traders decide whether to apply the income-generating condor spread or the volatility-focused one.

Once executed, the condor spread profits when the underlying asset trades between the two short strikes. As expiry approaches, the time decay benefits the trader. The maximum gain is the net premium received, while the maximum loss is capped by the protective long options.

When Should Traders Use This Neutral Spread?

The iron condor option setup is most effective when:

Markets are sideways or range-bound.

Volatility is expected to fall.

Traders want a strategy with limited risk.

Generates steady income in quiet markets.

Limited and pre-defined risk.

Flexibility to adjust strike prices as per market outlook.

Profit potential is limited compared to directional strategies.

Losses occur if the asset makes a big move outside the range.

Requires precise strike selection and monitoring.

Suppose Nifty 50 is trading at 22,000. A trader may:

Sell a 22,200 call and buy a 22,400 call.

Sell a 21,800 put and buy a 21,600 put.

Here, the neutral options spread profits if Nifty stays between 21,800 and 22,200.

The iron condor strategy is a versatile tool for traders seeking income from stable markets. By using this non-directional spread, one can balance risk and reward effectively. However, like any options approach, it requires careful planning and execution.

It is a four-leg options spread combining calls and puts to generate income in range-bound markets.

The short version earns from stability (credit spread), while the long version profits from volatility (debit spread).

When the market is range-bound and expected to stay within a narrow band.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.