28 Jul, 2025

28 Jul, 2025

5 mins read

5 mins read

If you’re investing in dividend-paying stocks in India, it’s crucial to understand how dividend dates work, especially the ex-dividend date. This is the cut-off point that decides who gets the dividend. Even if you miss it by a day, you could lose your chance to receive the payout.

So, what is ex-dividend date exactly? It’s the date when a stock begins trading without the value of its next dividend. If you buy shares on or after this date, you won’t receive the upcoming dividend payout.

To qualify for a dividend, you need to buy the stock before the ex-dividend date. This is because trades don’t settle immediately. In India, the standard settlement is T+1 (one trading day after the transaction). So, buying before the ex-dividend date ensures your name appears on the company’s shareholder list in time.

Think of it as a cut-off date. If you buy shares too late, you’ll miss the dividend, even though you own the stock.

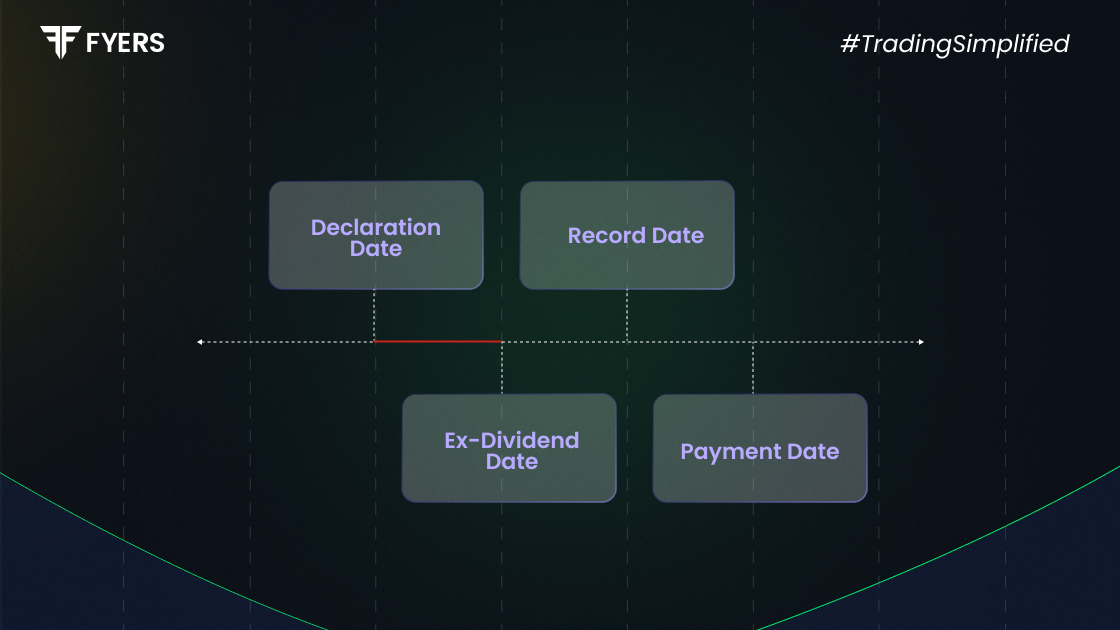

To better understand how dividend dates work, it helps to look at the full timeline involved in a dividend payout. There are four key dates:

Declaration Date: The day the company announces the dividend amount and other related dates.

Ex-Dividend Date: The cut-off to buy the stock if you want to get the dividend.

Record Date: The date the company checks its records to see who owns the shares.

Payment Date: The day the dividend is actually paid out to shareholders.

If you want to receive the dividend, you need to make sure you buy the stock before the ex-dividend date, so the settlement clears by the stock dividend record date.

Let’s quickly recap the types of dividend dates and what each one means:

Declaration Date: This is when the company makes the dividend official and announces the amount, ex-dividend date, record date, and payment date.

Ex-Dividend Date: Usually one working day before the record date. You must buy the stock before this day to receive the dividend.

Record Date: This is when the company checks its list to confirm who owns shares and is eligible for the dividend.

Payment Date: This is when you actually receive the money in your account.

All these dates are typically announced in advance through the stock exchange and company press releases.

The ex-dividend date has a few very important roles for investors:

Dividend eligibility: You must own the stock before the ex-dividend date to receive the dividend. If you buy on or after the date, you miss out.

Investment timing: If you invest specifically for income, knowing this date helps you plan your purchase.

Stock valuation: A stock’s price often drops on the ex-dividend date by about the same amount as the dividend. This is a normal market adjustment.

If you're a long-term investor, this date might not matter much to your overall strategy. But if you're buying shares to earn dividends, it's a crucial detail to get right.

When a company declares a dividend, the share price often drops on the ex-dividend date. Why? Because from that day onwards, new buyers aren’t entitled to the upcoming dividend, so the stock is technically worth a little less.

For example, imagine a stock closes at ₹200 and the company announces a ₹10 dividend. On the ex-dividend date, the price might open around ₹190, reflecting the fact that new buyers will not receive the ₹10.

This isn’t a sign that something’s wrong with the company. It’s just a fair price adjustment.

Still, other factors like news or market demand can affect how much the stock actually moves. It might not fall exactly by the dividend amount if there’s strong interest or positive sentiment.

Many people confuse the ex-dividend date vs. record date, but these dates have different purposes.

|

Criteria |

Ex-Dividend Date |

Record Date |

|---|---|---|

|

Definition |

Cut-off date to buy stock for dividend |

Date company checks shareholder records |

|

Relevance to investor |

You must buy before this date |

More of an internal checkpoint |

|

Dividend Eligibility |

Must buy before this date |

Must be on the record as of this date |

So, even if the stock dividend record date hasn’t arrived yet, if you buy the stock on or after the ex-dividend date, you will not get the dividend. The timing of your purchase is everything.

Why is the ex-dividend date useful? It helps different groups in different ways:

Investors: You can make better decisions about when to buy or sell shares to receive a dividend.

Traders: Some traders use dividend-related price changes to plan quick trades.

Companies: It helps firms identify who should get paid.

Brokers and Exchanges: Keeps the settlement and dividend process organised and predictable.

Whether you’re investing for long-term returns or short-term gains, knowing how to use the ex-dividend date can give you an edge.

In the world of dividend investing in India, understanding the ex-dividend date is a must. It affects whether you receive a dividend, impacts the stock price, and helps you plan your buying and selling strategy.

By learning how dividend dates work, especially the difference between the ex-dividend date vs record date, you’ll be better equipped to manage your investments and expectations. Keeping track of all these key dates means you won’t miss out on income opportunities and can make more informed choices in the stock market.

The ex-dividend date is when the stock starts trading without the value of its next dividend. If you buy shares on or after this date, you’re not eligible for the dividend.

The company and stock exchange set it based on the stock dividend record date. It’s usually one working day before the record date, considering India’s T+1 settlement system.

Yes, usually. The share price often drops by around the dividend amount on the ex-dividend date. It’s just a market adjustment because new investors won’t get the dividend.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.