31 Aug, 2025

31 Aug, 2025

4 mins read

4 mins read

The current ratio is one of the most widely used financial metrics to assess a company’s short-term financial health. It helps stakeholders understand whether a company has enough current assets to cover its current liabilities. This ratio is especially important in the Indian business context, where liquidity management plays a crucial role in day-to-day operations.

Let’s explore what the current ratio means, how it’s calculated, and why it matters.

The current ratio is a liquidity ratio that measures a company’s ability to pay its short-term obligations using its current assets. These obligations are typically due within a year and include items such as accounts payable, short-term loans, and other immediate liabilities.

If a company has a current ratio of 2, it means it has ₹2 in current assets for every ₹1 of current liabilities. This suggests that the business is in a relatively strong position to meet its short-term commitments.

This ratio indicates whether a company can manage its day-to-day operations without facing liquidity issues. A high current ratio usually suggests good short-term financial health, while a very low ratio could be a red flag for potential cash flow problems.

Here is what different levels may suggest:

Below 1: The company may struggle to meet its short-term obligations.

Around 1.5 to 2: Generally considered healthy.

Too high (above 3): May indicate inefficient use of resources or excess idle assets.

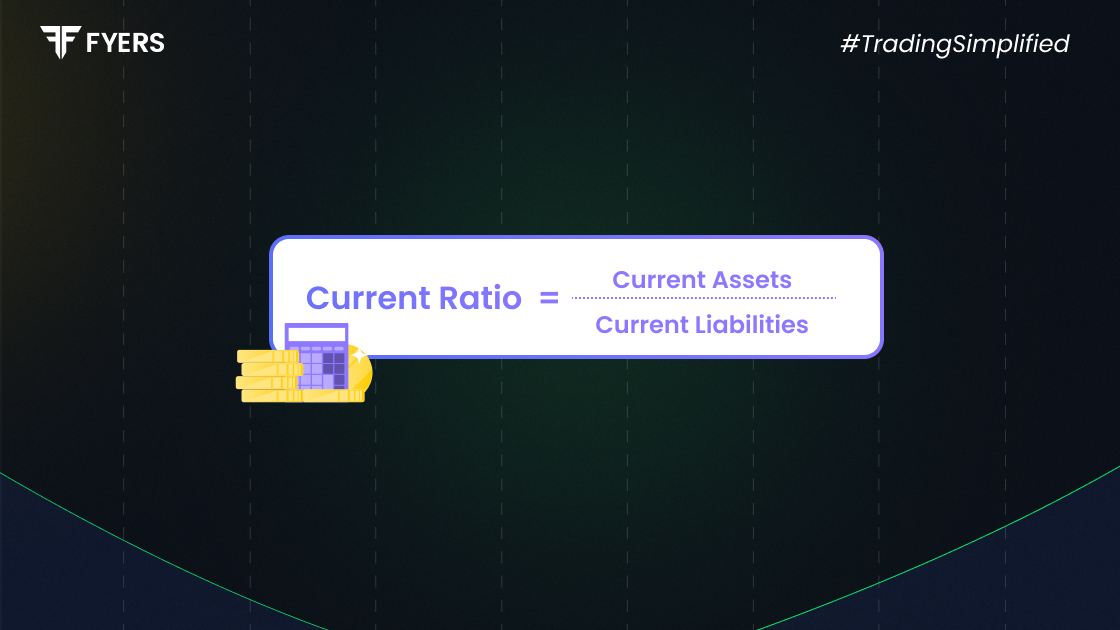

The formula to calculate current ratio is:

|

Current Ratio = Current Assets / Current Liabilities |

Where:

Current Assets may include cash, marketable securities, inventory, and accounts receivable.

Current Liabilities may include accounts payable, short-term debt, and accrued expenses.

Let’s take an example to understand how this ratio is calculated.

An Indian company has the following items on its balance sheet:

Current Assets: ₹50 lakh

Current Liabilities: ₹25 lakh

Current Ratio = 50 / 25 = 2.0

This means the company has twice as many assets as liabilities in the short term. It reflects a stable liquidity position.

The current ratio is especially significant in India where many businesses operate with tight working capital cycles. Here’s why it matters:

Investor Confidence: Investors use this ratio to assess a company’s financial health before making decisions.

Bank Loan Approvals: Lenders in India often look at the current ratio while evaluating short-term loan applications.

Creditworthiness: Suppliers may review this ratio to decide whether to offer goods on credit.

Internal Monitoring: Helps business owners and managers keep a check on their liquidity status.

For sectors like manufacturing, real estate, and trading where working capital needs are high, monitoring this ratio becomes even more critical.

While useful, the current ratio has certain limitations:

Doesn’t Show Asset Quality: The ratio considers total current assets, but not whether they are easily liquidated. For instance, slow-moving inventory can inflate the number.

Can Be Misleading: A very high ratio might seem positive but could indicate under-utilised resources.

Ignores Timing of Payments: It does not consider the exact timing of cash inflows and outflows.

Industry Differences: What’s considered a healthy ratio in one industry may not apply to another.

Hence, this ratio should be used alongside other financial metrics such as the quick ratio or cash ratio for better insight.

Current Assets: ₹80 crore

Current Liabilities: ₹40 crore

Current Ratio = 80 / 40 = 2.0

Current Assets: ₹100 crore

Current Liabilities: ₹80 crore

Current Ratio = 100 / 80 = 1.25

Company A has a more comfortable liquidity position. However, given that the construction industry typically operates with longer payment cycles, Company B’s ratio may still be acceptable. This shows how industry context plays a role.

The current ratio is a simple yet powerful tool to evaluate a company’s short-term financial strength. While a ratio close to 2 is often considered safe, the interpretation depends on the industry and business model. It’s a starting point for analysing liquidity, not the final word.

For Indian companies, maintaining a healthy current ratio is essential not just for financial reporting but also for building trust with investors, creditors, and suppliers.

It shows whether a company can pay its short-term bills using its short-term assets. A ratio of 2 means the company has twice the amount of assets compared to what it owes soon.

A current ratio between 1.5 and 2 is generally seen as ideal in India. However, this may vary depending on the industry. Manufacturing and trading firms often aim for higher ratios.

A low ratio, especially below 1, means the company may not have enough current assets to cover its short-term liabilities. This could indicate liquidity issues or poor working capital management.

The quick ratio is a more conservative measure. It excludes inventory and other less liquid assets from current assets. While the current ratio includes all current assets, the quick ratio only considers the most liquid ones like cash and receivables.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.