17 Jul, 2025

17 Jul, 2025

5 mins read

5 mins read

Cash and carry arbitrage is a widely used trading strategy in the derivatives market that seeks to profit from the price difference between the spot market and the futures market. While often considered a low-risk approach, this strategy is not without its own set of costs and potential pitfalls. For traders and investors looking to understand how to benefit from such opportunities, it’s important to grasp both the returns and risks that come with it.

Before diving into the cash and carry strategy, let’s clarify what arbitrage in the stock market means. Arbitrage refers to the simultaneous buying and selling of the same asset in different markets to take advantage of a price difference. Professional traders often use this method to earn risk-free profits by taking advantage of market inefficiencies.

These opportunities often arise due to temporary imbalances in demand and supply, or delays in price adjustments between related financial instruments.

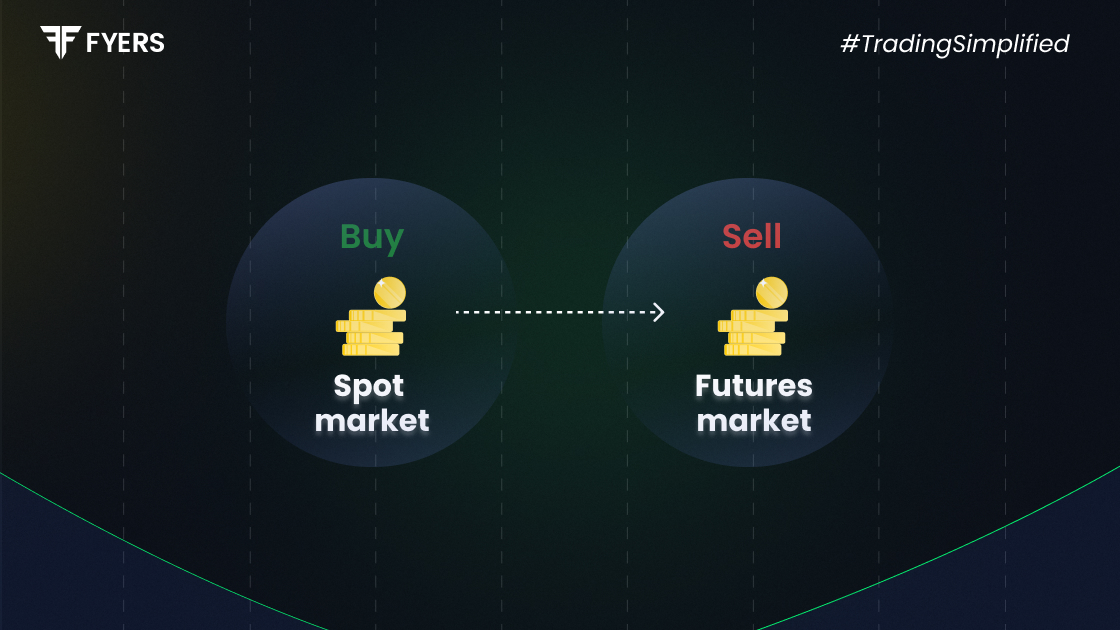

Cash and carry arbitrage is a specific form of arbitrage used in futures trading. It involves purchasing an asset (usually a stock or an index) in the cash/spot market, while simultaneously selling the same asset in the futures market at a higher price. The idea is to lock in a profit if the futures price exceeds the spot price plus carrying costs.

For example, if you can buy a stock today at ₹1,000 in the spot market and simultaneously sell its futures contract for ₹1,030, and your carrying costs until expiry are ₹20, you’ve secured a potential ₹10 profit per share.

The strategy hinges on market inefficiencies — when the futures price trades at a premium that more than compensates for the cost of holding the asset until expiry.

To understand the cash and carry model, let’s look at a typical trade:

Buy the underlying asset (e.g., stock, index ETF) in the cash market.

At the same time, sell an equal quantity of the asset in the futures market at a higher price.

Hold the cash market position until the futures contract expires. During this period, you may incur carrying costs like financing, storage (in case of commodities), or opportunity costs.

At expiry, deliver the asset to settle the futures contract. The difference between the futures price and the cost of carrying the position becomes your arbitrage profit.

This type of cash future arbitrage is commonly used by institutional investors and traders with access to capital and low transaction costs.

A crucial element in any cash and carry strategy is the concept of carrying costs. These include:

Interest on borrowed funds: If you finance the purchase of the underlying asset using borrowed capital.

Storage and insurance costs: Especially relevant for commodity arbitrage.

Dividend adjustments: If the asset pays a dividend during the holding period, it affects the expected return.

Transaction costs: Brokerage fees, taxes, and slippages.

These costs can significantly reduce — or even eliminate — your arbitrage profits. In fact, traders often abandon a cash and carry opportunity if carrying costs are too high relative to the futures premium.

Hence, understanding and accurately calculating all these costs is vital before entering into a trade.

While often promoted as a low-risk strategy, cash and carry arbitrage is not risk-free. Here are some key risks to consider:

Execution Risk: Prices can change quickly. If the cash and futures trades aren’t executed simultaneously, it could lead to unexpected losses.

Liquidity Risk: If the futures contract or the underlying asset lacks sufficient liquidity, slippages and wider bid-ask spreads can erode profits.

Funding Risk: A sudden rise in interest rates or a lack of access to funding could increase carrying costs beyond expectations.

Settlement Risk: Operational errors, margin calls, or delays in stock delivery can impact trade completion.

Dividend Uncertainty: Unexpected dividend announcements can affect the pricing of futures and reduce arbitrage margins.

These risks highlight the importance of precision and timing. While the strategy may appear straightforward, it requires careful monitoring and disciplined execution.

Despite its appeal, the cash and carry model has several limitations:

Small Margins: In efficient markets, the arbitrage margins are often slim. After costs, the net gain may not justify the capital tied up.

Requires Capital: A large upfront investment is needed to buy the underlying asset, making it less accessible for retail traders.

Market Efficiency: As technology improves and competition increases, arbitrage opportunities close faster, leaving little room for profit.

Short-Term Strategy: The model relies on short-term price differences that may not always be present, especially during stable market periods.

Therefore, while it’s a valuable tool, it’s best used selectively when genuine arbitrage gaps exist and the cost structure supports profitability.

Cash and carry arbitrage is a powerful trading strategy based on the idea of exploiting temporary pricing inefficiencies between spot and futures markets. When executed correctly, it can provide near risk-free returns, particularly in well-understood, liquid markets.

However, success in this strategy relies heavily on understanding and managing carrying costs, evaluating risks, and executing trades with precision. It is not a guaranteed profit-making method and can turn unprofitable if any key assumption — like interest rates, dividends, or market liquidity — changes unexpectedly.

While it remains a preferred strategy among institutional traders, retail investors should approach it with caution and carefully evaluate it.

It’s a trading strategy where you buy an asset in the cash market and sell it in the futures market simultaneously, profiting from the price difference after accounting for carrying costs.

Carrying costs — like interest, storage, and transaction fees — reduce your overall profit. If they exceed the futures premium, the arbitrage becomes unprofitable.

Not entirely. While it’s considered low-risk, there are risks related to execution, liquidity, funding, and market volatility.

It performs best when the futures price trades significantly above the spot price, and carrying costs remain low, creating a clear arbitrage window.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.