27 Jul, 2025

27 Jul, 2025

6 mins read

6 mins read

The statutory liquidity ratio is one of the important tools used by the Reserve Bank of India (RBI) to manage money supply and ensure that banks remain financially strong. If you’re interested in how India’s banking system works or how the RBI regulates financial stability, then understanding the SLR ratio meaning is essential.

It affects everything from interest rates to credit availability and plays a big part in shaping monetary policy.

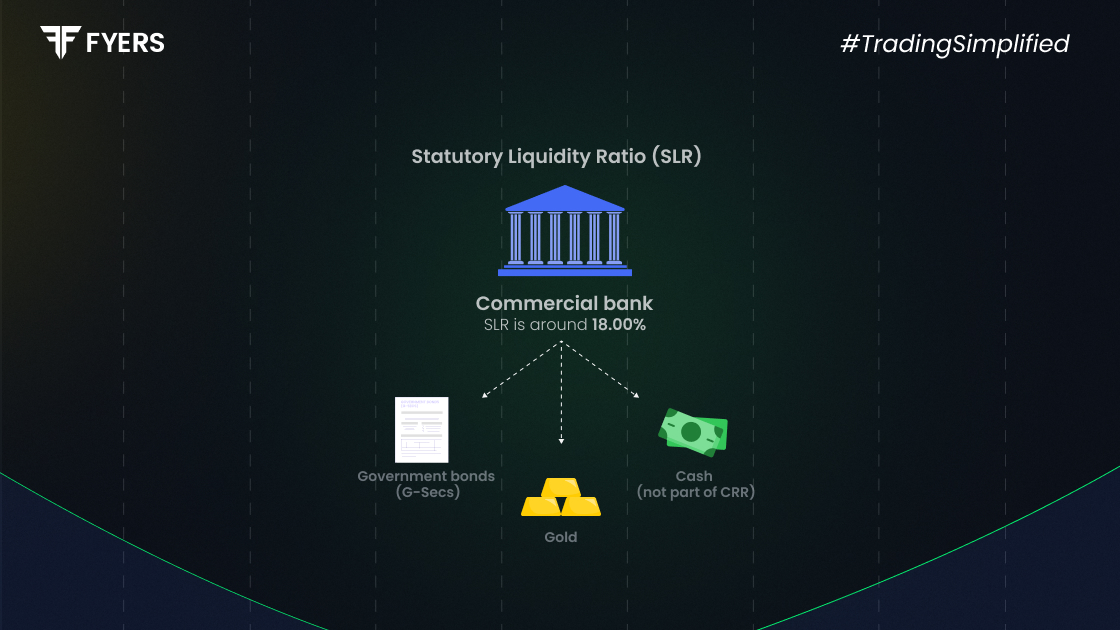

So, what is statutory liquidity ratio? Simply put, it's the minimum percentage of a bank's total deposits that must be kept in the form of liquid assets. These include cash, gold and approved government securities. This amount is calculated based on a bank’s Net Demand and Time Liabilities (NDTL).

To explain more clearly, if a bank receives ₹1,000 crore in deposits, and the SLR rate in India is 18%, the bank must set aside ₹180 crore in specific safe and liquid assets. This money cannot be used for lending or investing in risky financial products.

This requirement, called the statutory liquidity ratio, is set by the Reserve Bank of India (RBI) and can be changed from time to time based on economic conditions like inflation or financial market trends.

By asking banks to hold a portion of their funds in low-risk assets, the statutory liquidity ratio RBI aims to ensure banks are always able to handle sudden withdrawals or emergencies.

The RBI uses the statutory liquidity ratio for several key purposes. Here are the main objectives:

Ensure liquidity: One of the main goals is to make sure banks always have enough liquid assets to meet customer withdrawals and manage day-to-day operations.

Control inflation: When inflation is rising, the RBI can increase the SLR rate in India, which reduces the amount banks can lend. This helps slow down money supply and control inflation.

Strengthen financial discipline: By requiring banks to hold secure assets, SLR keeps banks from taking excessive risks.

Support government borrowing: Since government bonds qualify as SLR assets, this system also helps the government borrow money at stable rates.

Promote stability: In times of financial uncertainty, the SLR acts like a safety cushion to keep banks steady.

Boost investor confidence: A strong SLR position shows that a bank is financially sound, which reassures depositors and investors.

These objectives show the importance of SLR in maintaining the health and safety of India’s financial system.

Apart from meeting regulatory requirements, the statutory liquidity ratio has some very practical uses in the banking world:

Monetary policy tool: The RBI changes the SLR to either slow down or speed up credit growth. Increasing SLR tightens liquidity, while decreasing it makes more money available for lending.

Liquidity management: SLR helps banks maintain balance in their cash flow, making sure they don’t run into money shortages.

Benchmark for health: A bank that manages its SLR well is seen as financially responsible and well-managed.

Compliance metric: Banks must meet the required SLR or face penalties. This encourages careful financial planning.

Risk management: The liquid assets held for SLR protect banks from sudden economic changes and unexpected losses.

Encourages investment in government securities: Since banks use these bonds to meet the SLR, it helps create a strong and stable market for government borrowing.

These functions make it clear why the importance of SLR goes beyond just being a legal rule. It’s a useful tool for both the central bank and individual banks.

What counts as part of the statutory liquidity ratio? Only safe and liquid assets are allowed. Here are the main components of SLR:

Cash reserves: This includes actual cash held by the bank, not money kept with the RBI.

Gold holdings: Gold is allowed as long as it meets certain standards for purity and value.

Government-approved securities: These are bonds issued by the central or state government, considered very low risk.

Treasury bills: These short-term government papers are another form of secure, tradable investment.

The idea behind this list is to make sure that banks hold assets that are not only safe but also easy to convert to cash if needed. A mix of these assets helps banks stay flexible while meeting SLR rules.

People often confuse the Cash Reserve Ratio (CRR) with the statutory liquidity ratio, but they’re not the same. Let’s break it down:

|

Feature |

CRR (Cash Reserve Ratio) |

SLR (Statutory Liquidity Ratio) |

|---|---|---|

|

Form of Reserve |

Only in cash |

Cash, gold, or government bonds |

|

Held With |

RBI |

With the bank itself |

|

Earning Potential |

No interest |

Can earn interest on securities |

|

Objective |

Regulate liquidity |

Maintain solvency and support lending limits |

|

Impact on Lending |

Reduces bank's lendable funds |

Limits bank's exposure to risk |

Understanding CRR vs. SLR helps clarify how the RBI controls money supply and protects the banking system. CRR is stricter since it must be held with the RBI and earns no return. In contrast, the SLR lets banks earn interest while still being safe.

The statutory liquidity ratio is more than just a financial rule. It’s a powerful tool used by the Reserve Bank of India to keep banks stable, control inflation, and guide credit flow. By asking banks to keep part of their funds in secure and liquid forms, the statutory liquidity ratio RBI reduces risk and ensures smooth operations even in uncertain times.

Whether you’re a student of finance, a working professional, or someone curious about how banks work, understanding the SLR ratio meaning can give you insight into how India’s financial system stays balanced. When used along with other tools like CRR and the repo rate, SLR gives the RBI multiple ways to manage economic activity effectively.

SLR is calculated as a percentage of a bank’s NDTL (Net Demand and Time Liabilities). If a bank has ₹1,000 crore in NDTL and the SLR rate in India is 18%, then the bank must hold ₹180 crore in approved liquid assets. The RBI monitors and updates this regularly.

The importance of SLR lies in ensuring that banks are always able to meet withdrawal demands and withstand financial stress. It helps control inflation, guide lending, and promote trust in the banking system.

The statutory liquidity ratio RBI is used to manage credit, control inflation, and ensure the health of the banking sector. The RBI increases SLR to reduce liquidity and lowers it when more money is needed in the economy.

The current SLR rate in India is 18%, however it can be liable to change based on the economic climate.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.