31 Jul, 2025

31 Jul, 2025

5 mins read

5 mins read

Non-current liabilities are a crucial part of a company’s financial structure. These long-term obligations support growth and capital investment, but they also influence the company’s financial health and creditworthiness. In this article, we explain what non-current liabilities are, their types, and why they matter in long-term planning. We also compare them with current liabilities and provide real-life examples from Indian businesses.

Non-current liabilities meaning financial obligations that are not due for settlement within one year from the reporting date. These are also referred to as long-term liabilities. Common examples include long-term loans, lease obligations, and deferred tax liabilities.

In Indian financial reporting, the classification is governed by Ind AS 1: Presentation of Financial Statements. This standard requires a clear separation between current and non-current liabilities unless a liquidity-based format is more suitable.

These liabilities reflect a company’s long-term financial commitments and are shown in the non-current section of the balance sheet. They are essential for evaluating a company’s ability to handle future obligations while investing in growth and infrastructure.

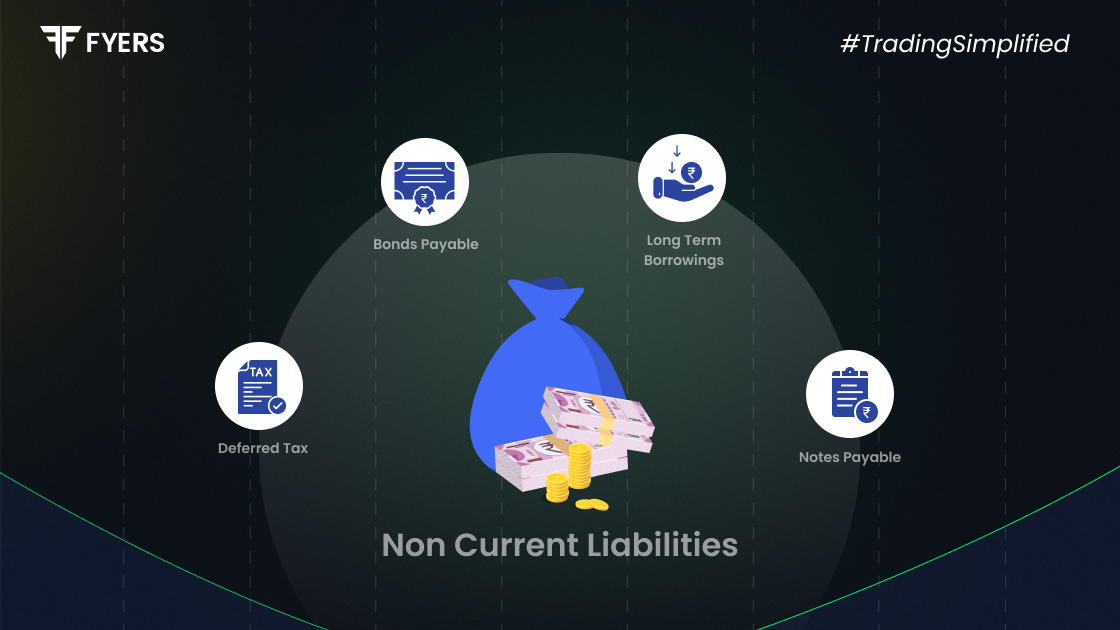

There are several types of non-current liabilities. Each serves a specific function in the company's financial strategy and capital structure.

1. Long-Term Loans

These are borrowings that are repayable beyond one year.

Example: A five-year term loan from a bank to fund factory construction.

2. Debentures

Debentures are a common form of unsecured debt in India, usually backed by the creditworthiness of the issuing firm.

Example: Non-convertible debentures (NCDs) issued by a listed company.

3. Lease Liabilities

Under Ind AS 116, lease obligations for contracts longer than 12 months must be recorded as liabilities, with the right-of-use asset on the other side of the balance sheet.

Example: Office premises leased for ten years.

4. Deferred Tax Liabilities

These arise from differences in the way income is recognised for accounting versus tax purposes.

Example: A difference in depreciation methods under the Companies Act and Income Tax Act.

5. Pension Obligations

Employers in India are required to provide long-term retirement benefits, including gratuity, provident fund, and superannuation.

Example: ₹1 crore allocated for employee gratuity and PF liabilities.

6. Provisions for Future Expenses

Companies may estimate and record provisions for costs they expect to incur in the future.

Example: ₹50 lakh reserved for the eventual dismantling of machinery.

Understanding the importance of non-current liabilities helps assess the long-term stability of a business. These obligations are not just debt figures; they are a reflection of strategic choices and financial planning.

Capital for Growth: They provide the necessary funds for infrastructure, research, and expansion.

Predictable Repayment: Because they are due over a longer period, companies can plan their repayment schedules without affecting daily operations.

Credit Evaluation: Investors and lenders consider the level of long-term liabilities when evaluating a company's credit risk.

Cash Flow Management: Knowing future payment obligations helps businesses manage their liquidity better and avoid surprises.

Non-current liabilities impact key financial ratios that reveal the strength and sustainability of a business.

Debt to Equity Ratio

This ratio compares total liabilities to shareholders' equity. A high ratio implies greater dependence on borrowed funds, which may increase risk.

Interest Coverage Ratio

This ratio shows how well a company can cover its interest payments with its earnings. A low ratio may indicate a risk of default.

Return on Capital Employed (ROCE)

Since non-current liabilities form a part of the capital employed, they influence the ROCE. High returns suggest efficient use of long-term funds.

While borrowing can support growth, excessive non-current liabilities may put stress on cash flow if not matched by revenue generation.

To understand the full financial picture, one must know the difference between current and non-current liabilities.

|

Feature |

Non-Current Liabilities |

Current Liabilities |

|---|---|---|

|

Payment Period |

More than one year |

Within one year |

|

Purpose |

Long-term investments |

Short-term operational needs |

|

Examples |

Debentures, term loans, lease liabilities |

Trade creditors, utility bills |

|

Impact |

Affects long-term strategy |

Influences short-term liquidity |

The difference between current and non-current liabilities is essential in financial analysis, as both serve distinct roles in operations and planning.

Let us look at some examples of non-current liabilities that are typically seen in Indian corporate balance sheets:

Bank Loan (5 years): A ₹10 crore loan taken from HDFC Bank to build a new manufacturing unit.

Corporate Debentures: NCDs issued by a firm, repayable after seven years.

Lease Agreement: A long-term lease of office space, recorded as per Ind AS 116.

Deferred Tax Liability: ₹50 lakh resulting from differences in depreciation accounting.

Employee Benefit Obligations: ₹1 crore earmarked for gratuity and provident fund liabilities.

Asset Retirement Provision: Funds reserved for dismantling plant machinery after eight years.

These examples of non-current liabilities illustrate their diversity and importance in financial reporting and long-term strategy.

Non-current liabilities are more than just numbers on a balance sheet. They represent long-term commitments that enable a company to grow and evolve. Understanding what non-current liabilities are and how they function allows investors and managers to better assess the company’s financial position.

The types of non-current liabilities, from loans to deferred taxes, provide capital and support long-term planning. At the same time, the importance of non-current liabilities lies in their ability to shape future decisions and maintain financial discipline.

It is a financial obligation that a company must pay after more than one year, such as long-term loans or debentures.

Non-current liabilities are due after one year, while current liabilities are settled within a year. They serve different roles in financing and operations.

They are shown on the balance sheet under the liabilities section, below current liabilities. Each type is listed separately with relevant notes in the financial statements, as per Ind AS 1.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.