31 Jul, 2025

31 Jul, 2025

5 mins read

5 mins read

The cash conversion cycle (CCC) is a vital financial metric that helps measure how quickly a business can turn its resources into cash. Specifically, it tracks the time between paying for inventory and receiving cash from sales. Understanding and managing the CCC is especially important for companies in India, where working capital cycles vary across industries due to differing supply chain conditions and payment practices.

A well-managed CCC can significantly improve cash flow, reduce borrowing needs and create more room for growth. Let us explore what the cash conversion cycle means, how to calculate it and how to improve cash conversion efficiency in your business.

The cash conversion cycle refers to the number of days it takes a company to convert its investments in inventory and other inputs into cash through sales. In simpler terms, it is the time between when a company pays its suppliers and when it collects money from customers.

The shorter the CCC, the more efficient the business is at managing its working capital cycle. A longer CCC can suggest problems in inventory turnover or collection delays. For example, Indian FMCG companies like Dabur or Marico often target a CCC of under 30 days, while construction or capital goods firms may face cycles over 100 days due to longer project timelines.

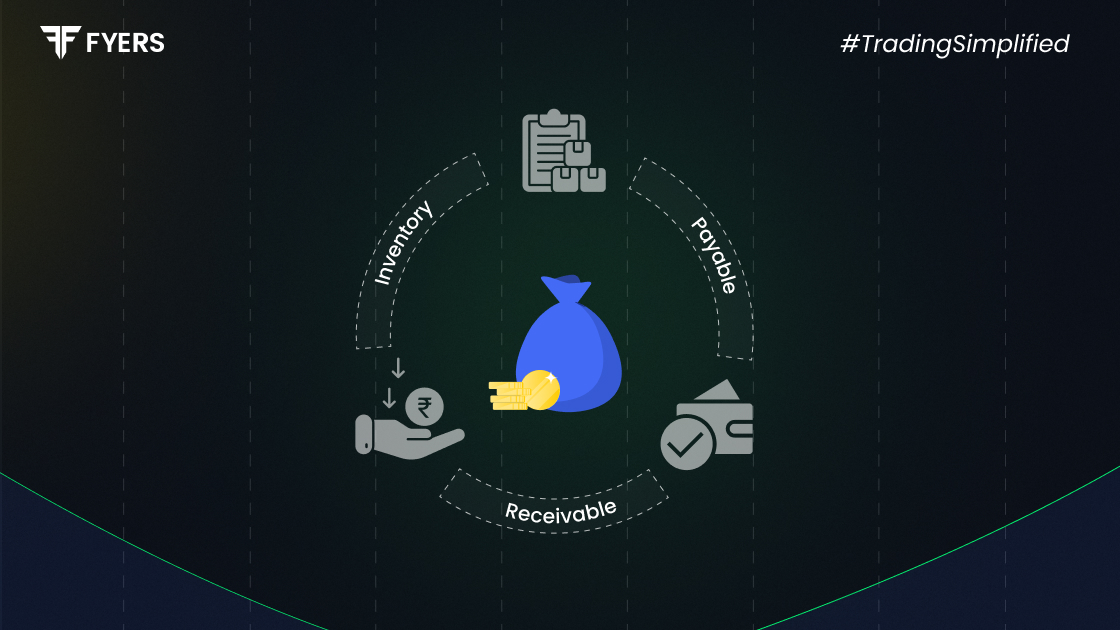

To understand how the cash conversion cycle works, we need to look at three stages of business operations:

1. Inventory Management:

This measures how fast inventory is sold and replaced. Businesses in India often face challenges due to unpredictable logistics and supplier delays, which can increase the time inventory sits on shelves.

2. Receivables Collection:

This tracks how long it takes to collect payment from customers. Many Indian B2B companies face an average collection period of 60 to 90 days, especially when dealing with large buyers or government entities.

3. Payables Management:

This reflects the time taken to pay suppliers. While extending payment periods can help cash flow, doing so excessively may damage supplier relationships.

By examining all three, the CCC gives a complete picture of working capital health. Businesses with a shorter CCC tend to have smoother operations, stronger cash positions and more flexibility to reinvest in growth.

The cash conversion cycle is built from three main components:

1. Days Inventory Outstanding (DIO)

DIO shows the average number of days a company holds inventory before selling it. A low DIO means faster turnover, which is good for liquidity.

Formula:

|

DIO = (Average Inventory ÷ Cost of Goods Sold) × 365 |

2. Days Sales Outstanding (DSO)

DSO measures how long it takes to collect payment after a sale. Lower DSO indicates faster collections and better receivables management.

Formula:

|

DSO = (Average Accounts Receivable ÷ Total Credit Sales) × 365 |

3. Days Payable Outstanding (DPO)

DPO reflects how long the company takes to pay suppliers. A higher DPO can help conserve cash, but it should not affect supplier trust.

Formula:

|

DPO = (Average Accounts Payable ÷ Cost of Goods Sold) × 365 |

To calculate the cash conversion cycle, use the following formula:

|

CCC = DIO + DSO - DPO |

Example Calculation:

Let us assume the following values:

|

Component |

Amount (₹) |

|---|---|

|

Average inventory |

₹4,00,000 |

|

Cost of goods sold |

₹20,00,000 |

|

Average accounts receivable |

₹3,00,000 |

|

Credit sales |

₹18,00,000 |

|

Average accounts payable |

₹2,50,000 |

DIO = (4,00,000 ÷ 20,00,000) × 365 = 73 days

DSO = (3,00,000 ÷ 18,00,000) × 365 = 61 days

DPO = (2,50,000 ÷ 20,00,000) × 365 = 46 days

CCC = 73 + 61 - 46 = 88 days

This means it takes the business 88 days to convert its investment in inventory into cash. Companies can benchmark this against industry averages to identify areas of improvement. For instance, retail giants and ecommerce players like Flipkart aim for a negative CCC, meaning they receive cash from customers before paying suppliers.

Improving the CCC is a key way to strengthen working capital management. Here are some actionable strategies:

1. Reduce Days Inventory Outstanding (DIO)

Use demand forecasting to avoid overstocking

Adopt just-in-time inventory systems

Work with local suppliers to cut lead times

2. Lower Days Sales Outstanding (DSO)

Offer early payment discounts to customers

Check customer creditworthiness before sales

Automate invoicing with software like Tally or Zoho

3. Increase Days Payable Outstanding (DPO)

Negotiate longer payment terms with suppliers

Use the full credit period without delay

Consolidate supplier payments to improve cash flow

4. Use Technology to Manage CCC

Implement ERP systems like SAP, Oracle or Tally Prime

Use tools like RazorpayX or Clear for real-time tracking

Automate collections and payment reminders to reduce manual effort

These steps can significantly improve cash conversion efficiency and enhance a company’s financial flexibility, particularly for startups and MSMEs that operate with tighter margins.

The cash conversion cycle is an essential measure of a company’s ability to manage its cash flow and working capital cycle. By calculating the CCC, businesses can identify delays in their inventory turnover, customer collections and supplier payments.

A shorter CCC means faster cash recovery and stronger liquidity. Companies that improve their CCC can reinvest in growth, reduce dependence on external financing and navigate market changes more effectively. For example, ecommerce platforms in India operate with a negative CCC model, boosting efficiency and profitability.

Ultimately, continuous monitoring and improvement of CCC using modern tools and best practices can give any business from small firms to large corporations, a competitive edge.

It is the number of days a business takes to convert its inventory purchases into cash from customers, after adjusting for payment to suppliers.

There is no single ideal number. Shorter CCCs are better, but the benchmark depends on your industry. For example, FMCG firms may aim for 30 days or less.

It means the company receives money from customers before it pays its suppliers. This improves cash flow and reduces the need for borrowing.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.