27 Mar, 2025

27 Mar, 2025

4 mins read

4 mins read

Arbitrage trading is a popular strategy in financial markets. It takes advantage of price differences for the same asset across different markets. This approach offers low risk and helps make markets more efficient. In this article, we will explore arbitrage trading, how it works, its types, strategies, and benefits.

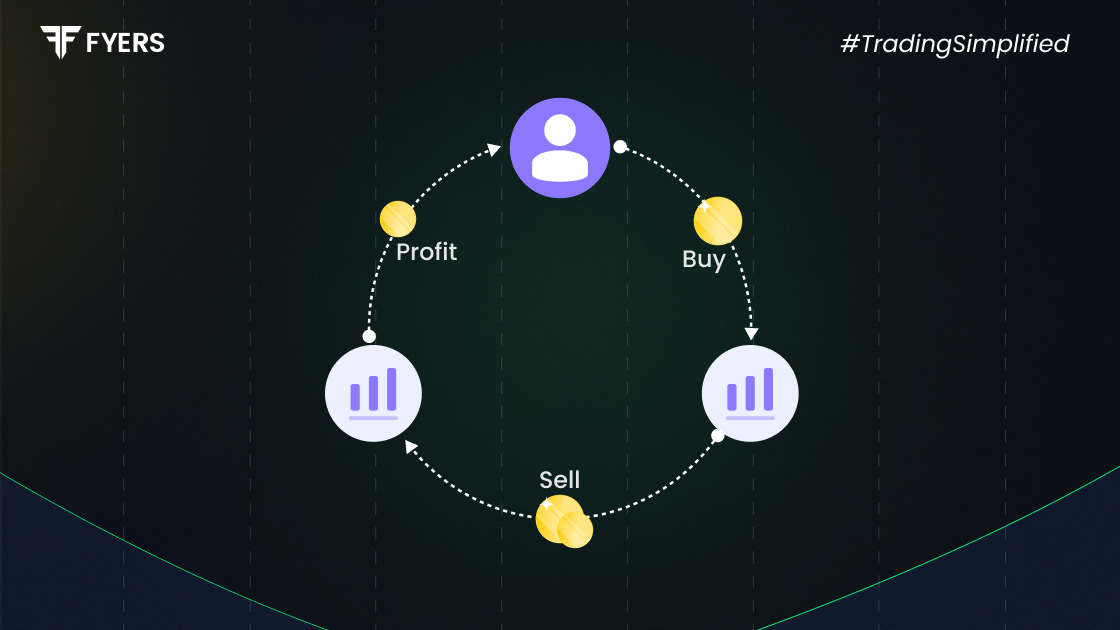

Arbitrage trading means buying and selling an asset in different markets at the same time. You do this to profit from price differences. For example, if a stock costs less on one exchange and more on another, you can buy it from the cheaper market and sell it in the more expensive one. This helps you earn profits with minimal risk while also helping align prices across markets.

Arbitrage trading in India is legal but regulated by SEBI. According to SEBI, arbitrage trading is not allowed for intraday trades but only for delivery trades.

Arbitrage trading exists because of market inefficiencies. Since price differences often don't last long, traders use special software to find these opportunities quickly. Cross-border arbitrage can happen when Indian stocks trade on foreign exchanges too. You must hold shares in your Demat account before making arbitrage trades.

For instance, a stock might cost ₹200 on NSE but ₹202 on BSE. You can sell shares on BSE while buying them on NSE at the same time. This earns you ₹2 per share as profit.

Arbitrage trading comes in several forms:

Inter-Exchange Arbitrage: Exploits price differences between Indian exchanges such as NSE and BSE. Traders simultaneously sell securities at higher prices on one exchange while purchasing identical securities at lower prices on another.

Cash-Futures Arbitrage: Involves buying stocks in the cash market while simultaneously selling equivalent futures contracts when futures are trading at a premium. This strategy capitalises on price convergence as the expiry date approaches.

Cross-Border Arbitrage: Leverages price disparities between Indian and international markets. After accounting for currency conversion costs, traders purchase undervalued securities on one exchange (like BSE) and sell them at higher prices on foreign exchanges (like NYSE).

Statistical Arbitrage: Employs mathematical models and historical data analysis to identify temporarily mispriced assets.It executes trades that profit when prices revert to expected values.

Merger Arbitrage: Capitalises on price inefficiencies during corporate mergers and acquisitions. It involves trading the stocks of companies to profit from price convergence upon deal completion.

Pure arbitrage is buying something in one place and selling it in another place to profit from the price difference. You don't take any risks because you complete both transactions immediately. It works by finding the same thing priced differently in two places at the same time.

Risk arbitrage involves buying stocks now because you think they'll be worth more later. Unlike pure arbitrage, you must wait and hope the price goes up. The "risk" part means you could lose money if your prediction is wrong.

Involves buying convertible bonds and shorting the underlying stock to profit from mispricing. This is a strategy typically used by hedge funds.

Merger arbitrage means buying stocks in companies that are about to be bought by other companies. When companies merge, the target company's stock price usually goes up. You make money by selling those stocks after the price rises.

Dividend arbitrage is buying stocks right before they pay dividends to shareholders. You buy the stock just in time to receive the dividend payment, and then you might sell afterward. This helps boost your investment returns.

Futures arbitrage involves buying stocks with cash now while selling them in the futures market for later delivery. Usually, futures prices are higher than current prices. As the delivery date gets closer, these prices come together, creating profit opportunities.

Arbitrage trading offers several advantages for you:

Risk-Free Profits: Arbitrage strategies generate returns by exploiting temporary price discrepancies between markets, offering nearly risk-free profits when executed properly.

Market Efficiency: These trades naturally eliminate price inefficiencies, helping markets reach equilibrium faster and improving overall price discovery.

Liquidity Improvement: Increased arbitrage activity enhances trading volumes and market depth, benefiting all participants through tighter spreads and better execution.

Income Diversification: Provides traders with returns uncorrelated to general market direction, creating a valuable portfolio diversification tool.

Low-Risk Strategy: Offers conservative investors a methodical approach to achieve consistent returns without taking on significant directional market exposure, though execution speed and transaction costs remain important considerations.

Arbitrage trading helps you earn nearly risk-free profits by using price gaps across markets. In India, SEBI regulates it to ensure good practices while improving market efficiency. By following the rules and using advanced tools for quick action, you can make the most of this rewarding strategy in the Indian financial markets.

Arbitrage trading is legal in India, but you can't buy and sell the same company's stock on different exchanges in one day, and you must take delivery of shares for the trade to be legal.

Most common types of arbitrage strategies: Pure arbitrage finds price differences of the same asset across markets. Futures arbitrage involves buying an asset while selling its futures contract. Risk arbitrage makes money from price changes during events like mergers.

Arbitrage traders use specialised calculators, trading bots, API connections, and market analysis software to spot and take advantage of price differences between markets.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.