28 Feb, 2025

28 Feb, 2025

3 mins read

3 mins read

The concept of margin of safety plays a vital role in financial decision-making and investing. It acts as a protective buffer, ensuring that your investments or business decisions have room for error without causing significant losses. In this article, we’ll explore everything you need to know about the margin of safety, including its formula, applications, and significance.

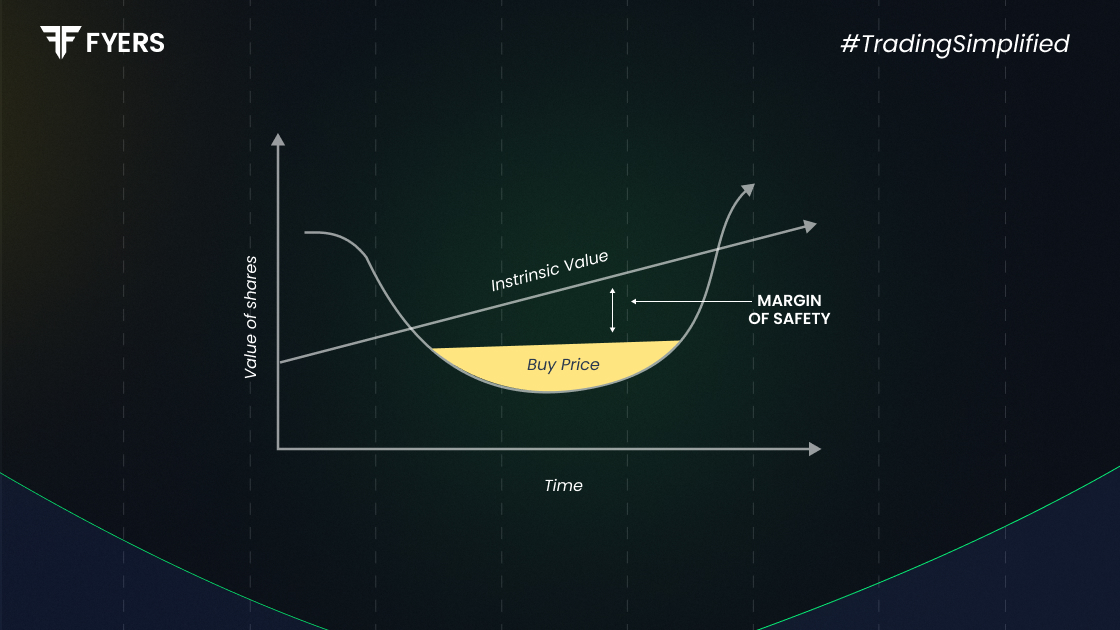

What is the margin of safety? Simply put, it’s the difference between the expected value of an investment or business outcome and the point at which losses would occur. It serves as a cushion against potential risks or errors in judgment.

In investing, the margin of safety helps protect investors from market volatility by ensuring they buy securities below their intrinsic value. In business, it shows how much sales can drop before the company reaches its break-even point.

Understanding how to calculate the margin of safety is essential for both investors and business owners. It allows you to assess the risk level associated with your decisions.

To calculate it, you need two primary pieces of information:

By comparing these two figures, you can determine how much sales can decrease before losses occur.

The margin of safety formula can be expressed in two main ways:

Absolute Value:

The margin of Safety = Actual Sales – Break-even Sales

Percentage:

Margin of Safety (%) = [(Actual Sales – Break-even Sales) / Actual Sales] × 100

The percentage formula is more commonly used because it provides a clearer picture of the risk level relative to sales.

Let’s look at a simple margin of safety example to understand how it works.

Imagine a company has actual sales of ₹10 lakh and a break-even sales level of ₹7 lakh.

Absolute Margin of Safety:

₹10 lakh – ₹7 lakh = ₹3 lakh

Percentage Margin of Safety:

(₹3 lakh / ₹10 lakh) × 100 = 30%

This means the company’s sales can drop by 30% before it starts incurring losses. A higher percentage indicates a lower risk level.

Several factors impact the margin of safety, including:

The application of a margin of safety in investing is a critical strategy popularised by renowned investor Benjamin Graham. It involves purchasing securities at prices significantly below their intrinsic value to minimise risk.

Here’s how it works:

For instance, if the intrinsic value of a stock is ₹1,000 but it’s available at ₹700, the margin of safety is 30%. This means the stock can lose up to 30% of its value before the investor faces potential losses.

The margin of safety is a cornerstone concept in investing and business decision-making. By understanding what is the margin of safety, knowing how to calculate the margin of safety, and applying the margin of safety formula, investors and business owners can make more informed decisions. The real-world margin of safety examples shows how this concept reduces risk and increases profitability. Its importance lies in offering a safety net against uncertainties, making it an essential strategy for achieving long-term financial success.

The ideal margin of safety percentage depends on the investor’s risk tolerance. However, many experts recommend a margin of safety of at least 20-30% for stocks. For more volatile investments, a higher margin may be prudent.

While the margin of safety is a valuable tool, it has some limitations:

The margin of safety is mainly applicable to value investing, where investors seek undervalued stocks. However, it can also be adapted to real estate, bonds, and business acquisitions. The key is to understand the intrinsic value of the asset and apply a suitable margin to cushion against potential risks.

While the margin of safety reduces investment risk, it cannot fully protect against market crashes. However, it provides a buffer, ensuring that investments are made at lower prices, which can minimise losses during downturns.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.