4 Aug, 2023

4 Aug, 2023

5 mins read

5 mins read

For F&O traders who frequently trade and maintain a significant amount of cash in their brokerage accounts rarely realize that it can earn them an interest income. For example, if ₹10 lakh is in your trading account and you don't have any open positions, the idle cash is not yielding anything apart from supporting your trading activities. However, another trader, Raj, with similar funds in the trading account is getting a return on investment of approximately 7-8% per annum in addition to the returns made from trading in the stock market.

Now you may ask, 'How is this possible'?

The answer to this is Pledging!

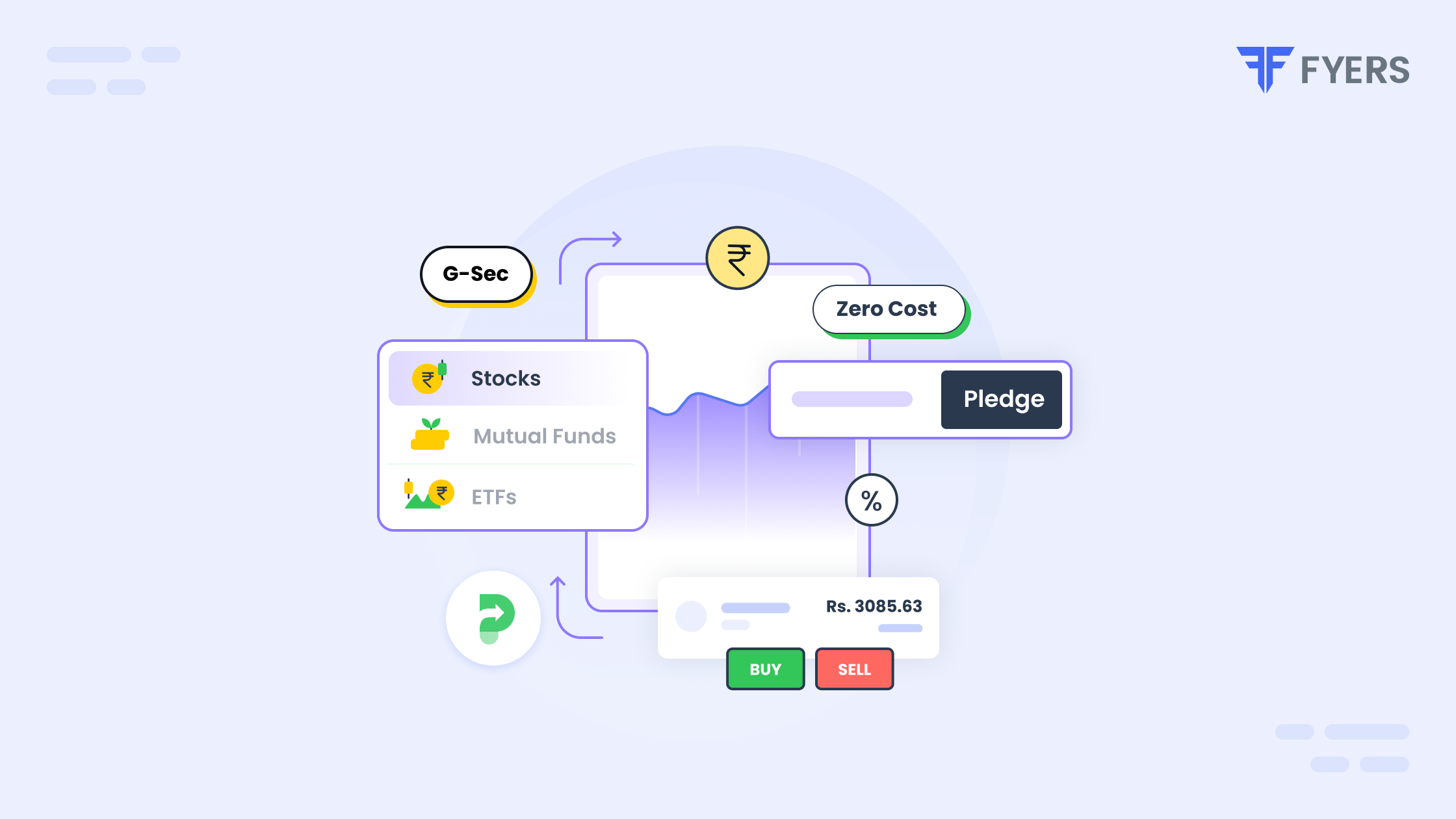

Pledging is the process of using your securities as collateral to get additional funds or margin for trading from your broker after applicable haircuts. This way, you can increase your trading exposure and leverage your returns without selling your securities. With pledged securities, you can trade without selling them, diversify your portfolio by investing in different segments, and take advantage of market opportunities.

So, Raj has successfully traded with his pledged securities without missing out on interest, dividend or capital appreciation depending on the nature of the collateral.

Pledging of securities via FYERS platform is simplified for all. You can easily pledge and unpledge your holdings and pay no interest charges for collateral margin. To place a pledge request, you need to go to pledge.fyers.in and login with FYERS credentials. You can view the list of approved securities, which includes shares, ETFs, equity mutual funds, debt mutual funds, and other debt instruments like Government bonds, along with the haircut applicable. Please note that if you have pledged securities, then you cannot sell them before unpledging them.

Yes, there is. The concept of pledging has always been under the purview of SEBI.

The exchanges require that 50% of the margin for futures and options (F&O) positions must be in cash or cash equivalent collateral, while the remaining 50% can be in the non-cash collateral margin. That means you cannot pledge all your shares and trade with 100% borrowed funds. You must maintain at least 50% of your margin in cash or cash equivalents, such as liquid funds, government securities, Debt ETFs, etc.

However, keeping 50% of funds idle in cash reduces potential returns and increases the opportunity cost of earning interest income from investments made in cash equivalents.

But what if we tell you that there is a way to use your investments as collateral and earn passive income on them? Sounds too good to be true, right? Well, not really. With the introduction of government securities (G-Secs) as eligible collateral for F&O trading on the FYERS platform, you can now do both.

G-Secs are debt financial instruments issued by the RBI on behalf of the government that offer a fixed interest rate and are considered risk-free investments. By investing in G-Secs and pledging them as collateral, you can meet the requirement of a 50:50 ratio mandate of exchange and earn interest on the pledged securities also. This way, you can optimize your funds and enhance your returns.

Let's look at three scenarios to understand how this works in practice.

Scenario 1: Part Cash and Part Stocks.

Suppose you have ₹10 lakhs in your trading account, ₹8 lakhs in collateral margin from pledging the stock holdings (after haircut), and ₹2 lakhs in cash. You want to trade in F&O that requires a margin of ₹10 lakhs. According to exchange regulations, you need to have ₹5 lakhs in cash and ₹5 lakhs in non-cash equivalents. Now, to comply with the mandatory cash requirement, you have to sell some of your stocks or add more funds to your account. Both options are not ideal, as selling stocks may incur capital gains tax, and adding funds may not be feasible or convenient.

Moreover, by keeping ₹5 lakhs in cash, you are missing out on the opportunity to earn returns on that amount.

Scenario 2: Investing in G-secs and Stocks.

Suppose you invest ₹4 lakhs in G-Secs and ₹6 lakhs in stocks. To trade in F&O, you can easily pledge G-Secs and stocks and get the desired amount after the haircut applicable. This way, you can trade in F&O without maintaining any cash balance in your account. You also earn interest on the pledged G-Secs, which adds to your income. For example, if the G-Secs offers an interest rate of 8% per annum, you can earn ₹32,000 per year on your ₹4 lakhs investment along with trading income.

Scenario 3: Investing in G-secs, Pledging Them, and Trading in the Market.

Lastly, to trade in F&O, you can invest ₹10 lakhs in G-Secs and pledge it as collateral. Post haircut ( Approximately 5%) applicable, you will receive ₹9.5 lakhs which can be used to trade in the market. This way, you can take advantage of the market movements and opportunities without blocking any funds in cash. You also earn interest on the pledged G-Secs, which adds to your income. For instance, if you invest ₹10,00,000 in G-Secs 8.24% GOVT.STOCK 2027 through the FYERS platform and pledge them for a ₹9,50,000 margin (5% haircut). Then you can use this margin amount to buy 5 lots of Nifty Futures at ₹19,800 and sell them at ₹19850 the next day, making a profit of ₹12,500 and simultaneously you earn interest of approximately ₹225 per day on the total investment in G-Secs.

To know more about pledging of securities, refer FYERS support portal.

Even Interest.

You can earn interest on your pledged government securities as per the coupon rate. Also, FYERS does not charge any interest on the funds released by pledging your government securities. That means you can trade with the funds and also earn interest on them simultaneously.

Circumventing Running Account Settlement

Running account settlement is the process by which the exchange requires trading members to transfer unused funds back to the client's bank account. This is done to ensure that clients have access to their funds regularly and to prevent broking members from holding on to client funds for an extended period of time.

However, if you are a regular trader, frequent transfer of funds between your bank and trading accounts is a hassle. So now, if you pledge your G-Secs as collaterals, you don't need to undergo running account settlement. You can keep your securities pledged with FYERS and trade with the funds released without any hassle.

Reduces the Opportunity Cost.

Opportunity cost is the loss of potential benefit from other alternatives when one alternative is chosen. For instance, if you have ₹ 10 lakhs in cash to trade in F&O segment, you are losing the opportunity to make passive income in the form of interest, dividends, capital appreciation, etc. Instead, you can reduce the opportunity cost by investing in G-Secs and stocks, complying with 50:50 cash to collateral-margin requirements, pledging your shares and G-Secs as collateral, and trading with the funds released. This way, you can profit from trading, earn interest, and also benefit from your holdings for future appreciation.

Well, there are numerous benefits of investing and pledging G-Secs, but you should also be aware of certain risks associated:

Margin Call Risk

Margin call risk means that if the value of your pledged G-Secs falls below a certain level, you will have to provide additional margin or cash to maintain your F&O positions. That can happen due to market volatility or changes in the exchange rules. Therefore, it is always recommended to have an additional cash balance in your trading account to provide additional margin or meet the Mark To Market (MTM) losses (if any). If you are unable to provide additional margin during a margin call in time, your pledged securities can be invoked and liquidated to recover the losses and/or meet the risk management criteria, which are subject to change from time to time.

Liquidity Risk

If you need to sell your pledged G-Secs urgently, you may not get the best price or may not find a buyer at all or may incur impact cost. This can happen due to low demand or supply in the market or due to regulatory restrictions.

Interest Rate Risk

If the interest rate on G-Secs changes, the value of your pledged G-Secs will also change accordingly. This can affect your margin requirement and your returns.

Pledging G-Secs and shares can be a smart strategy to optimize funds and maximize returns. By doing so, you can meet the requirement of the 50:50 ratio mandate of exchange and earn passive income from interest and dividends on your pledged securities. Moreover, you can retain the ownership and benefits of your securities even after pledging them.

If you are interested, Pledge to Trade with FYERS is a smart and convenient way to trade in the market with more capital and flexibility. It allows you to use your existing securities as collateral to trade in other segments without liquidating them. It also enables you to earn interest on your pledged securities while they are used as a margin.

So, if you find this useful and are willing to take the risks to earn additional returns, you can explore this option. If you are new to FYERS, you can open a Demat account with us to get started. If you are already a customer and enjoy trading or investing on FYERS platform, do consider referring your friends and peers here. But make sure you don't lure them into opening an account. Trading should be a careful choice.

Pledging is a process of using your securities as collateral to secure extra funds or trading margin from your broker, subject to appropriate haircuts. With pledging, you can amplify your trading exposure and leverage potential returns without needing to liquidate your securities.

With pledging G-Secs, you can earn even interest as per the coupon rate, and reduce the overall opportunity cost.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.