28 Feb, 2025

28 Feb, 2025

3 mins read

3 mins read

Mutual funds have become a popular investment option for many individuals looking to grow their wealth. However, when investing in mutual funds, one common question arises: Should I invest in a Regular or a Direct Mutual Fund? Understanding the difference between direct and regular mutual funds can help you make an informed decision. In this article, we will explore what regular and direct mutual funds are, their key differences, and their respective pros and cons.

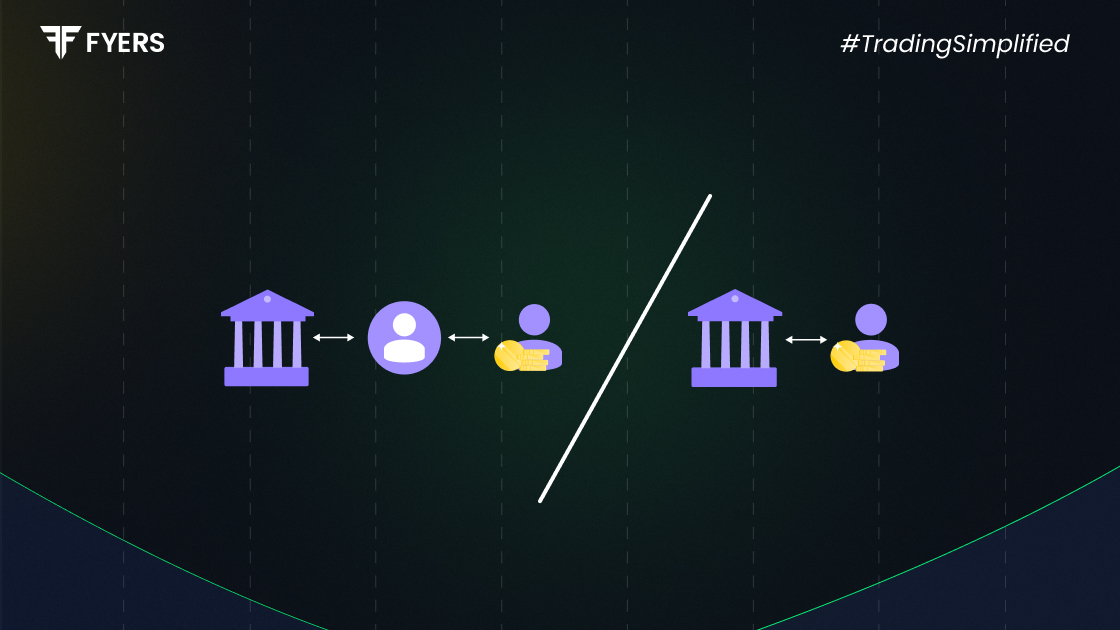

A regular mutual fund is a type of mutual fund scheme where you invest through an intermediary such as a broker, financial advisor, or distributor. The fund house pays a commission to these intermediaries for selling the mutual fund. This commission is included in the expense ratio, which means you, as an investor, bear the cost indirectly.

Purchased through intermediaries such as banks, brokers, and financial advisors.

Includes a commission or distribution fee paid by the fund house to intermediaries.

Slightly higher expense ratio compared to direct funds.

Guidance and financial advice from experts.

Suitable for investors who prefer professional assistance.

A direct mutual fund is a mutual fund scheme where you invest directly with the fund house without involving any intermediaries. Since no commission is paid to brokers or advisors, the expense ratio of direct funds is lower, leading to potentially higher returns.

Purchased directly from the mutual fund company through their website or office.

No intermediary commissions or distribution fees.

Lower expense ratio, leading to potentially better long-term returns.

Requires investors to make decisions without external guidance.

Suitable for experienced or self-directed investors.

|

Feature |

Regular Mutual Fund |

Direct Mutual Fund |

|---|---|---|

|

Mode of Purchase |

Through intermediaries |

Directly from AMC |

|

Expense Ratio |

Higher due to commission |

Lower due to no commission |

|

Returns |

Slightly lower due to higher costs |

Higher due to lower costs |

|

Investor Guidance |

Financial advisors provide assistance |

Self-researched investment decisions |

|

Best Suited For |

Beginners or those who prefer expert advice |

Experienced investors comfortable with independent investing |

Professional Guidance: Investors get expert advice from financial advisors.

Convenience: Advisors help with fund selection, documentation, and portfolio management.

Better for Beginners: Those new to investing may benefit from guided decision-making.

Higher Expense Ratio: Commissions and distribution fees increase the cost.

Lower Returns: Due to the higher expense ratio, returns may be slightly lower compared to direct funds.

Lower Expense Ratio: No intermediary commission means lower costs.

Higher Returns: Since expenses are lower, investors get better long-term returns.

Full Control: Investors make independent decisions based on their research.

No Professional Guidance: Investors must research and select funds on their own.

Time-Consuming: Requires continuous monitoring and decision-making.

Not Suitable for Beginners: May be challenging for those unfamiliar with mutual fund investments.

Deciding between a regular and direct mutual fund depends on several factors, including your investment knowledge, financial goals, and preference for professional guidance. If you are comfortable managing your investments and want to maximize returns, a direct mutual fund is a more cost-effective choice. But, if you are a beginner and need assistance, a regular mutual fund may be the better option, as financial advisors provide guidance in fund selection, portfolio management, and market insights. This is especially helpful for investors who lack the time or expertise to analyse different funds.

The choice between regular and direct mutual funds depends on your investment knowledge and preference. If you are comfortable making investment decisions on your own, direct mutual funds are a better option as they offer higher returns due to lower costs. However, if you prefer expert guidance, a regular mutual fund may be the better choice despite the slightly lower returns.

Direct mutual funds do not involve intermediaries like brokers or financial advisors. As a result, fund houses do not need to pay commissions, which reduces the expense ratio and increases returns for investors.

Switching from a regular mutual fund to a direct mutual fund is simple:

Log in to your mutual fund account on the AMC’s website or a registered investment platform.

Select the mutual fund scheme you wish to switch

Choose the “Switch to Direct Plan” option.

Submit your request and complete the necessary documentation.

The switch usually takes a few business days to process.

No, direct mutual funds are not riskier than regular ones. The risk level of a mutual fund depends on the type of fund (equity, debt, hybrid, etc.), not whether it is direct or regular. The primary difference lies in the expense ratio and advisory support.

Regular mutual funds provide expert guidance, making them ideal for beginners or those who prefer professional assistance. Financial advisors help with fund selection, portfolio management, and documentation, offering a hassle-free experience. While they have a higher expense ratio due to intermediary commissions, the convenience and personalised recommendations can be beneficial for investors who value ongoing support.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.