30 Mar, 2025

30 Mar, 2025

6 mins read

6 mins read

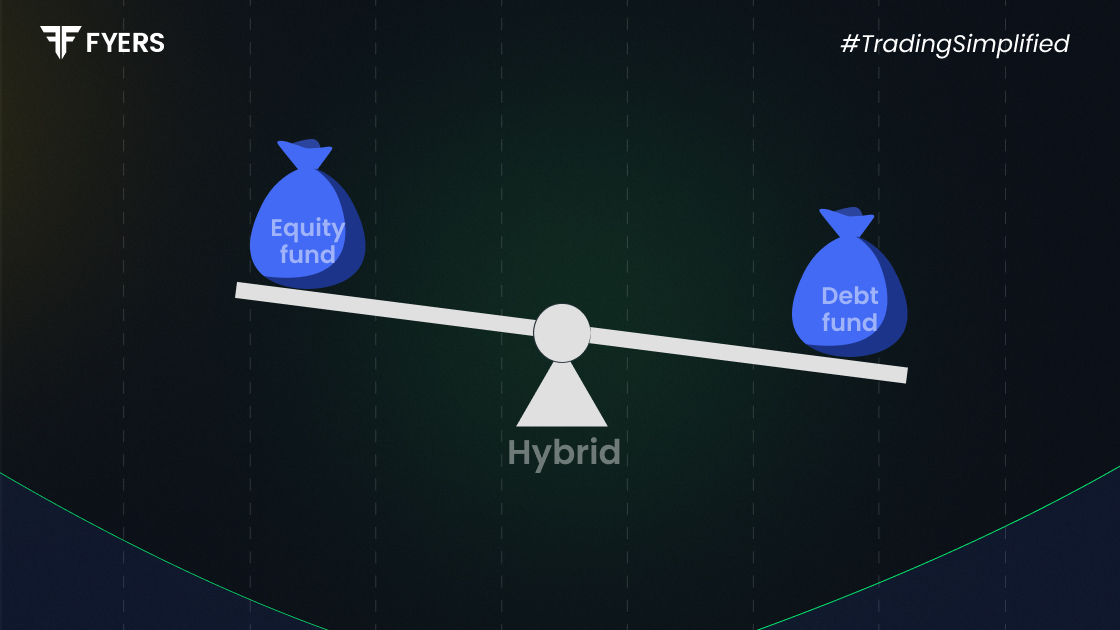

Hybrid mutual funds are a popular investment option for those looking to balance risk and reward by diversifying their portfolio across multiple asset classes. Whether you are a new investor seeking stability or an experienced one looking for growth, hybrid mutual funds offer a blend of equity and debt investments to match various financial goals. In this guide, we’ll explore what is hybrid mutual fund is, its types, features, benefits, and tax implications to help you make informed investment decisions.

Hybrid mutual funds are investment funds that allocate capital across different asset classes, such as equity and debt, to balance risk and reward. These funds are designed to provide investors with diversified portfolios that can offer growth potential while managing volatility.

The hybrid mutual funds meaning lies in their ability to combine asset classes strategically. Some hybrid funds may have a higher proportion of equities, while others may focus more on debt instruments, making them suitable for various risk appetites.

Hybrid mutual funds work by diversifying investments across multiple asset classes, primarily equities and debt, to balance risk and returns. The fund manager actively manages the asset allocation, shifting between debt and equity based on market conditions to optimise returns.

For instance, when the stock market is bullish, the fund may allocate more funds to equities to maximise gains. Conversely, during market downturns, the fund might shift towards debt instruments for stability. This dynamic strategy makes hybrid funds an attractive option for both conservative and aggressive investors.

Hybrid mutual funds come in various types, catering to different investor profiles. Here are the major types of hybrid mutual funds. According to SEBI, hybrid mutual funds are categorised into 7 different types. Here are the details.

|

Conservative Hybrid Fund |

10% to 25% investment in equity & equity-related instruments; and 75% to 90% in debt instruments |

|---|---|

|

Balanced Hybrid Fund |

40% to 60% investment in equity & equity-related instruments; and 40% to 60% in debt instruments |

|

Aggressive Hybrid Fund |

65% to 80% investment in equity & equity related instruments; and 20% to 35% in Debt instruments |

|

Dynamic Asset Allocation or Balanced Advantage Fund |

Investment in equity/ debt that is managed dynamically as per market conditions (0% to 100% in equity & equity-related instruments; and 0% to 100% in Debt instruments) |

|

Multi Asset Allocation Fund |

Investment in at least 3 asset classes (Equities, debt, real estate/gold/commodities) with a minimum allocation of at least 10% in each asset class |

|

Arbitrage Fund |

Scheme following an arbitrage strategy, with a minimum of 65% investment in equity & equity-related instruments |

|

Equity Savings Fund |

Equity and equity-related instruments (min.65%); Debt instruments (min.10%) and Derivatives (min. for hedging to be specified in the Scheme Information Document) |

Source: AMFI

Diversification: Hybrid mutual funds offer diversification by investing in a mix of asset classes such as equity, debt, and sometimes gold or other securities, which helps reduce overall investment risk and enhances portfolio stability.

Balanced risk-return: These funds aim to strike a balance between risk and return by blending the high-growth potential of equities with the relative stability of debt instruments, making them a well-rounded investment choice.

Dynamic allocation: One of the key advantages of hybrid mutual funds is their dynamic asset allocation, where fund managers actively adjust the proportion of equity and debt based on market conditions within the overall mandate of the fund to optimise returns and manage risk.

Suitability for various investors: Hybrid funds cater to a wide range of investors - whether conservative, moderate, or aggressive - by offering different types of funds with varying equity and debt allocations to match individual risk appetites and investment goals.

Tax efficiency: The tax implications of hybrid mutual funds depend on their underlying asset allocation. For instance, equity-oriented hybrid funds are taxed like equity funds, while debt-oriented ones follow the taxation rules of debt funds, making it important for investors to consider tax efficiency when choosing a fund.

Investing in hybrid mutual funds provides several benefits:

Lower risk compared to pure equity funds - Hybrid funds offer the potential for capital appreciation while reducing risk through debt allocation.

Professional fund management - Experienced fund managers make strategic allocation decisions to maximise returns.

Suitable for new investors - Beginners who find it difficult to decide between equity and debt can benefit from hybrid funds.

Liquidity and flexibility - These funds provide liquidity and allow investors to withdraw funds when needed.

Tax benefits - Depending on the allocation, hybrid mutual funds' taxation varies, potentially offering tax efficiency.

Investing in hybrid mutual funds is straightforward. Here’s a step-by-step guide:

Assess your risk appetite: Choose a hybrid fund based on your risk tolerance and financial goals.

Select the right hybrid fund: Compare different hybrid mutual funds based on past performance, asset allocation, and expense ratio.

Choose between a SIP or lump sum: You can either invest a lump sum or opt for a systematic investment plan (SIP) to invest gradually.

Open an investment account: You need to open an account with an asset management company (AMC) or a mutual fund platform like FYERS.

Complete KYC requirements: Submit necessary KYC documents such as PAN card, Aadhaar, and address proof.

Start investing: Once your account is set up, you can begin investing and track your fund’s performance regularly.

The tax on hybrid mutual funds has undergone significant changes due to amendments in the Union Budget 2025. Here’s an overview:

Equity-oriented hybrid funds: These funds invest at least 65% of their assets in equities or equity-related instruments.

Short-term capital gains (STCG): Gains from units held for less than 12 months are taxed at 20%.

Long-term capital gains (LTCG): Gains from units held for more than 12 months are taxed at 12.5%, with an exemption for gains up to ₹1.25 lakh.

Debt-oriented hybrid funds: These funds allocate less than 35% of their assets to equities and are taxed as per the investor's income tax slab rate.

Balanced and multi-asset funds: The tax treatment for these funds depends on their specific equity and debt allocations. It’s essential to review the fund’s portfolio composition to determine the applicable tax rates.

Understanding these tax implications is crucial for optimising post-tax returns on your hybrid mutual fund investments.

Hybrid mutual funds are an excellent investment option for those looking to balance risk and returns. They offer diversification, stability, and growth potential, making them ideal for various investors. By understanding the difference between equity and hybrid mutual funds, investors can make informed decisions based on their financial goals and risk appetite.

With different types of hybrid mutual funds available, investors can choose funds that align with their preferences. Additionally, understanding tax on hybrid mutual funds can help optimise returns and minimise tax liabilities.

Yes, hybrid funds are good investments for individuals seeking balanced risk and returns. They provide diversification and professional management, making them a suitable choice for both beginners and experienced investors.

Hybrid mutual funds are relatively safer than pure equity funds since they have a debt component that provides stability. However, the level of risk depends on the type of hybrid fund chosen.

Equity funds invest primarily in stocks, offering high return potential but with greater risk. In contrast, hybrid funds allocate assets across equities and debt, balancing risk and returns, making them more stable than equity funds.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.