17 Jul, 2025

17 Jul, 2025

4 mins read

4 mins read

Imagine walking into a market where every item is perfectly priced, no hidden bargains, no overpriced junk, just everything valued exactly as it should be. That’s the idea behind the Efficient Market Hypothesis, or EMH - one of the most talked-about theories in investing.

But what is the Efficient Market Hypothesis really saying? And does it mean you can never “beat the market”? Let’s break it down, plain and simple.

So, what is EMH? In short, the Efficient Market Hypothesis suggests that stock prices always reflect all the information that’s available at any given time. So, whether it’s breaking news, earnings reports, or economic updates, the market adjusts prices almost instantly - leaving no room for clever guesses or hidden tricks.

This idea came from economist Eugene Fama back in the 1960s. If EMH holds true, then no matter how much analysis you do or how carefully you time your trades, you can’t consistently earn returns above the market average.

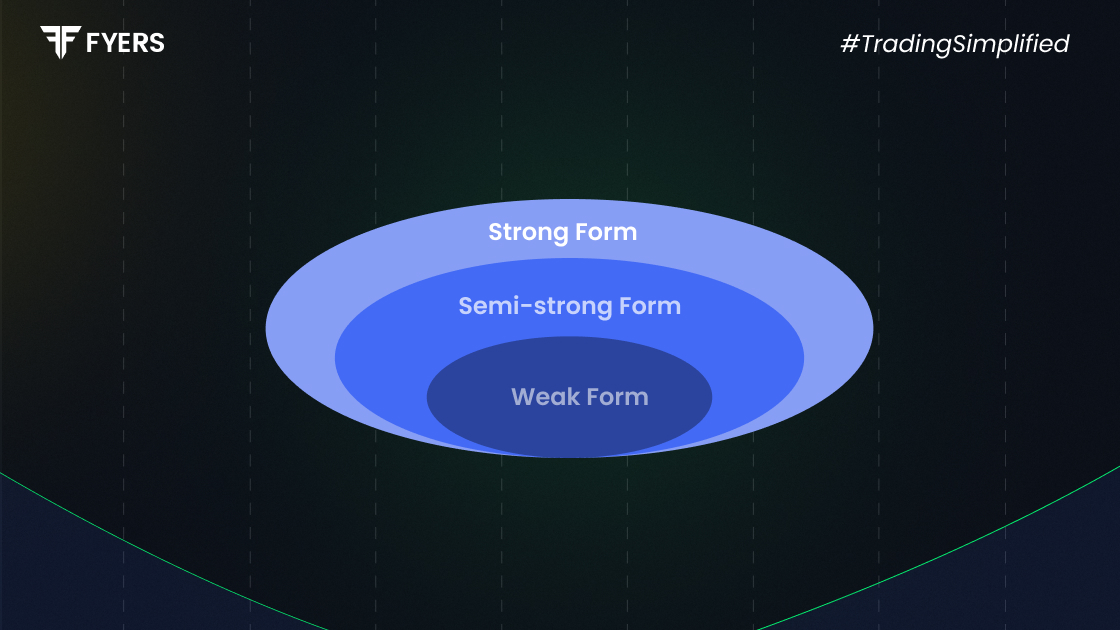

There are three types of Efficient Market Hypothesis, each based on how much information is factored into stock prices:

|

Type |

Description |

|---|---|

|

Weak Form EMH |

Prices already reflect all past trading data (like historical prices and volumes). So, using charts or trends (technical analysis) won’t give you an edge. |

|

Semi-Strong Form EMH |

All publicly available information - news, earnings reports, economic data - is already priced in. That means even fundamental analysis might not help. |

|

Strong Form EMH |

Prices include all information - public and private (like insider info). So even those with inside access supposedly can’t outperform the market. |

For EMH to work, certain assumptions need to be true - even if they don’t always reflect reality:

Investors act rationally, using all available information to make decisions.

No transaction costs - meaning trading is free and frictionless.

Prices adjust instantly when new info comes in.

Everyone has equal access to information at the same time.

Lots of market participants are constantly analysing stocks, keeping prices accurate.

These assumptions of Efficient Market Hypothesis make the model neat and tidy in theory, though real markets are a bit messier.

The EMH has had a massive impact on how people approach investing:

Investment strategy: If markets are efficient, active stock picking is unlikely to beat passive investing over time.

Market behaviour: Prices are seen as unpredictable, following a “random walk” - meaning past movements don't predict the future.

Valuation models: If all information is priced in, tools like discounted cash flow models can only go so far.

Investor behaviour: It supports the idea of long-term investing and staying diversified instead of chasing trends.

Despite its logic, the EMH has its fair share of critics. Let’s look at some limitations of Efficient Market Hypothesis:

Human emotion: Investors don’t always act rationally - fear, greed, and herd behaviour lead to bubbles and crashes.

Delayed reactions: Markets don’t always price in news instantly - it can take time.

Market outliers: Investors like Warren Buffett have regularly outperformed the market - which raises eyebrows for EMH believers.

Anomalies exist: Things like the January effect or momentum investing suggest markets aren’t always efficient.

Insider advantage: Strong form EMH assumes insiders can’t benefit from private info - but insider trading scandals prove otherwise.

So, while the theory is solid in parts, reality often has other ideas.

Think of the Efficient Market Hypothesis like a clean, ideal map of the financial world. It gives a framework for understanding how markets should work - where prices reflect all known info, and beating the system is nearly impossible.

But just like any map, it doesn’t show every pothole or shortcut. Real-world investing is full of twists and turns - human emotions, unexpected news, and market quirks all play a role.

So, should you ditch your stock picks and only buy index funds? Not necessarily. But EMH does remind us that the market is a tough opponent and being consistently smarter than everyone else is harder than it looks.

It’s a theory that says stock prices always reflect all available information, making it difficult to beat the market through analysis or timing.

Partially. Some large-cap stocks show efficiency, but smaller stocks often don’t due to lower liquidity and less coverage.

If the market is fully efficient, consistently beating it would be almost impossible. But real-life inefficiencies mean some investors may still succeed with skill, luck or a mix of both.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.