19 Mar, 2025

19 Mar, 2025

6 mins read

6 mins read

Options trading is a crucial aspect of the derivatives market, offering traders the flexibility to hedge risks or speculate on price movements. Understanding the key concepts of In-the-Money (ITM), At-the-Money (ATM), and Out-of-the-Money (OTM) options is essential for making informed trading decisions. These classifications show if an option has intrinsic value and affects the risk-reward balance of an options contract. This article explores these terms in detail, highlighting their differences and real-life examples to help you navigate the options market effectively.

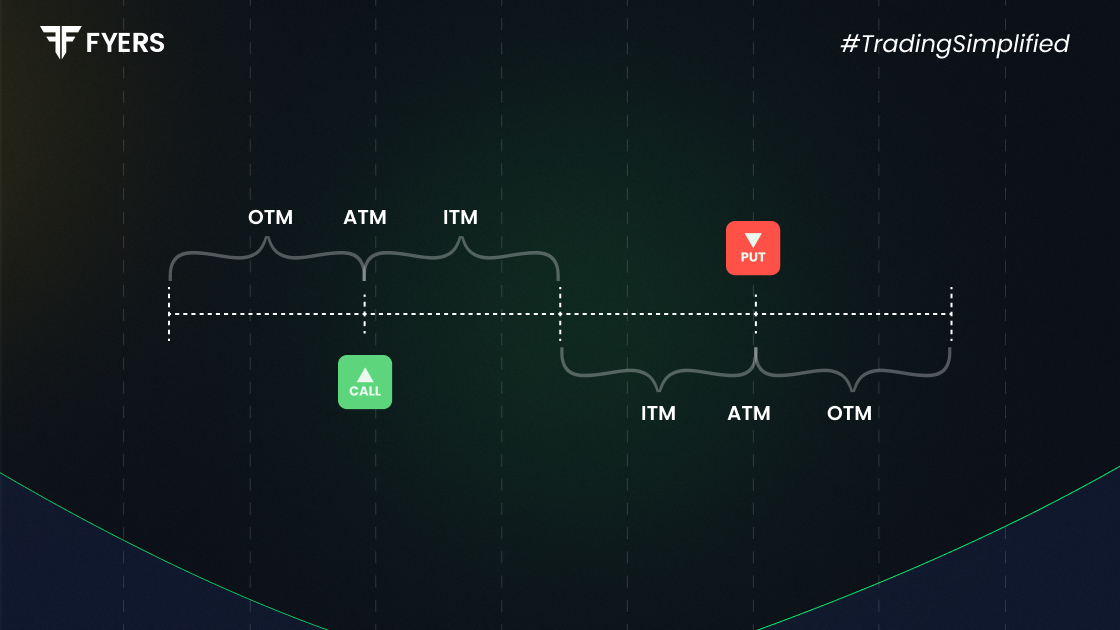

Options trading involves contracts that give you the right, but not the obligation, to buy or sell an asset at a predetermined price. Depending on the relationship between the strike price and the current market price of the underlying asset, options are classified as follows:

An option is considered ITM when it has intrinsic value.

For a call option, this means the strike price is lower than the current market price of the underlying asset. This means that in a call option, you can exercise that particular call and make a profit from the option. For a put option, it means the strike price is higher than the market price. Similarly, you could sell this put option and make a profit.

Since ITM options already have intrinsic and time value, they tend to have higher premiums, making them less risky than OTM options.

Let’s use an example to understand this better.

As of 17 March 2025, the Nifty 50 index is trading at ₹22,508.75

ITM Call Option: A call option with a strike price below ₹22,508.75, such as ₹22,400, is considered in-the-money. Exercising this option allows you to purchase the Nifty 50 at ₹22,400, which is cheaper than the current market price, providing intrinsic and time value.

ITM Put Option: A put option with a strike price above ₹22,508.75, say ₹22,600, is in-the-money. This option allows you to sell the Nifty 50 at ₹22,600, higher than the current market price, yielding intrinsic value.

An ATM option has a strike price that is equal (or very close) to the current market price of the underlying asset. Since there is no intrinsic value in ATM options, their price is primarily made up of time value. These options are often preferred by traders who anticipate a price movement but are uncertain about the direction.

Using the same example as above

ATM Call Option: A call option with a strike price equal to ₹22,500 is at-the-money. Here, the strike price is nearly identical to the current market price, resulting in no intrinsic value but the potential for profit if the index rises.

ATM Put Option: A put option with a strike price of ₹22,500 is at-the-money, with no intrinsic value but the potential for profit if the index declines.

OTM options have no intrinsic value because they would result in a loss if exercised at the current market price. For a call option, this means the strike price is above the market price, while for a put option, the strike price is below the market price. OTM options have the lowest premiums but are the riskiest, as they rely entirely on favorable price movements to become profitable.

Continuing our Nifty example from above,

OTM Call Option: A call option with a strike price above ₹22,508.75, such as ₹22,600, is out-of-the-money. Exercising this option would not be beneficial at present, as it would cost more than buying at the current market price.

OTM Put Option: A put option with a strike price below ₹22,508.75, such as ₹22,400, is out-of-the-money. Exercising this option would result in selling at a lower price than the current market value, making it unprofitable at this time.

Understanding these classifications helps traders assess potential profits, risks, and the likelihood of an option expiring profitably.

The following table outlines the key differences between these types of options:

|

Criteria |

ITM (In-the-Money) |

ATM (At-the-Money) |

OTM (Out-of-the-Money) |

|---|---|---|---|

|

Call Option |

Strike price < Market price |

Strike price = Market price |

Strike price > Market price |

|

Put Option |

Strike price > Market price |

Strike price = Market price |

Strike price < Market price |

|

Intrinsic Value |

Has intrinsic value |

No intrinsic value |

No intrinsic value |

|

Premium |

Highest among the three |

Moderate |

Lowest |

|

Risk Level |

Lower than OTM |

Moderate |

Highest |

|

Profit Potential |

Limited compared to OTM |

Neutral |

Higher if the market moves in the right direction |

ITM options are less risky as they already hold intrinsic value, but they come with higher premiums.

ATM options are ideal for short-term strategies, especially in volatile markets.

OTM options have lower premiums but are riskier, as they rely entirely on future market movement.

Let’s consider a real-life example using Reliance Industries Ltd (RIL) stock, which is currently trading at ₹1,251 per share. Suppose you are evaluating different call option contracts:

ITM Call Option (Strike Price: ₹1,200)

Since the strike price (₹1,200) is lower than the market price (₹1,251), this option is in-the-money and has a real value of ₹51 (₹1,251 - ₹1,200). If exercised, the option would be profitable as the stock can be bought at a discount.

ATM Call Option (Strike Price: ₹1,251)

The strike price matches the market price, making this option at-the-money.

This option has no real value but holds time value, making it sensitive to market fluctuations.

OTM Call Option (Strike Price: ₹1,300)

Since the strike price (₹1,300) is higher than the market price (₹1,251), this option is out-of-the-money. Exercising it would result in a loss, so its value depends purely on potential price movement.

ITM Put Option (Strike Price: ₹1,300)

Since the strike price is above the market price (1251), this option is in-the-money if exercised, as the strike price is above the market price.

ATM Put Option (Strike Price: ₹1,251)

Since the strike price equals the market price, this option is at the money. It holds no real value but has time value if the stock moves from this level.

OTM Put Option (Strike Price: ₹1,200)

Since the strike price is lower than the market price the option will not be profitable if exercised now.

Understanding ITM, ATM, and OTM options helps you make better trading decisions. Whether you're a conservative or aggressive trader, aligning your strategy with the right type of option is key to navigating the derivatives market effectively.

The choice depends on your risk appetite and strategy. ITM options are safer but come with higher premiums. ATM options work well for short-term trades, while OTM options offer high returns but carry greater risk.

ITM options have intrinsic value, making them more valuable and expensive. The premium consists of both intrinsic value and time value, contributing to the higher cost.

ATM options are highly sensitive to volatility. A surge in market fluctuations can increase their premiums due to higher time value, making them attractive for short-term traders.

Calculate your Net P&L after deducting all the charges like Tax, Brokerage, etc.

Find your required margin.

Calculate the average price you paid for a stock and determine your total cost.

Estimate your investment growth. Calculate potential returns on one-time investments.

Forecast your investment returns. Understand potential growth with regular contributions.